Rapid Rise in Market Cap Ranking from 23rd to 13th Early This Year

Surpassing Financial Stocks like Shinhan Financial Group and KB Financial Group

New 52-Week Highs... Strong Q1 Performance Expected Despite COVID-19

[Asia Economy Reporter Minwoo Lee] Amid the domestic stock market fluctuations caused by the novel coronavirus infection (COVID-19), Kakao has surpassed financial holding companies in market capitalization rankings to reach 13th place (including preferred shares). This is attributed to the accelerated growth driven by various online services and the promotion of techfin (technology-centered financial services).

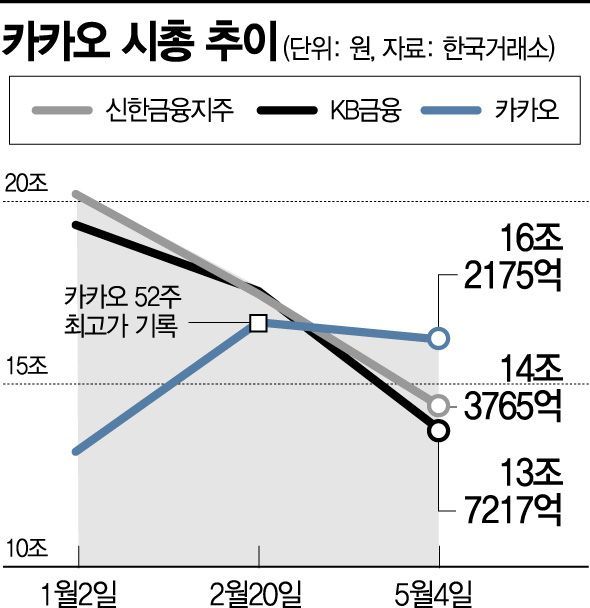

According to the Korea Exchange on the 6th, as of the closing price on the 4th, Kakao's market capitalization was 16.2175 trillion KRW, ranking 13th among KOSPI-listed companies. This marks a 10-rank rise from 23rd place with 13.1476 trillion KRW on January 2. It surpassed major financial companies such as Shinhan Financial Group and KB Financial Group. During the same period, Shinhan Financial Group's market cap ranking fell from 12th (20.2009 trillion KRW) to 17th (14.3765 trillion KRW), and KB Financial Group dropped from 14th (19.3559 trillion KRW) to 18th (13.7217 trillion KRW). Expanding into various financial services such as securities and insurance, Kakao appears to be threatening the positions of traditional financial firms.

The stock price continues its upward trend. As of 10:10 AM on the day, it recorded 191,000 KRW, up 2.41% from the previous day. Around 9:40 AM, it reached 192,500 KRW, surpassing the 52-week high of 191,500 KRW recorded on February 20. Despite concerns over economic slowdown due to COVID-19, investors flocked as forecasts predicted solid first-quarter earnings this year.

Kakao is considered the biggest beneficiary of the non-face-to-face (untact) culture expansion caused by COVID-19. Demand for e-commerce, advertising, and content based on the "national messenger" KakaoTalk has increased, while financial services centered on Kakao Pay and Kakao Bank have steadily grown. According to financial information provider FnGuide, Kakao's first-quarter market consensus for this year forecasts sales of 859.9 billion KRW and operating profit of 73.6 billion KRW. Sales are expected to increase by 21.7% and operating profit by 165.7% compared to the first quarter of last year.

The KakaoTalk chatroom list advertisement format, "KakaoTalk Bizboard (Talkboard)," is also expected to perform well in the first quarter. Although offline commercial districts suffered significant damage due to COVID-19, advertisers using Talkboard mainly operate online sales businesses, suggesting they may have benefited instead. Hana Financial Investment projected sales of 234.7 billion KRW from the Talkboard sector alone. Sales in content sectors such as webtoons, games, and music are also expected to increase.

The growth of the simple payment service "Kakao Pay" is also analyzed to be a key factor. With outdoor activities restricted due to COVID-19, non-face-to-face remittances and payments have increased. Entry into the securities business has also been a positive factor. In February, Kakao acquired Baro Investment & Securities and renamed it Kakao Pay Securities. Subsequently, within 28 days of its launch, on March 25, it surpassed 500,000 new securities account openings. Mina Lee, a researcher at Daishin Securities, stated, "Kakao Pay's payment fees and financial product-linked fees have likely increased significantly," adding, "Upgrading Kakao Pay accounts to securities accounts enables high-value product payments, so the trend of increasing payment fee revenue is expected to continue."

Kakao Bank is also showing growth. Its operating profit in the first quarter of this year was 18.4 billion KRW, about 187% higher than the first quarter of last year. This means it earned more than last year's net profit of 13.7 billion KRW, which was the first profit recorded. This is attributed to the growth of partner loan recommendation services and increased securities account applications through Kakao Bank for NH Investment & Securities, which boosted fee revenue.

Kakao is on the verge of entering the top 20 companies. This is the result of steady growth after surpassing total assets of 10 trillion KRW last year, entering the ranks of large corporations. According to the Fair Trade Commission, the number of Kakao affiliates this year is 97, an increase of 26 from last year, ranking second among large business groups after SK Group. Its total asset ranking also surged from 32nd to 23rd. Scattered affiliates will also be consolidated in one place. Since May 2022, Kakao has leased a newly constructed building in Pangyo, Seongnam-si, Gyeonggi-do, with 15 floors above ground and 7 underground floors, to be used as an integrated headquarters.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)