To Be Included in Sub-Regulations of the Financial Consumer Protection Act to Be Enforced in March Next Year

[Asia Economy Reporter Kim Hyo-jin] The 'Model Code of Conduct for Financial Consumer Protection,' which imposes the responsibility of consumer protection on the chief executive officer (CEO) of financial companies, will be legislated. Some express concerns that the level of private sector intervention by financial authorities will increase, and there are also criticisms that excessive consumer protection measures could hinder the development of the financial industry.

According to financial authorities on the 28th, the Financial Services Commission and the Financial Supervisory Service plan to include the current Model Code of Conduct for Financial Consumer Protection, valid until the end of this year, in the Financial Consumer Protection Act (FCPA) bill to be enacted in March next year, and will soon begin practical reviews. A financial authority official said, "Most of the contents of the current Model Code will be included in the subordinate regulations of the FCPA," adding, "It is necessary to refine it according to the legislative format."

The Model Code of Conduct for Financial Consumer Protection is an administrative guidance by financial authorities aimed at enhancing the consumer protection function of financial companies and does not have legal binding force. However, it gained attention as distrust toward financial companies increased and calls for financial consumer protection surged following last year's incidents involving overseas interest rate-linked derivative-linked funds (DLF) and Lime Asset Management's large-scale incomplete sales and losses.

With the intention of continuously encouraging financial companies' consumer protection efforts until the FCPA is implemented, the financial authorities partially revised the Model Code at the end of last year and extended its operation period until the end of this year. The FCPA, which has the character of a 'basic law' for financial consumer protection, was first proposed in 2011 and saw the light of day after about nine years when it passed the National Assembly last March. The government approved and promulgated the FCPA at the Cabinet meeting in the same month. The FCPA will be enforced one year after the date of promulgation.

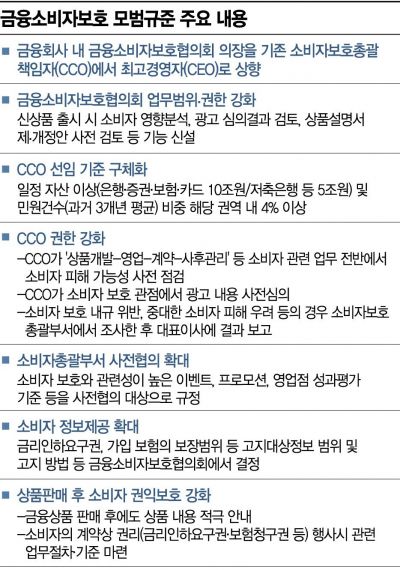

The Model Code of Conduct for Financial Consumer Protection stipulates that the chairperson of the Financial Consumer Protection Council within financial companies should, in principle, be the CEO. This means that the executive at the top of management is responsible for the in-house consumer protection function. However, companies with good consumer protection status can have the Chief Consumer Officer (CCO) operate the council as is currently done. This applies to companies that receive a rating of 'good' or higher in the status evaluation or have appointed a dedicated CCO at the executive level (excluding those rated below inadequate).

To manage consumer issues company-wide, the council's duties and functions have been expanded, and the results of council meetings must be reported to the board of directors. Financial companies with large asset sizes and a high proportion of complaints must appoint an independent executive-level CCO. This applies to banks, securities firms, insurance companies, and card companies with assets of 10 trillion won or more, and savings banks with assets of 5 trillion won or more, where the proportion of complaints (average over the past three years) is 4% or more within the respective industry.

The authority and role of the CCO have also been strengthened, including pre-assessment of potential consumer damage and prior review of advertising content. The Model Code also requires financial companies to inform financial consumers of information such as the right to request interest rate reductions, changes in transaction conditions, insurance coverage scope, and notifications before and after the maturity of financial products, either periodically or as needed.

While financial companies sympathize with the purpose of the system, there is a prevailing concern about the increased pressure from financial authorities in the future. A senior official at a commercial bank said, "Much of the content of the Model Code has been developed jointly by the authorities and financial companies, and many financial companies are already faithfully implementing it," but added, "If it is legislated beyond administrative guidance, the management burden will increase significantly."

A financial sector official expressed concern, saying, "Even with non-explicit regulations at the level of 'shadow regulation,' the pressure financial companies feel regarding inspections or evaluations is tremendous," and added, "There is a sufficient possibility that the authorities' intervention or influence will become stronger as a result of legislation."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.