GS Construction Acquires Three Overseas Modular Companies Simultaneously

President Heo Yoonhong Has Been Seeking Modular Housing Acquisition Candidates Since 2018

New Challenge in Eco-Friendly Housing Market Through US and European Companies' Technology

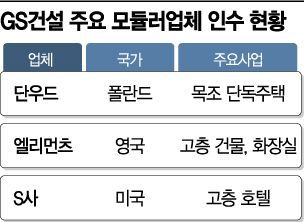

[Asia Economy Reporter Donghyun Choi] GS Engineering & Construction revealed a strong commitment to pursuing new business by simultaneously acquiring three overseas modular companies on the 21st. The companies acquired or scheduled for acquisition?Poland's Danwood, UK's Elements, and the US-based S Company?are all regarded as firms with considerable technological capabilities in the modular market. The company aims to leverage the technologies of these firms, each with strengths in different areas, to secure a leading position in domestic as well as Asian and Oceania markets in the future.

◆ Unlimited Growth Potential with Eco-Friendly Construction Methods = GS Engineering & Construction's move to target the global modular housing market as a new growth engine reflects its high expectations for domestic and international growth potential. Modular construction involves manufacturing 70-80% of the building process?including basic framework and electrical wiring?in a factory beforehand, then assembling it on-site like fitting Lego blocks. Currently, the modular construction market is most active in advanced countries such as the UK, Japan, and the US. Research shows that the UK market size surpassed 4.2 trillion KRW as early as 2007.

Domestically, the market is still in its early stages, with the market size expected to reach approximately 2.4188 trillion KRW in 2022. A GS Engineering & Construction official said, "The modular market has so far been centered on advanced countries where securing construction labor is difficult and wages are high," adding, "Recently, the modular market is expanding domestically due to aging construction workforce, labor shortages, and stricter environmental regulations."

The industry’s main view is that modular construction has high growth potential due to changing market conditions. Modular housing allows simultaneous progress of construction processes both on-site and in factories, significantly shortening construction periods. Additionally, standardization, specification, and mass production lead to substantial cost reductions. It also facilitates relocation and reinstallation, enabling sustainable and eco-friendly construction through material recycling. In Korea, structural changes in the construction labor market?such as declining youth population, aging construction workers, increasing foreign construction laborers, and reduced working hours?are gradually expanding demand for modular housing. An industry insider said, "Modular housing has so far been limited to public rental housing led by public enterprises like Korea Land & Housing Corporation (LH) and Seoul Housing & Communities Corporation (SH)," adding, "With GS Engineering & Construction’s entry into this new business, modular construction in the private sector is expected to expand significantly."

◆ Drive to Discover New Industries = The acquisition of the modular housing business is reportedly led proactively by Heo Yoonhong, the fourth-generation head of the GS family. Since July 2018, when he served as head of the New Business Promotion Office, Heo has shown strong interest in entering the modular housing business, closely engaging with advanced overseas companies in the US, Singapore, Japan, and scouting acquisition candidates. A company official stated, "We plan to introduce advanced modular housing technologies and expand beyond Asia into the Oceania market," adding, "We are actively exploring various new businesses beyond modular housing."

Heo has also been exploring various new businesses beyond housing. In December last year, after his promotion to president, he entered the Indian solar power business with a project worth 220 billion KRW as his first initiative. This year, he continues his aggressive moves. On the 9th, he entered the battery recycling business in the Pohang Battery Recycling Regulatory Free Zone, planning to invest 100 billion KRW by 2022. The smart farm business, which has been a focus area, is also set to be fully launched this year. Smart farms are next-generation agricultural systems that use IoT (Internet of Things), big data, and artificial intelligence technologies to maintain and manage optimal growth environments for crops and livestock, enabling remote automated management. Heo is also considering elevator business and aquaculture as new growth engines beyond construction.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)