South Korea's Household Cash Payment Share at 19.8% in 2018

Commercial Bank Branches Down 14.0%, ATMs Down 2.1%

BOK: "Need Measures to Address Side Effects of Cashless Society"

[Asia Economy Reporter Kim Eun-byeol] It has been revealed that the proportion of cash payments in household expenditures in Korea is less than 20%. Following Sweden, the United Kingdom, and New Zealand, Korea is rapidly entering a 'cashless society.' Although there is no clear definition of a 'cashless society,' it generally refers to a society where the use of non-cash payment methods such as credit cards accounts for 90% of transactions instead of coins or banknotes.

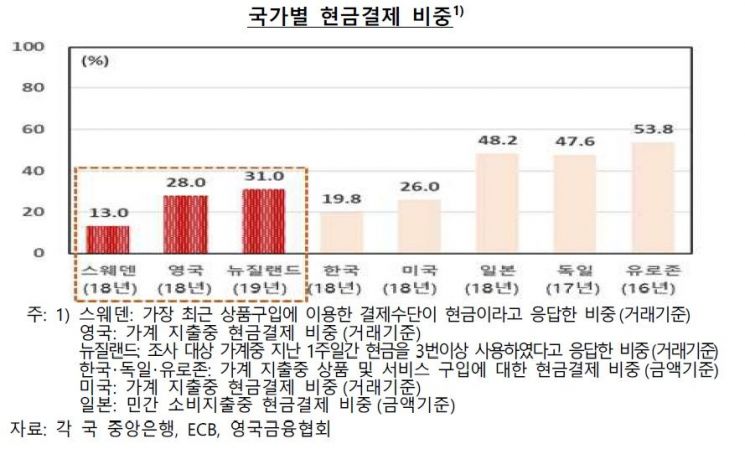

According to the Bank of Korea on the 6th, the proportion of cash payments for the purchase of goods and services in household expenditures in 2018 was recorded at 19.8% based on the amount. In comparison, Japan's cash payment ratio in private consumption expenditures (based on amount) was 48.2%, and in the Eurozone (19 countries using the euro), the cash payment ratio reached 53.8% in 2016, which is significantly higher.

Sweden, the United Kingdom, and New Zealand are already considered countries rapidly transitioning to a cashless society. In Sweden, only 13.0% of respondents reported having recently purchased goods with cash in 2018 (based on transactions). The cash payment ratio in the UK was recorded at 28.0%. In New Zealand, 31.0% of respondents said they used cash three or more times in the past week last year.

The Bank of Korea explained, "In the 2018 'Survey on Cash Usage Behavior by Economic Agents,' 0.5% of respondents reported having experienced refusal of cash payments," adding, "Although cases of cash payment refusal are still rare in Korea, considering the decreasing proportion of cash payments, it is assessed that transactions are progressing toward a cashless society." In Sweden, the proportion of respondents who experienced refusal of cash payments surged to 45% in 2018 from 27% in 2014.

The ratio of currency issuance balance to Gross Domestic Product (GDP) in Korea was 6.1%, which is below the average of OECD member countries (6.9%) and lower than the United States (8.3%), the Eurozone (10.9%), and Japan (21.1%). However, the currency issuance balance itself has maintained an increasing trend.

The Bank of Korea advised that since Korea is rapidly entering a cashless society, it is necessary to preemptively examine and prepare for potential side effects.

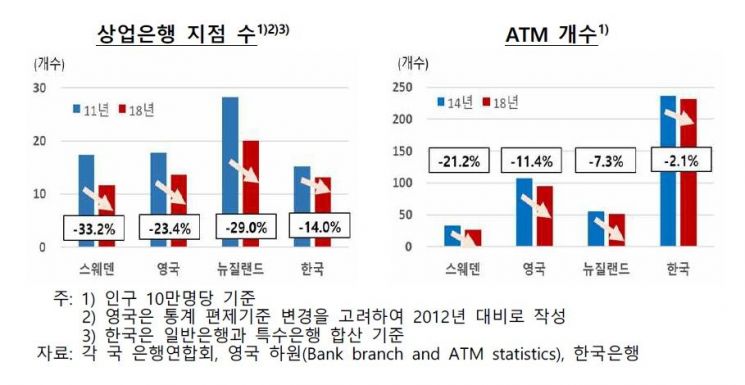

Problems associated with a cashless society include ▲ weakened public access to cash due to the reduction of cash supply channels such as ATMs ▲ financial exclusion and consumption activity restrictions for vulnerable groups ▲ weakening of the public currency distribution system that guarantees the choice of cash as a final payment method. As cash usage decreases, commercial banks may reduce branches and ATMs due to concerns over increasing handling costs, which could lead to financial exclusion of vulnerable groups.

As of 2018, the number of commercial bank branches in Sweden, the UK, and New Zealand decreased by 33.2%, 23.4%, and 29.0%, respectively, compared to 2011 (2012 for the UK). The number of ATMs recorded in 2018 also decreased by 21.2% compared to 2014. The UK saw an 11.4% decrease, and New Zealand a 7.3% decrease. In Korea, the number of bank branches and ATMs is also declining. During the same period, the number of commercial bank branches in Korea decreased by 14.0%, and the number of ATMs decreased by 2.1%.

It was also pointed out as a problem that entering a cashless society could cause significant inconvenience to elderly people and persons with disabilities who heavily rely on cash, which could become a serious social issue. In the event of large-scale power outages, alternative payment methods disappear, and the monopoly of a few private payment companies is cited as a negative factor. The disappearance of safe investment options during deflation periods could also negatively affect vulnerable groups.

The Bank of Korea stated, "As Korea enters a cashless society, it is necessary to pay special attention and effort to prepare countermeasures to prevent issues such as financial exclusion of vulnerable groups, restrictions on consumption activities, and weakening of the public currency distribution system."

Additionally, it introduced policy responses from various countries to prevent side effects and advised that Korea also needs to prepare countermeasures. These include Sweden's legislation mandating commercial banks to handle cash transactions, the UK's postal budget support and strengthened supervision of ATM operators, the establishment of a currency distribution system integrated management consultative body, and a report from the Reserve Bank of New Zealand emphasizing the need for appropriate intervention and management of the currency distribution system by the central bank (or government).

Furthermore, the Bank of Korea emphasized, "Under the recognition that 'no inconvenience should be caused to all citizens in their use of currency,' we plan to make multifaceted efforts to maintain public access to cash and the choice of cash usage by closely monitoring domestic and international trends related to the cashless society and major countries' responses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)