Due to COVID-19, Personal Credit Card Spending in March Down 4.1%

[Asia Economy Reporter Ki Ha-young] Last month, individual credit card usage decreased by more than 4% compared to the same period last year. This confirms the 'consumption cliff' caused by the novel coronavirus infection (COVID-19) in the data. Considering that personal card spending had grown by an average of about 5% in recent years, the financial sector analyzes that this decline far exceeds expectations.

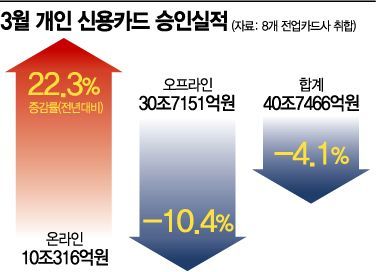

According to the card industry on the 10th, the March individual credit card approval performance of eight specialized card companies (Shinhan, Samsung, KB Kookmin, Hyundai, Lotte, Woori, Hana, BC Card) recorded 40.7466 trillion won, down 1.7269 trillion won (4.1%) from the previous year. This is the first time since 2017 that card approval amounts have decreased compared to the previous year. An industry official said, "Considering the trend of increased consumption, individual credit card usage usually increases by 5-6%. Taking this natural growth into account, the March performance is shocking." In fact, individual card usage in January and February was 45.1998 trillion won and 39.6526 trillion won, respectively, which increased by 5.4% and 6.6% compared to 42.8757 trillion won and 37.2043 trillion won in January and February last year.

In May 2015, when the Middle East Respiratory Syndrome (MERS) outbreak occurred, the total industry card approval amount was 51.76 trillion won, an increase of 7.1% compared to the same month the previous year, and in June it was 50.85 trillion won, up 8.6%. Compared to this, the consumption cliff caused by COVID-19 is at a serious level. In particular, last month's offline payment amount was 30.7151 trillion won, down 3.5586 trillion won (10.4%) compared to the same period last year. On the other hand, online consumption increased by 22.3% to 10.0316 trillion won as the number of 'homebodies' increased.

An industry official explained, "Overall, consumption contraction is occurring, and the decrease in consumption is particularly prominent in sectors that require consumer movement, such as travel, hotels, and dining out."

According to the 'March 2020 Consumer Sentiment Survey' recently announced by the Bank of Korea, the Consumer Confidence Index (CCSI) in March fell by 18.5 points from the previous month to 78.4. This is the lowest level since March 2009 (72.8), during the height of the global financial crisis. The decline from the previous month is the largest since statistics began in July 2008. Previously, the largest drop was 12.7 points in October 2008, right after the Lehman Brothers bankruptcy (September 2008). During the financial crisis, the consumer confidence index plummeted by 12.7 points in October 2008 and only recovered to pre-crisis levels (90.6 in September 2008) six months later in April 2009.

Although the government has continuously introduced measures to stimulate consumption, the industry forecasts that these are insufficient to revive the contracted consumer sentiment, and only the early stabilization of COVID-19 can lead to consumption recovery.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.