Hana Bank More Popular Than Kakao Bank with Better Terms

Results Achieved in 6 Months... Also Offering Debt Refinancing Service

[Asia Economy Reporter Kim Min-young] KEB Hana Bank's non-face-to-face credit loan product, "Hana 1Q Credit Loan," known as the "3-minute loan" or "cup noodle loan," has surpassed 2.4 trillion KRW in performance.

According to Hana Bank on the 22nd, the Hana 1Q Credit Loan, launched on June 10 last year, achieved sales of 2.4 trillion KRW as of December 31. This is a result achieved in about six months since its launch.

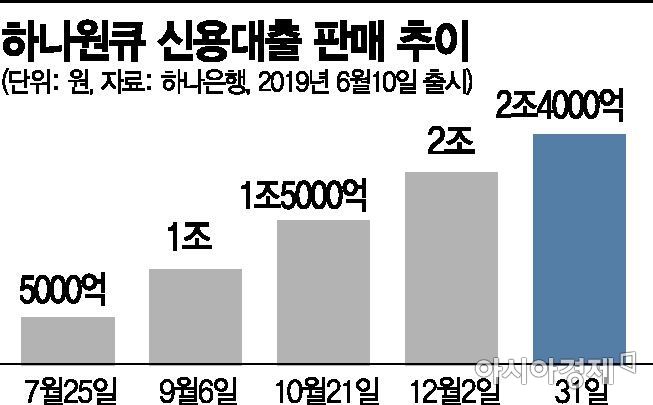

This loan product showed steady growth, starting with surpassing 500 billion KRW in performance on July 25 last year, just 45 days after launch, then reaching 1 trillion KRW on September 6, 1.5 trillion KRW on October 21, and 2 trillion KRW on December 2. Especially in December last year, it recorded sales of about 400 billion KRW over four weeks.

This product is mobile-exclusive and allows users to check loan limits and eligibility within "3 minutes" using only a smartphone registered in their name and a public certificate. It only takes a few clicks on Hana Bank's smart banking application (app) "Hana 1Q." There is no need to visit a branch or submit separate documents.

Compared to other commercial banks, it offers superior limits and lower interest rates. Its conditions are better than those of KakaoBank, an internet-only bank. The maximum limit for this product is 220 million KRW, with an interest rate as low as 2.791% per annum (as of that day). KakaoBank's credit loan limit is 150 million KRW, with a minimum interest rate of 2.921%. It was launched targeting KakaoBank and is considered to have surpassed KakaoBank.

A Hana Bank official stated, "We calculate limits and interest rates by reflecting various big data such as the applicant's workplace information and assets," adding, "Not only salaried workers but also beginners in society, self-employed individuals, and housewives can easily check loan eligibility based on estimated income information calculated by credit rating agencies."

Recently, they also introduced a refinancing loan service that allows customers to easily switch from other banks' credit loans as if "transferring subway lines." By pressing "3-minute loan switching" on the Hana 1Q app, users can see other bank loan details at a glance and immediately receive information on refinancing interest rates and limits.

There is no need to submit documents for refinancing, and loan execution and repayment can be processed at the desired branch within five days. A Hana Bank official said, "Internet banks without branch channels cannot provide this service," and added, "This is an online-offline integrated service that leverages the advantages of financial companies with branches in the omni-channel era."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.