[Asia Economy Reporter Kum Boryeong] Hyundai Motor Securities achieved record-high performance last year. In particular, the Investment Banking (IB) and Private Investment (PI) divisions played a key role.

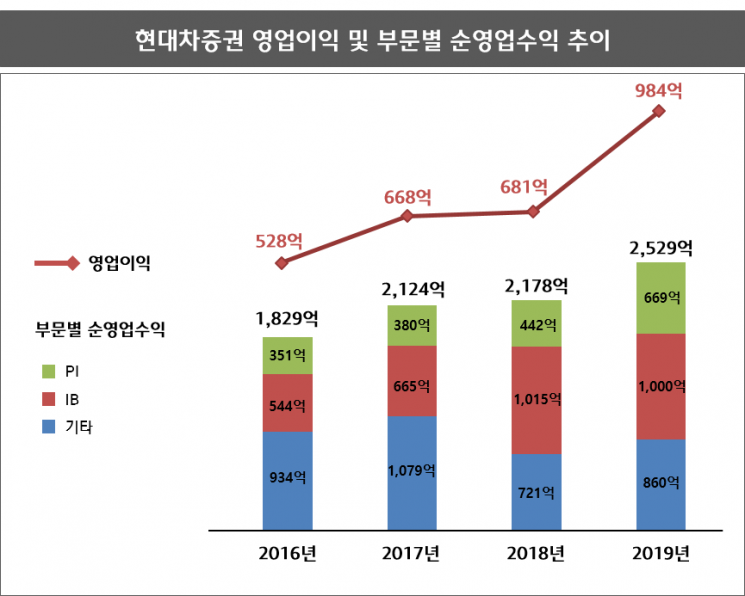

According to Hyundai Motor Securities on the 18th, the consolidated operating profit last year was 98.4 billion KRW, an increase of 44.5% compared to the previous year. Sales reached 716.2 billion KRW, up 15.7%, and net profit was 71.8 billion KRW, rising 42.1%.

Despite many internal and external challenges such as the domestic stock market slump caused by the US-China trade dispute and the derivative-linked securities (DLS) and private placement product incidents last year, Hyundai Motor Securities' IB and PI divisions generated stable profits. These two divisions accounted for 66% of the total net operating income.

The IB division recorded net operating income of 100 billion KRW. On a quarterly basis, it maintained growth by achieving net operating income in the 20 billion KRW range for eight consecutive quarters. Notably, the swift response to the declining number of large-scale real estate project financing (PF) cases was effective. Profitable deals were consistently secured, including financial advisory and arrangement for the 360 billion KRW 'Sewoon 3-1, 4, 5 District' urban environment improvement project, and financial arrangement and funding for the 198 billion KRW Dongtan Sports Park development project. In the fourth quarter, deals included leading PF financing for the 73 billion KRW Yongin logistics center, equity investment in the 20 billion KRW Sweden wind power PF, and investment in the 102.7 billion KRW Oksan-Ochang highway asset-backed commercial paper (ABCP).

The PI division also played a driving role in the strong performance. Last year, the PI division's net operating income was 66.9 billion KRW, a 51.4% increase from the previous year. The sale profit of 232.5 billion KRW from Dongtan Centerpoint Mall was recognized in the first half, and the Shinhan Alpha REITs deal showed an annual return of 49.27%, combining stable dividend income and stock price appreciation. Additionally, stable dividend income was earned from overseas investments such as German wind power, US logistics portfolios, and Luxembourg offices.

The contingent liability ratio has been decreasing. As of the end of last year, the contingent liability ratio was 69.24%, significantly lower compared to 97.71% at the end of 2016.

Hyundai Motor Securities plans to focus on strengthening the IB and PI divisions this year as well. Recently, the Strategic PI Team was promoted to the 'Strategic PI Office,' and the 'Capital Markets Office' was newly established within the IB1 Headquarters as part of organizational restructuring. A Hyundai Motor Securities official said, "Based on the increased capital, we will focus on discovering high-quality projects to continue the growth of the IB and PI divisions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.