[Asia Economy Reporter Kim Hyo-jin] The number of Open Banking subscribers, registered accounts, and usage transactions has significantly increased since the full-scale implementation of the service.

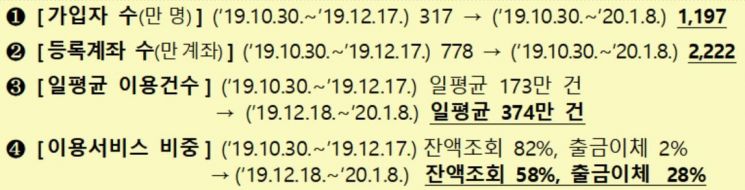

According to the Financial Services Commission on the 10th, the number of Open Banking subscribers, which was 3.17 million between October 30 and December 17 of last year during the pilot operation, nearly quadrupled to 11.97 million in just a few weeks from December 18, when the full-scale implementation began, until the 8th of this year.

During the same period, registered accounts increased from 7.78 million to 22.22 million, and the average daily usage transactions rose from 1.73 million to 3.74 million, approximately two to three times higher.

During the pilot operation, balance inquiries accounted for 82% of total service usage, and withdrawal transfers were 2%. After full-scale implementation, balance inquiries changed to 58%, and withdrawal transfers increased to 28%. This indicates a significant rise in actual transaction proportions.

As of the 8th, 193 institutions have applied to use Open Banking, and five more institutions are expected to start the service within this month. It is anticipated that 15 fintech companies will additionally participate in the first quarter of this year. This will increase the number of participating fintech companies to 67.

The Financial Services Commission is exploring advanced measures to ensure the sustainability and scalability of Open Banking. To this end, a research project is underway. The research is expected to begin next month, including analysis of field opinions through industry surveys and examination of overseas cases.

Open Banking is a service that allows users to check balances, make payments, and transfer funds for all their bank accounts through a single financial application (app). In the future, it will also be linked with savings banks and mutual finance institutions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)