Funds with Suspended Redemptions Continue Collecting Sales Fees...Ignoring Ethical Responsibility Beyond Legal Issues

Among Securities Firms, Shinhan Financial Investment Leads with 124.9 Billion KRW in Suspended Redemption Funds

[Asia Economy Reporter Park Jihwan] "I am a victim of the Lime Fund redemption suspension. Upon checking, I found out that securities firms are deducting sales commissions (annual 0.5~1%) daily from the settled amount of the currently subscribed funds. It feels like I was robbed and yet my pockets were picked without any help."

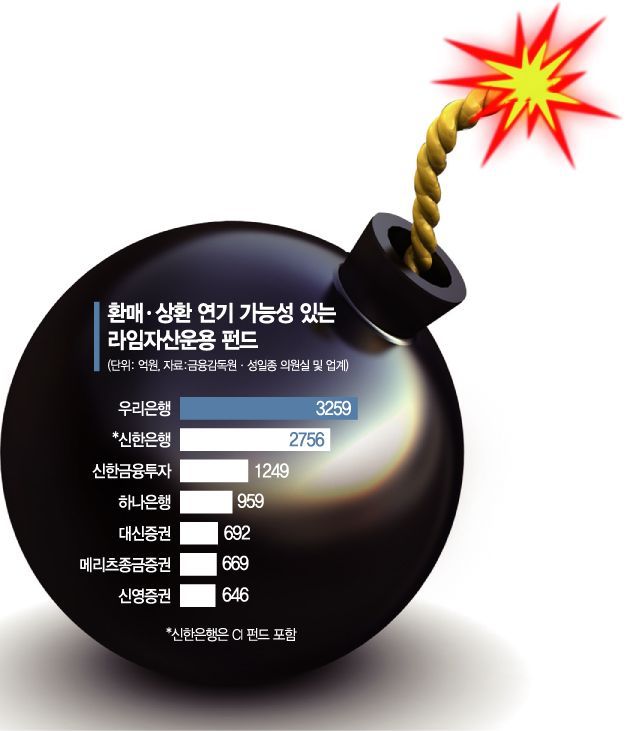

It has been revealed that the Lime Asset Management fund distributors, involved in the 1.6 trillion won fund redemption suspension crisis, continue to receive sales commissions even after the suspension. Customers face the risk of losing thousands of billions of won immediately, but the securities firms, as fund distributors, are reportedly profiting in the middle without suffering losses.

According to the securities industry on the 6th, the costs incurred when subscribing to a fund are generally divided into 'fees' and 'commissions.' Fees include sales fees and early redemption fees, which occur only once at the time of sale or redemption. On the other hand, commissions continue to accrue during the contract period and are divided into management commissions, sales commissions, trust commissions, and administrative commissions. Among these, the management commission taken by the asset manager and the sales commission taken by the distributor are the largest. Currently, the sales commission taken by securities firms is known to be about 1% annually of the fund amount. Sales commissions are settled over a specific period (6 months, 1 year, etc.) or at the final redemption point.

A securities industry official said, "Although sales commissions are expressed as annual figures, they are actually calculated pro-rata based on the subscription period, so it is almost as if they are being deducted daily even now," adding, "Even if the upfront sales fees already received cannot be helped, it seems necessary for securities firms to make a decision on sales commissions from a moral responsibility standpoint."

In fact, about 30 banks and securities firms, including Shinhan Financial Investment, Daishin Securities, Shinhan Bank, and Woori Bank, which sold Lime funds, have already received upfront sales fees of around 1% of the sales amount. Considering that the fund size was 5.9 trillion won as of July last year, just before the crisis, their commission income is estimated to have approached 60 billion won.

The financial authorities maintain that the setting and receipt of fees by financial companies are purely market matters. A Financial Supervisory Service official explained, "Our role is to investigate whether sellers made fraudulent recommendations when selling products to customers," and added, "Since fund sales occurred and related services are being provided afterward, it is difficult for the authorities to intervene and force them to 'not receive' or 'reduce' commissions."

A representative of a securities firm selling Lime funds said, "In the past, not receiving sales commissions for normal funds was legally considered an 'act of loss compensation,'" and added, "Recently, there has been a consensus that Lime funds are not normal funds, so once the accounting firm's due diligence results come out, we plan to pursue a method of not receiving sales commissions with the agreement of all securities firms."

Meanwhile, Lime Asset Management announced in October last year, at the time of the redemption suspension, that it would not receive management fees. Alpenroot Asset Management, which is currently experiencing a 200 billion won scale redemption suspension, is also considering waiving management fees.

An Alpenroot representative stated, "Regardless of whether the fund's underlying assets are non-performing or high-quality assets, we are seriously considering whether to waive all or part of the management fees for redemption suspension funds from a moral standpoint."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)