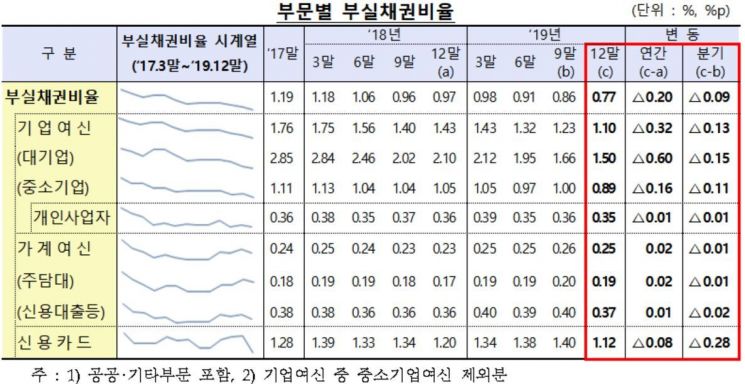

[Asia Economy Reporter Kim Hyo-jin] The non-performing loan (NPL) ratio of domestic banks at the end of last year was 0.77%, down 0.20 percentage points from 0.97% at the end of 2018, the Financial Supervisory Service (FSS) announced on the 9th.

This is the lowest level since the end of June 2018 (0.70%).

During the same period, the size of non-performing loans decreased by 15.8% (29 trillion KRW) to 153 trillion KRW compared to the previous year-end.

Corporate loans accounted for 132 trillion KRW, representing 86.3% of the total non-performing loans. Household loans amounted to 19 trillion KRW, and credit card receivables were recorded at 2 trillion KRW.

New non-performing corporate loans were 115 trillion KRW, down 26.6% (41 trillion KRW) from 156 trillion KRW the previous year.

New non-performing household loans increased by 23.4% (6 trillion KRW) to 31 trillion KRW from 25 trillion KRW the previous year.

At the end of last year, the loan loss provision coverage ratio was 113.2%, up 9.0 percentage points from 104.2% at the end of the previous year.

The FSS plans to continuously monitor the trend of new non-performing loans and encourage banks to strengthen their loss absorption capacity by adequately provisioning loan loss reserves.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.