Gold at $1672.40 per Ounce Hits 7-Year High

Fear Index Rises 46.55% from Previous Day

Domestic ETNs Surge Over 10%

[Asia Economy Reporters Oh Ju-yeon, Lee Min-ji, Kwon Jae-hee] As fear of the spread of the novel coronavirus infection (COVID-19) grows, global investment funds are rapidly moving into safe-haven assets. Following South Korea, U.S. Treasury yields plunged sharply, and gold prices hit their highest level in seven years. In South Korea, derivatives tracking the fear index surged into the 10% range.

According to domestic and international financial markets on the 25th, as money poured into the U.S. Treasury market due to the spread of COVID-19, the 10-year U.S. Treasury yield fell by 0.093 percentage points to 1.377% on the previous day (local time). This is close to the previous lowest level of 1.32%. The 30-year Treasury yield dropped 0.068 percentage points to 1.849%, marking an all-time low. Gold, considered a representative safe-haven asset, also reached $1,672.40 per ounce on the same day, the highest level since February 6, 2013.

Wall Street is closely watching how the U.S. Federal Reserve (Fed) will respond to the impact of COVID-19. The Fed has maintained a steady policy after three rate cuts from July to October last year, but expectations for a rate cut within this year are gradually increasing due to the COVID-19 fallout. Narayana Kocherlakota, former president of the Minneapolis Fed, even argued that "the Fed should immediately cut rates."

This sentiment is strengthening as forecasts suggest that U.S. economic growth will fall short of expectations this year. On the 23rd (local time), U.S. investment bank Goldman Sachs lowered its Q1 U.S. growth forecast from an annualized 1.4% to 1.2%, anticipating a contraction in trade with China due to the spread of COVID-19. However, Goldman Sachs expects the U.S. economy to rebound with 2.7% growth in Q2. The International Monetary Fund (IMF) also downgraded the global economic growth rate by 0.1 percentage points to 3.2%, citing the spread of COVID-19.

There are also considerable opinions advocating for maintaining the current rate. Loretta Mester, president of the Cleveland Fed, stated, "It is difficult to measure the economic impact of COVID-19," but added, "We will monitor carefully," emphasizing the view that the economic shock from COVID-19 in the U.S. will be limited.

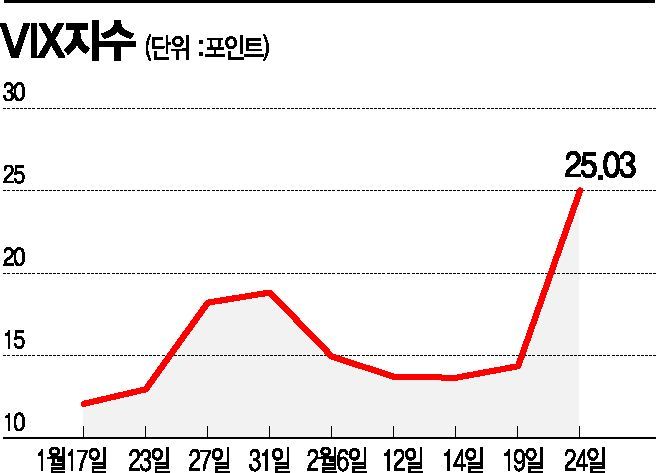

According to the Chicago Mercantile Exchange (CME) FedWatch, the FF rate futures market priced in a 23.2% chance of a 25 basis point rate cut in March. Meanwhile, the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) surged 46.55% from the previous trading day to 25.03.

In South Korea, exchange-traded notes (ETNs) tracking the fear index (VIX) also surged. As of the previous day, the 'Shinhan S&P500 VIX S/T Futures ETN B' closed at 13,060 KRW, up 12.2% from the previous session. This is the largest increase since the stock market uncertainty caused by the U.S.-China trade dispute in October last year. Other ETNs tracking the same index, such as 'Samsung S&P500 VIX S/T Futures ETN(H) B' (11.02%) and 'QV S&P500 VIX S/T Futures ETN B' (12.18%), also closed higher. Compared to the period after February 14, when COVID-19 showed signs of resurgence, these have surged about 21%.

The VIX is an index that shows the market's expectation of volatility over the next 30 days for the U.S. Standard & Poor's (S&P) 500 index. It typically rises when stock market volatility increases. Recently, as the U.S. stock market has deepened its decline due to concerns over economic shocks from the COVID-19 pandemic, the VIX index at the Chicago Board Options Exchange (CBOE) has surged. The VIX closed at 25.03, up 46.55% from the previous session, and has risen more than 89% over the past week.

Moon Nam-jung, a researcher at Daishin Securities, explained, "The U.S. stock market had risen significantly on expectations of improved corporate earnings, so with the negative factor of COVID-19, the decline is inevitably large," adding, "The possibility that the U.S.-China trade dispute could be reignited after the COVID-19 situation is also a burden."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.