[Asia Economy Reporter Donghyun Choi] While the jeonse price-to-sale price ratio of apartments in the six major metropolitan cities has been declining for 34 consecutive months, Daejeon's jeonse price-to-sale price ratio has fallen to the lowest level among these metropolitan cities.

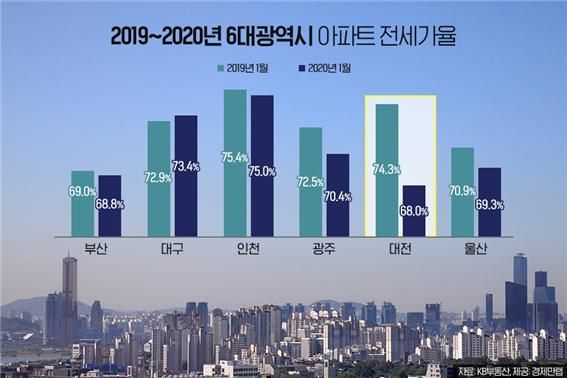

According to an analysis of KB Real Estate's housing price trends by real estate information company Economanlab, the jeonse price-to-sale price ratio of apartments in the six major metropolitan cities was around 74.6% as of April 2017, but it has continuously declined for 34 months, dropping to 71.2% as of January this year.

Among them, Daejeon experienced the largest decline in apartment jeonse price-to-sale price ratio over the past year. In January last year, Daejeon's apartment jeonse price-to-sale price ratio was 74.3%, second only to Incheon, but by January this year, it had fallen 6.3 percentage points to 68%. As a result, Daejeon became the metropolitan city with the lowest apartment jeonse price-to-sale price ratio among the six major cities.

In particular, Jung-gu in Daejeon showed the largest drop in apartment jeonse price-to-sale price ratio nationwide. In January last year, Jung-gu's apartment jeonse price-to-sale price ratio was 74.7%, but by January this year, it had plummeted 9.8 percentage points to 64.9%. Similarly, Seo-gu in Daejeon saw a decline from 76.2% to 68.1%, a drop of 8.1 percentage points, and Yuseong-gu also fell 6.9 percentage points from 71.9% to 65% during the same period.

This decline in the jeonse price-to-sale price ratio is attributed to apartment sale prices rising more sharply than jeonse prices. In January last year, the average apartment sale price per 3.3㎡ in Daejeon was 9.24 million KRW, but by January this year, it had risen 15.49% to 10.671 million KRW. Meanwhile, during the same period, the apartment jeonse price per 3.3㎡ in Daejeon increased only 5.34%, from 6.894 million KRW to 7.262 million KRW, widening the gap between sale and jeonse price growth rates and causing the jeonse price-to-sale price ratio to decline.

For example, an 84㎡ unit in ‘Central Park 3 Complex’ located in Munhwa-dong, Jung-gu, Daejeon, was traded at 495 million KRW in January last year, but by January this year, it was traded at 595 million KRW, a 100 million KRW increase. In contrast, the jeonse price for the same size unit in this apartment was 325 million KRW in February last year, but only rose by 25 million KRW to 350 million KRW this month.

As housing prices in Daejeon have surged significantly, the government is currently considering designating Daejeon as a regulated area. If designated as a regulated area, the loan-to-value ratio (LTV) for mortgage loans will be lowered from 70% to 60%, and the debt-to-income ratio (DTI) will be tightened to 50%.

Gwangju and Ulsan also saw their apartment jeonse price-to-sale price ratios fall by 2.1 percentage points and 1.6 percentage points respectively over the past year. Gwangju's apartment jeonse price-to-sale price ratio dropped from 72.5% in January last year to 70.4% this January, while Ulsan's fell from 70.9% to 69.3%.

O Daeyeol, head of the research team at Economanlab, said, “When the jeonse price-to-sale price ratio declines, the cost burden for switching from jeonse to purchase increases, making gap investment using jeonse leverage difficult. It appears that the era of gap investment in Daejeon and Gwangju is coming to an end.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.