14 Additional Managed Items... About 60% Compared to 23 Last Year

33 Companies Including Kona I and Pine Nex Undergoing Delisting Procedures

Reasons for New Designation or Removal of Management Items Are Classified by Representative Reason in Case of Duplicate Reasons (Provided by Korea Exchange)

Reasons for New Designation or Removal of Management Items Are Classified by Representative Reason in Case of Duplicate Reasons (Provided by Korea Exchange)

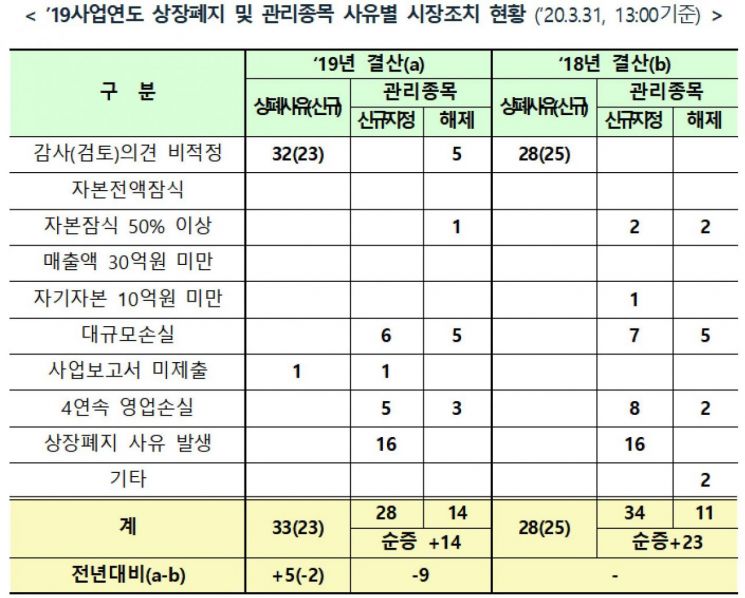

[Asia Economy Reporter Minwoo Lee] The net increase in companies designated as management items in the KOSDAQ market nearly halved from 23 last year to 14 this year.

On the 31st, the KOSDAQ Market Headquarters of the Korea Exchange announced the status of market measures related to the December corporate settlement for the 2019 fiscal year, which included this information. The review targeted 1,366 out of a total of 1,384 KOSDAQ-listed corporations with December fiscal year-end. Fifteen foreign corporations and three newly listed SPACs were excluded. As a result, measures were taken including ▲delisting procedures initiated (33 companies) ▲new designation as management items (28 companies) and cancellations (14 companies) ▲new designation as investment caution items (37 companies) and cancellations (14 companies).

Specifically, 28 companies including PixelPlus were designated as management items due to operating losses over four fiscal years, large-scale losses, or reasons for delisting. The net increase, calculated by subtracting the companies removed from the newly designated ones, was 14, nearly half compared to 23 last year (34 newly designated, 11 removed).

The total number of companies undergoing delisting procedures was 33. Among them, 32 companies including Kona I had delisting reasons related to adverse audit opinions (scope limitation, disclaimer of opinion). In the case of FineNex, failure to submit a business report met the delisting criteria. Among the companies undergoing delisting procedures, 23 had newly arisen delisting reasons this year, slightly down from 25 last year. Ten companies including P&Tel received an improvement period until the 9th of next month due to adverse audit opinions in 2018.

Additionally, 37 companies including IA Networks were newly designated as investment caution items due to adverse reasons related to internal accounting control systems. Fourteen companies including Yes24 resolved these adverse reasons and were removed from the investment caution list. The net increase in investment caution items was 23, the same as last year (30 newly designated, 7 removed).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.