[Asia Economy Reporter Oh Hyung-gil] Warnings are emerging both inside and outside the company that the governance structure of Kyobo Life Insurance, which is celebrating its 62nd anniversary this year, could be shaken. The conflict between Chairman Shin Chang-jae of Kyobo Life and the financial investors (FI) over the exercise price of the put option (the right to sell shares at a certain price) is hitting a deadlock.

Kyobo Life Insurance filed a complaint against Deloitte Anjin Accounting Firm with the U.S. Public Company Accounting Oversight Board (PCAOB) on the 31st of last month, marking a new phase in the full-scale battle surrounding the put option, which is expected to be worth nearly 2 trillion won.

While Chairman Shin and the FIs are undergoing arbitration proceedings at the International Chamber of Commerce (ICC), Kyobo Life has reported Deloitte Anjin to the U.S. accounting authorities. Additionally, a complaint will be filed against Deloitte Global, which oversees Deloitte Anjin, to seek damages.

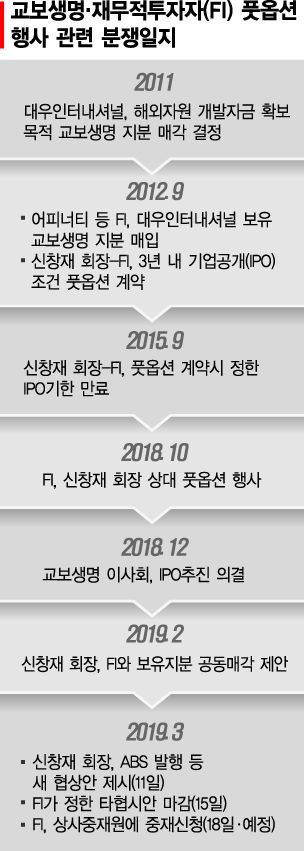

The reason for the complaint is that the fair market price of the put option was arbitrarily calculated. The background of the complaint dates back to 2012.

That year, a contract was signed for the Affinity Consortium and others, including Chairman Shin, to acquire 24% of Kyobo Life shares held by Daewoo International at the time for 1.2054 trillion won. The per-share valuation was set at 245,000 won.

The FIs included a clause in the contract that if an initial public offering (IPO) was not completed within three years (by September 2015), they could recover their investment by exercising the put option (the right to sell shares back).

Kyobo Life failed to go public by the promised deadline of September 2019. The FIs decided in October 2018 to exercise the put option worth about 2 trillion won, citing the failure to conduct the IPO even after the agreed deadline.

As a result, the per-share value of Kyobo Life shares was re-evaluated and calculated at 409,912 won per share. Deloitte Anjin was responsible for calculating this per-share price.

However, Chairman Shin's side argued that the market value of the life insurance company had fallen to the mid-200,000 won range. They also questioned the validity of the contract itself and claimed that the share value was excessively overvalued.

Ultimately, the two sides failed to narrow their differences and applied for arbitration at the ICC, with results expected as early as the end of this year. The ICC hearing is scheduled for September.

If the ICC sides with the FIs and Chairman Shin fails to raise funds, there could be changes in Kyobo Life's governance structure. Kyobo Life disclosed this fact and took the step of filing a complaint against Deloitte Anjin to stabilize management.

Deloitte Anjin calculated the market value of Kyobo Life shares based on the average stock value of similar companies over one year from June 2017 to June 2018, rather than at the time of the put option exercise.

During this period, the stock prices of Kyobo Life's major competitors such as Samsung Life Insurance and Orange Life reached record highs.

Typically, the exercise price for put options on listed shares refers to the price at the time of exercise, and for unlisted shares, the stock price from the previous month is applied. Deloitte Anjin, however, calculated the value differently from these evaluation standards.

However, some argue that there is no clear standard for evaluating corporate value and that this does not align with common sense in the capital market. For example, if a listed company's stock price falls below the IPO price calculated by an accounting firm, the firm is not usually sued.

Deloitte Anjin also responded to the lawsuit, stating, "We performed the stock valuation work in accordance with expert standards under a service contract with the FIs. We consider the complaint to be groundless."

Even if the PCAOB concludes that Deloitte Anjin overvalued the per-share price excessively, some analysts believe this will not significantly affect the arbitration outcome between Chairman Shin and the FIs. Ultimately, if the FIs win the ICC arbitration, this may be seen as a gesture to lower the put option exercise price.

Meanwhile, there is also a view that Kyobo Life's recent increase in dividends is part of Chairman Shin's efforts to defend his management rights. Last month, Kyobo Life decided to pay a record-high cash dividend of 153.7 billion won to shareholders, nearly 30% of net income for 2019. Chairman Shin will receive 51.9 billion won in cash dividends.

Song Seong, Director of the Insurance Department at the Financial Consumers Federation, said, "This is the largest dividend amount in Kyobo Life's history since its founding, and compared to last year's 102.5 billion won, it is an increase of 50%. Distributing 30% of profits made with policyholders' money to shareholders treats shareholders as 'kings' and policyholders as 'servants,' which is a flawed dividend policy that must be corrected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)