[Asia Economy Reporter Kim Hyo-jin] Specialized credit finance companies such as card companies and capital companies will abolish the practice of linking early repayment penalty rates to interest rates. The early repayment penalty rates in the credit finance sector will be lowered to 2% or less. On the 25th, the Financial Services Commission and the Financial Supervisory Service announced an improvement plan for the operation practices of credit finance companies' loan fees containing these details.

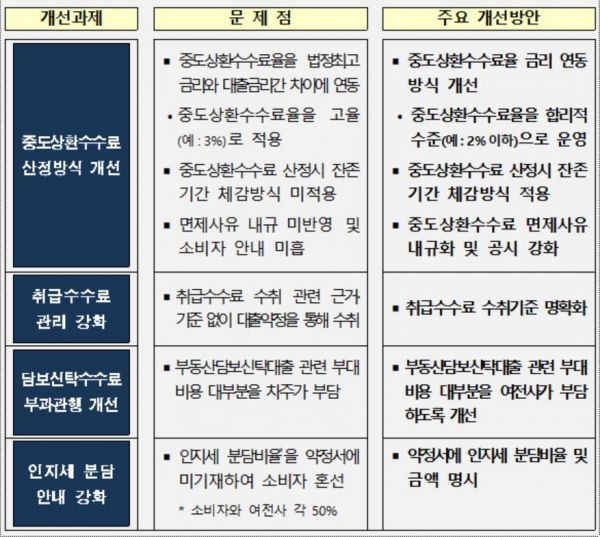

According to financial authorities, some credit finance companies calculate early repayment penalty rates by linking them to the interest rate obtained by subtracting the loan interest rate from the statutory maximum interest rate (24%). As a result, discrimination occurred, such as high-credit borrowers with low loan interest rates being applied higher penalty rates.

The financial authorities plan to abolish this practice and, considering cases in other sectors within the financial industry, operate the early repayment penalty rates in the credit finance sector at 2% or less. In the banking sector, savings banks, and mutual finance sectors, early repayment penalty rates are mostly operated at 2% or less.

The financial authorities also plan to change the calculation method of early repayment penalties to a graduated method so that the shorter the remaining loan period, the less penalty fee the borrower has to bear. The intention is to prevent consumers from bearing high fees even when the remaining period is short by imposing early repayment penalties at a fixed rate.

The financial authorities intend to collect handling fees, which are generally imposed to compensate for various transaction costs associated with loan handling, only when the service nature is clear.

When establishing a mortgage, major costs such as registration and license tax, local education tax, and registration fees are borne, but the practice of charging related costs to the borrower in the case of collateral trust will be improved so that the credit finance company bears all costs except for stamp tax.

Consumer guidance related to the sharing of stamp tax will also be strengthened, such as specifying the stamp tax sharing ratio (50%) in the agreement and having consumers directly write the shared amount at the time of contract signing.

The financial authorities expect that these measures will reduce consumer cost burdens by about 8.8 billion KRW annually.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)