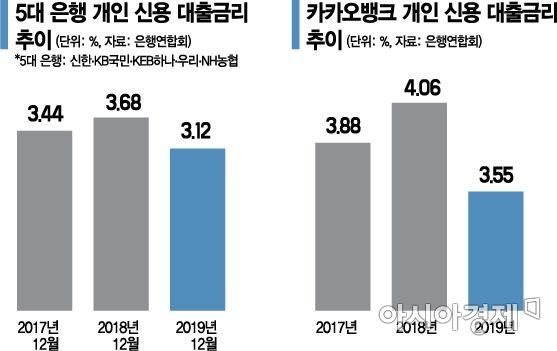

Average Personal Loan Interest Rate of 5 Major Banks at 3.12%

Lower than Kakao Bank's 3.55%

Market Focused on High Credit Scores 1-3 Needs Improvement

[Asia Economy Reporter Kim Min-young] The average personal credit loan interest rate at major commercial banks has dropped by 0.56 percentage points over the past year. It is lower than the loan interest rate of KakaoBank, an internet-only bank. However, there are concerns that the lending practices remain focused on high-credit borrowers, and calls for improvement have been raised.

According to the Korea Federation of Banks on the 14th, the average personal credit loan interest rate of the five major banks (Shinhan, KB Kookmin, KEB Hana, Woori, and NH Nonghyup) stood at 3.12% annually as of December last year. This is a decrease of 0.56 percentage points from 3.68% in December 2018.

Shinhan Bank had the lowest rate at 2.97%, followed by Woori Bank at 2.99%, Nonghyup Bank at 3.12%, Kookmin Bank at 3.25%, and Hana Bank at 3.28%.

During the same period, KakaoBank’s loan interest rate was lowered by 0.51 percentage points from 4.06% to 3.55%.

This rate is a weighted average of the interest rates on newly issued household loans in the previous month (November 2019) and the average credit rating of the borrowers from credit rating agencies.

Banks explained that the average interest rate declined due to the base interest rate cut and an increase in credit loans made through mobile applications (apps). In October last year, the Bank of Korea lowered the base interest rate by 0.25 percentage points from 1.50% to 1.25%. Banks that strengthened their own mobile apps introduced non-face-to-face credit loans for office workers and professionals last year. By reducing branch costs and loan agent commissions, they were able to offer loans at lower interest rates in the 2-3% range.

However, a clear polarization by credit rating was observed in lending. The concentration of loans to high-credit borrowers in bank credit loans is intensifying. Typically, high-credit borrowers refer to those with credit ratings from 1 to 3.

The proportion of loans issued by the five major banks at interest rates below 4% reached 81.40% as of December last year. This is an increase of 16.82 percentage points from the average share of 64.58% in December 2018.

The share of mid-interest loans, with rates between 6% and less than 10%, was only 5.6% on average among the five major banks. While banks offer low-interest loans to high-income workers such as professionals, public officials, and regular employees of large corporations, they have been stingy with mid-credit borrowers rated between 4 and 7. This can be interpreted as meaning that mid- and low-credit borrowers in need of funds may face difficulties.

The concentration of loans to high-credit borrowers is similar at KakaoBank. The share of loans below 4% interest in December last year was 82.6%, higher than that of the five major banks. This surged by 28.2 percentage points from 54.4% in December 2018.

This result runs counter to the government’s original intention that the launch of internet banks would expand mid-interest loans for low-credit borrowers and reduce the concentration of loans to high-credit borrowers.

A financial industry official said, “To prevent mid-credit borrowers rejected by banks from turning directly to high-interest card loans or savings bank loans, the five major banks and KakaoBank need to improve their credit evaluation systems and increase the issuance of mid-interest loans for mid-credit borrowers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)