Notice for May Incentive Application for 3.65 Million Households... Excluding 2.03 Million Households Already Applied

Non-face-to-face Applications Available via Phone, Sontax, Hometax... Payment Advanced by One Month to August

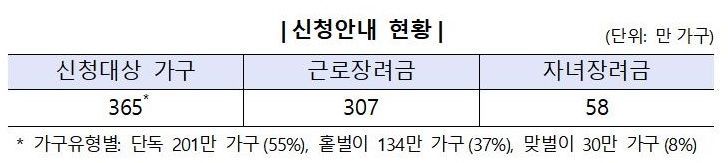

[Asia Economy Reporter Kwangho Lee] The National Tax Service announced on the 27th that it is guiding 3.65 million households (3.07 million households for Earned Income Tax Credit, 580,000 households for Child Tax Credit) out of a total of 5.68 million households with earned or business income last year to apply for the May tax credits to encourage work among low-income working households and support child-rearing.

The 2.03 million households that have already applied for income from the first and second half of last year are not eligible to apply for the Earned Income Tax Credit or Child Tax Credit.

The National Tax Service is doing its best to expedite the payment of tax credits so that low-income households struggling due to COVID-19 and other difficulties can overcome them as soon as possible.

After review and settlement of applications from May, payments are planned to be made in August, ahead of the statutory payment deadline (October 1). The expected amount is 3.8 trillion KRW. Additionally, about 600 billion KRW will be paid in June, before the statutory payment deadline (July 20), to households that applied for the first and second half of the year.

This year, to prevent COVID-19 infection, the non-face-to-face application method that allows applications without visiting tax offices has been expanded. Especially for the elderly who are unfamiliar with electronic applications, they can request application assistance by phone through the 'Tax Credit Dedicated Call Center' or the tax office. Furthermore, the electronic application procedures have been improved to make ARS phone, Hometax, and Sontax more convenient to use.

The application period is from June 1 to July 1, and households that received the application notice can apply electronically from that day. Applications submitted between July 2 and December 1 will receive only 90% of the final calculated tax credit, and the payment timing will be after October.

The annual Earned Income Tax Credit is up to 3 million KRW, and the Child Tax Credit is up to 700,000 KRW per child.

Eligibility requires earned, business, or religious income last year, and the combined annual income of the couple last year must be less than 20 million KRW for single-person households, less than 30 million KRW for single-earner households (less than 40 million KRW for Child Tax Credit), and less than 36 million KRW for dual-earner households (less than 40 million KRW for Child Tax Credit).

Additionally, as of June 1 last year, the total value of assets owned by all household members, including houses, land, buildings, and deposits, must be less than 200 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.