IBK, Credit Facility for 320 Billion KRW Asiana ABS with Downgraded Credit Rating

Shinhan Bank's 430 Billion KRW Korean Air Foreign Currency ABS Reaches Early Redemption Trigger... IBK, Kookmin, Nonghyup Banks Also Exposed

Banking Sector Tense Over Potential Debt Burden Amid Early Redemption Pressure on Airline ABS

[Asia Economy Reporter Kwon Haeyoung] Asset-backed securities (ABS), a means by which airlines borrow funds secured by future airline ticket sales, are facing a 'default' crisis due to the impact of the novel coronavirus disease (COVID-19). As airlines struggling with financial difficulties face tightening corporate bond markets and increasing pressure for early repayment of ABS, the burden of liquidity management is rapidly growing. If airlines fail to repay principal and interest, banks that have extended credit to the ABS will have to bear the debt, raising concerns that ABS could become a financial time bomb for the banking sector.

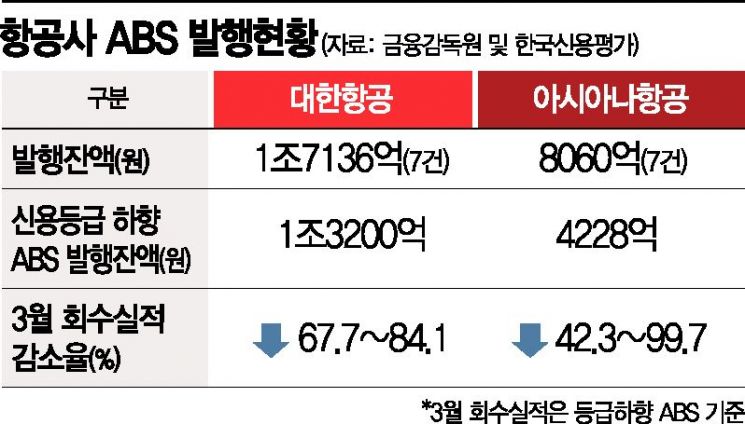

According to the Financial Supervisory Service on the 14th, as of the end of last year, the outstanding ABS issuance amounts for Korean Air and Asiana Airlines were approximately KRW 1.7136 trillion and KRW 806 billion respectively, totaling about KRW 2.52 trillion. Among these, the ABS outstanding amounts downgraded by Korea Ratings on the 10th were KRW 1.32 trillion for Korean Air and KRW 422.8 billion for Asiana Airlines.

The problem is that due to COVID-19, airline ticket sales?the source of ABS repayment?have sharply declined, potentially triggering an 'early repayment trigger' requiring funds to be repaid before maturity. Many recently issued ABS include forced redemption options linked to corporate bond credit ratings. These special clauses require early repayment if credit ratings fall. For Asiana Airlines ABS, early payment reasons include reaching below BBB- credit rating on corporate bonds, failing to meet certain debt repayment ratios, or defaulting on other borrowings. ABS recovery performance in March showed a decrease of 42.3% to 99.7% year-on-year for Asiana Airlines and 67.7% to 84.1% for Korean Air, indicating a critical situation. If the average performance over the three months from March to May remains this poor by the end of next month, the early repayment trigger will be activated. With the corporate bond and ABS markets both contracting, failure by airlines to make early ABS repayments could lead to a cascade of repayment demands on other debts.

An airline official stated, "In the case of Asiana Airlines, there is potential for financial structure improvement after the acquisition by HDC Hyundai Development Company, and Korean Air plans to respond through the sale of idle assets, but the shock from COVID-19 is expected to continue for some time," adding, "Since airlines have limited capacity to respond on their own, government-level support is urgently needed."

Banks are also concerned about the fallout from the airline ABS crisis. Given the severe liquidity crunch faced by airlines, even after the early repayment trigger is activated, airlines may be unable to repay ABS, forcing banks that have extended credit to bear the debt.

Among Asiana Airlines ABS downgraded by Korea Ratings from 'BBB+' to 'BBB', with an outstanding amount of KRW 468.8 billion (7 cases), IBK Industrial Bank of Korea has provided credit enhancement for ABS worth KRW 315.8 billion (3 cases). If airline ticket sales remain poor until the end of next month, forced early repayment will be required, and IBK will have to bear the burden. IBK explained, "We provided credit enhancement for 3 Asiana Airlines ABS cases, with an initial enhancement amount of KRW 330 billion, but as repayments have continued, the remaining balance is about KRW 150 billion."

The Korean Air ABS, for which Shinhan Bank has been the primary credit provider, already triggered the early repayment clause at the end of last month. This is a foreign currency ABS issued in October 2018 worth USD 350 million (approximately KRW 430 billion). It is based on the North American route, and the clause requires early repayment if more than 40% of flights are canceled due to COVID-19. Shinhan Bank has distributed credit risk, with Shinhan, IBK, and KB Kookmin Bank each providing about KRW 120 billion in credit, and NongHyup Bank about KRW 60 billion. Shinhan Bank has postponed the declaration of the early repayment trigger to the end of September as a reluctant measure.

Commercial banks have already reduced loans to airlines but are closely monitoring the rising risks from ABS credit extensions. Rating agencies estimate that since ABS have been considered safe assets and actively traded, banks likely hold a significant amount of ABS directly.

A commercial bank official said, "It will take time for air travel demand to normalize due to COVID-19, and there is a considerable possibility that the airline ABS early repayment trigger will be activated," adding, "We are closely watching market conditions as there is potential for financial structure improvement through airlines’ asset sales and government support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.