Financial Authorities Introduce Measures to Strengthen Safety of Non-Face-to-Face Transactions in Savings Banks

Also Enhance Convenience with Full Expansion of Holiday Loan Repayment System

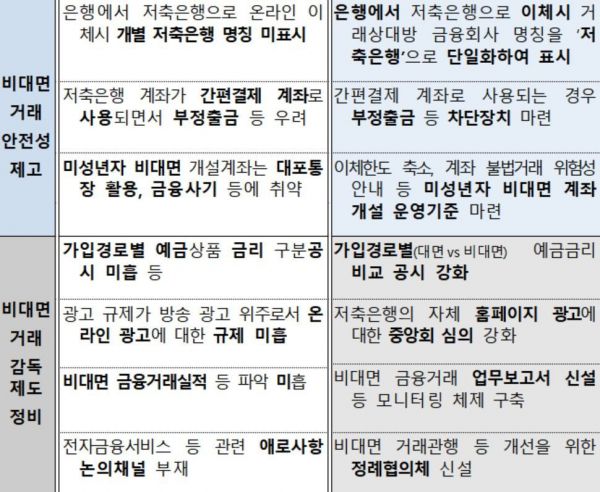

[Asia Economy Reporter Kim Hyo-jin] To enhance the safety of non-face-to-face transactions with savings banks, the name of the counterparty financial institution will be unified as 'Savings Bank' when transferring from a bank to a savings bank. The disclosure of deposit interest rate comparisons by savings bank subscription channels will be strengthened, and the central association's review of advertisements on savings banks' own websites will also be intensified.

According to financial authorities and the savings bank sector on the 12th, the Financial Services Commission and the Financial Supervisory Service plan to promote such measures to improve transaction safety as non-face-to-face deposit and loan handling by savings banks expands with the introduction of electronic financial services.

Currently, when transferring money from banks' internet/mobile banking or ATMs to savings banks, the name of the individual savings bank is not displayed as the transfer counterparty; instead, various terms such as 'Savings Bank', 'Mutual Savings', 'Mutual Savings Bank', or 'Mutual Savings Bank Central Association' are shown, causing confusion among consumers, according to the financial authorities.

Accordingly, the financial authorities have decided to unify the name displayed as the transfer counterparty to 'Savings Bank' when transferring to savings banks via internet/mobile banking. However, when checking transfer results on bank internet homepages where the counterparty name display is limited to 2-3 characters, it may be shown as 'Jeochuk' or 'Jeochukeun' (shortened forms of Savings Bank in Korean).

The financial authorities also plan to require savings banks to notify account holders via real-time text messages when simple payment service providers register withdrawal authorization on customer accounts and to encourage setting appropriate withdrawal limits on accounts used for simple payments.

Furthermore, since minors opening non-face-to-face accounts alone may be vulnerable to misuse such as mule accounts compared to face-to-face account openings and have higher transfer limits than banks, operational standards such as guidance on illegal account transaction risks and reduction of transfer limits will be established.

Currently, information such as interest rates by savings bank is disclosed comparatively through the central association's website, but comparing deposit product interest rates is somewhat inconvenient because users must click 'View Details' for each deposit product. The financial authorities plan to improve this by disclosing deposit interest rates comparatively by subscription channels to enhance consumers' choice of deposit products.

To strengthen monitoring of savings banks' non-face-to-face financial transactions, the financial authorities will establish a separate business report and regularly collect and analyze the number of subscribers and transaction performance by type of electronic financial service to enable timely responses.

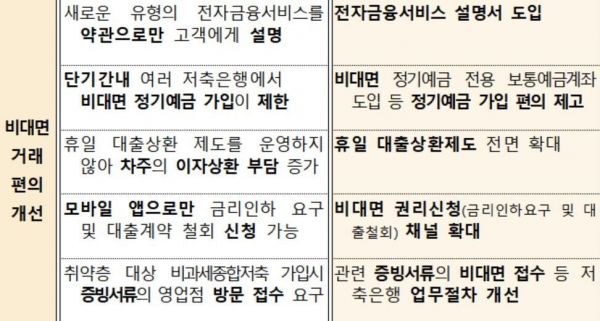

At the same time, the financial authorities will introduce measures to improve the convenience of non-face-to-face transactions with savings banks. They will create an electronic financial service guide to strengthen guidance on important aspects such as fees, transfer limits, usage hours, and transaction precautions.

Currently, if a customer wants to subscribe to non-face-to-face fixed deposits at two or more savings banks, they must wait at least 20 days after the first fixed deposit subscription. The financial authorities plan to introduce a dedicated ordinary deposit account solely for non-face-to-face fixed deposit subscriptions to block the misuse of mule accounts while allowing consumers to subscribe to multiple non-face-to-face fixed deposits simultaneously.

Additionally, all savings banks will enable repayment of loan principal and interest via internet/mobile banking even on holidays for household loans, preventing interest charges during holiday periods when repayment funds are available.

Non-face-to-face deposit and loan transactions at savings banks are rapidly expanding. New subscriptions via internet/mobile banking, which were 199,000 cases in 2016, increased to 286,000 cases in 2018 and 327,000 cases up to the third quarter of last year. The non-face-to-face deposit balance of savings banks rose from 6.9 trillion KRW at the end of 2016 to 17.1 trillion KRW at the end of the third quarter last year. The non-face-to-face loan balance increased from 6.1 trillion KRW at the end of 2016 to 10.6 trillion KRW at the end of the third quarter last year.

The financial authorities said, "With improvements in internet/mobile banking services and the introduction of innovative financial services, the non-face-to-face operations of savings banks are expected to accelerate further," adding, "We will support the sound growth of savings banks by enhancing the convenience and safety of non-face-to-face transactions through improvements in non-face-to-face transaction practices and systems."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.