[Asia Economy Reporter Eunmo Koo] The KOSPI is showing a slight decline in the early session. Concerns over escalating friction between the U.S. and China surrounding the Hong Kong National Security Law appear to be negatively impacting the index.

On the 29th, the KOSPI opened at 2018.37, down 10.17 points (0.50%) from the previous trading day. The KOSPI, which started lower, is showing a slight decline in the early session amid simultaneous net selling by foreigners and institutions. As of 9:20 a.m., it was at 2018.08, down 10.46 points (0.52%) from the previous day.

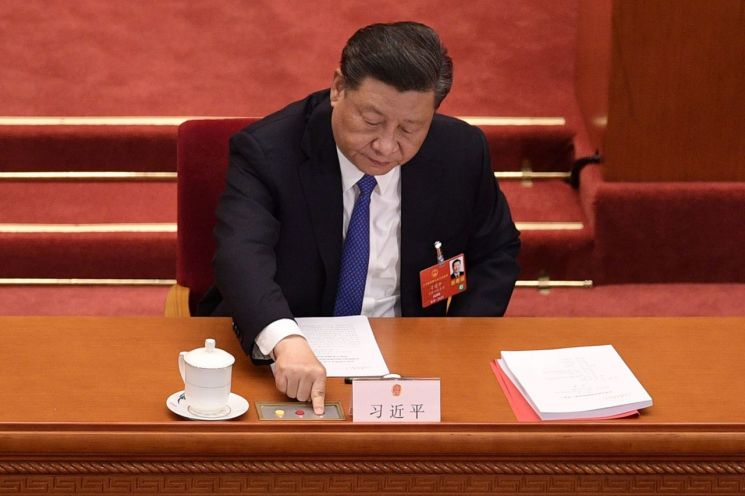

The previous day, the KOSPI closed at 2028.54, down 0.13% from the previous trading day, amid concerns over the economy and highlighted U.S.-China conflicts. The Bank of Korea’s downward revision of this year’s economic growth forecast heightened economic anxiety, and China’s submission of the Hong Kong National Security Law to the National People's Congress spotlighted U.S.-China tensions, causing the index to fall. However, expectations for an improvement in the semiconductor sector, following an upward revision of earnings forecasts by U.S. semiconductor company Micron, supported the index’s downside as electrical and electronics sectors such as Samsung Electronics and SK Hynix rose.

Overnight, major New York stock indices fell due to concerns over clashes with China despite signs of easing U.S. unemployment. On the 28th (local time) at the New York Stock Exchange (NYSE), the Dow Jones Industrial Average closed at 25,400.64, down 147.63 points (0.58%) from the previous day. The Standard & Poor’s (S&P) 500 index fell 6.4 points (0.21%) to 3,029.73, and the tech-heavy Nasdaq index closed down 43.37 points (0.46%) at 9,368.99.

Seosangyoung, a researcher at Kiwoom Securities, said, “U.S. economic indicators did not have a major impact on the U.S. stock market but showed a tendency of continued sluggishness, indicating ongoing economic slowdown, which is expected to negatively affect foreign demand.” He added, “The healthcare sector showed strength in the U.S. market, boosted by the opening of ASCO (American Society of Clinical Oncology), which could also impact related domestic stocks, so attention is needed.” He forecasted, “Considering these changes, the Korean stock market will likely see rapid sectoral and stock-specific rotation, resulting in a stock-driven market.”

Looking at current trading trends by investor type, foreigners and institutional investors are leading the index decline with net sales of 59.1 billion KRW and 38.3 billion KRW, respectively. In contrast, individual investors are net buyers with 92.5 billion KRW.

By sector, pharmaceuticals, food and beverages, and non-metallic minerals are rising, while insurance, banking, and securities are falling.

Among the top market capitalization stocks, Samsung Biologics, NCSoft, Celltrion, SK Telecom, and Samsung SDI are rising. Conversely, SK Hynix, Kakao, NAVER, Samsung Electronics, and Hyundai Mobis are declining.

Currently, in the KOSPI market, 309 stocks are rising without any hitting the upper price limit, 483 stocks are falling without any hitting the lower price limit, and 95 stocks are unchanged.

The KOSDAQ index is showing a slight gain. It opened at 706.16, down 2.59 points (0.37%) from the previous day, but turned upward shortly after the opening and is maintaining a steady trend. As of 9:20 a.m., it was at 708.93, up 0.18 points (0.03%) from the previous day.

Regarding current demand and supply, foreign investors are net buyers with 27.9 billion KRW. Meanwhile, individual and institutional investors are net sellers with 10.6 billion KRW and 13.7 billion KRW, respectively.

By sector, distribution, food and tobacco, and other manufacturing are rising, while textiles and apparel, broadcasting services, and construction are falling.

Among the top market capitalization stocks, EcoPro BM, Celltrion Healthcare, Celltrion Pharm, KMV, and Pearl Abyss are rising. On the other hand, Seegene, CJ ENM, Studio Dragon, and Genexine are declining.

Currently, in the KOSDAQ market, 495 stocks are rising, including one hitting the upper price limit, 668 stocks are falling without any hitting the lower price limit, and 140 stocks are unchanged.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.