Bank of Korea, March 2020 and Q1 International Balance of Payments (Preliminary)

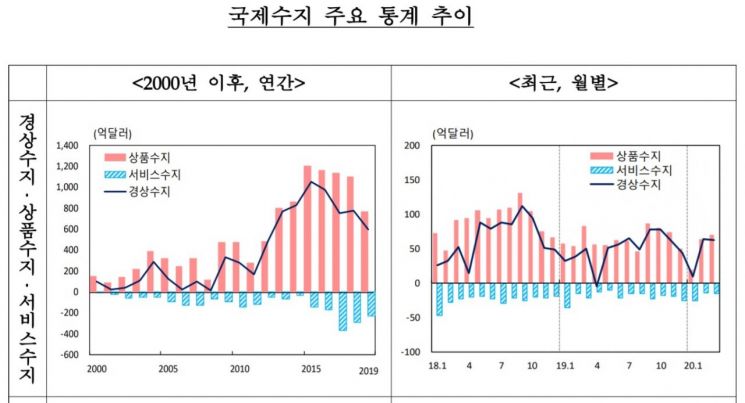

[Asia Economy Reporter Kim Eunbyeol] Despite the COVID-19 pandemic, the current account balance maintained a favorable trend through the first quarter. However, with the global trade volume slowing down and prices of semiconductors and petroleum products falling, the surplus in the goods balance for the first quarter was the smallest in seven years. Due to the combined effects of trade deficits and dividend payments, a current account deficit is expected to be inevitable in April.

According to the "March 2020 and Q1 International Balance of Payments (Provisional)" released by the Bank of Korea on the 7th, the current account surplus for the first quarter was $13.61 billion, marking 32 consecutive quarters of surplus. The current account surplus for March was also $6.23 billion, maintaining a surplus for 11 consecutive months since May last year.

However, the goods balance for the first quarter was $15.34 billion, the smallest surplus since Q1 2013 ($13.74 billion). Exports in the first quarter were $131.51 billion, down 4.5% compared to the same period last year. This marks the fifth consecutive quarter of decline since Q1 last year (-8.2%). A Bank of Korea official explained, "While global trade volume is slowing, exports to China and the EU were sluggish, and exports of passenger cars, petrochemical products, and steel products decreased."

March exports amounted to $46.42 billion, turning to a year-on-year decrease (-3.3%). This was influenced by the global spread of COVID-19 starting in March, which led to price drops in semiconductors (-15.8%) and petroleum products (-40.3%).

Imports also decreased. The import volume for the first quarter was $116.17 billion, marking five consecutive quarters of decline. March imports were $39.42 billion, also turning to a year-on-year decrease. Although imports of capital goods such as semiconductor manufacturing equipment increased, imports of raw materials like crude oil and consumer goods decreased.

The services balance improved. The services deficit for the first quarter was $5.28 billion, a reduction of $1.9 billion compared to the same period last year. However, this result is not entirely welcome as it reflects the impact of COVID-19, with people neither traveling abroad nor coming in, and a decrease in cargo volume. The transportation balance for the first quarter showed a deficit of $280 million, with the deficit shrinking by $380 million year-on-year. The travel balance deficit was also $2.17 billion, a reduction of $380 million compared to the same period last year. This was the smallest travel deficit in 15 quarters since Q2 2016 (-$1.83 billion). During the first quarter, the number of outbound travelers was 3.7 million (-52.9%), and inbound travelers were 2.04 million (-46.9%), with the decrease in outbound travelers exceeding that of inbound travelers.

Due to the base effect from large one-time dividend payments in Q1 last year and reduced dividend income payments caused by deteriorating profitability of foreign direct investment companies, the primary income account surplus increased by $2.34 billion year-on-year to $3.86 billion. The primary income account for March also turned to a surplus (+$930 million) year-on-year due to a significant decrease in dividend income payments.

Meanwhile, the financial account net assets, which indicate capital inflows and outflows, increased by $13.82 billion in the first quarter. Foreigners' domestic securities investment decreased by $12.27 billion in the first quarter and by $10.63 billion in March alone. A Bank of Korea official stated, "Foreign equity investment decreased further due to concerns over the global economic downturn caused by the spread of COVID-19, but foreign bond investment turned to an increase, mainly driven by public fund inflows."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)