Blue Owl Halts Redemptions from Private Credit Funds

U.S. Private Lending Market Turbulence Persists After Last Year

Korean Market Still in Its Infancy, Impact Seen as Limited

Pension Funds Investing in Overseas Private Lending on "Hi

Concerns over the U.S. private credit market are resurfacing. This comes as news emerged that Blue Owl Capital, a U.S. alternative investment specialist, has restricted redemptions from its private credit funds for individual investors. While the impact on the still nascent domestic private lending market is expected to be limited for now, some warn that, in the long run, negative sentiment could spread and have an adverse effect.

Warning Lights Flash Again in U.S. Private Lending Market

According to major foreign media outlets on the 20th, Blue Owl sold a total of 1.4 billion dollars worth of assets from three of its funds the previous day to secure cash for redemptions and debt repayment. Among the three funds, Blue Owl Capital Corp II (OBDC II) went as far as permanently suspending quarterly redemptions. Blue Owl stated that, through this move, it intends to secure liquidity and also carry out a special cash distribution equivalent to about 30% of its future net asset value (NAV).

This is seen as a measure to prevent the situation from escalating into a liquidity crisis akin to a bank run, as redemption requests have recently increased across private funds and anxiety has spread through the market. After concerns over private lending erupted when U.S. auto lender Tricolor Holdings and auto parts maker First Brands filed for bankruptcy in quick succession late last year, unease is once again mounting. At the time, it was revealed that the two companies had exploited the fact that collateral information for loans is not shared among private lending providers as it is among banks, using a single piece of collateral to obtain multiple loans.

More recently, a private credit fund managed by BlackRock marked down the value of some of its portfolio assets, and worries have surfaced that the spread of artificial intelligence (AI) could threaten the business models of certain borrowing companies, further fanning a sense of crisis in the private lending market. On the U.S. stock market on the 19th (local time), shares of major listed private credit managers tumbled across the board, including Blue Owl (-5.93%), Apollo Global Management (-5.21%), and Ares Management (-3.08%).

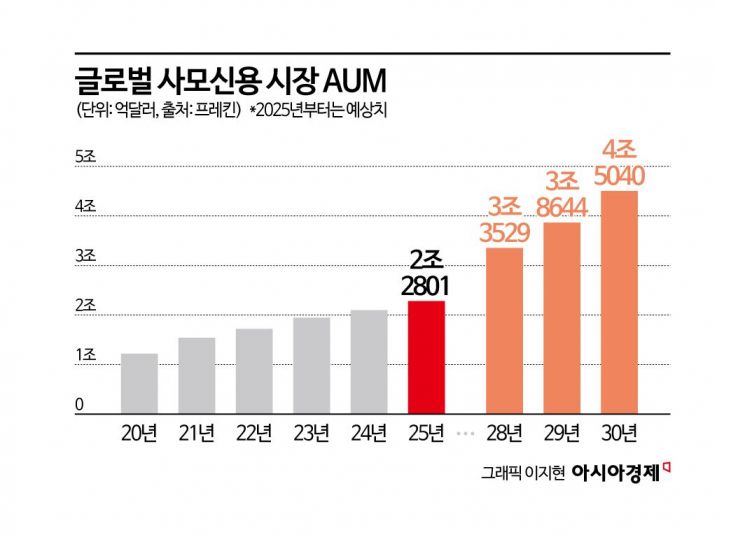

Given that private lending has already become a key funding channel for companies in the United States, some predict that the more such turbulence continues, the greater the anxiety surrounding the private lending market could grow. According to alternative investment data provider Preqin, global private lending assets under management (AUM) expanded from 1.2204 trillion dollars (about 1,775 trillion won) in 2020 to an estimated 2.2801 trillion dollars last year. The market is expected to grow sharply to 4.5040 trillion dollars by 2030.

Impact on Korean Market Still Limited

However, the impact on the Korean private lending market is expected to be limited. The market is still in its infancy and its business structure differs from that of the United States. The U.S. market is centered on direct lending, and a large number of individual investors can participate.

By contrast, in Korea, direct lending is firmly controlled by the banking sector. The domestic private lending market has mostly developed around mezzanine instruments such as convertible bonds and bonds with warrants. It focuses on senior secured loans, infrastructure and real estate credit backed by stable cash flows, and bridge loans to restructuring companies. Access for individual investors is effectively restricted. The nature of borrowers, deal structures, and collateral all differ from those in the U.S. market, and the lending profile is relatively conservative. This is why some assess that, even if a private lending crisis erupts in the United States, Korea will remain close to a "safe zone" in the short term.

That said, the possibility of psychological contagion over the longer term cannot be ruled out. If global limited partners (LPs) strengthen their risk perception of private credit assets, their investment stance could become more conservative. In that case, the funding environment for domestic private equity funds (PEFs) could also be indirectly affected.

Overseas investment portfolios of Korean institutional investors are also cited as a variable. If valuation losses arise from such assets going forward, they could weigh on returns. Insurance companies and major pension funds have consistently committed capital to global private lending funds. Some pension funds are even planning to ramp up their private lending investments. The National Pension Service established a dedicated private lending investment team last year, and the Teachers' Pension increased the share of private lending in its portfolio from around 20% in 2024 to 40% last year. The Korean Local Authorities Members' Pension Association also plans to raise the share of private lending to 33.5% by 2029. Through an organizational restructuring, it reduced its real estate asset team and increased the number of private lending teams to two.

An investment banking industry source said, "The likelihood that the Korean market will immediately suffer the same shock is low, but it cannot be completely immune to changes in the global alternative investment environment," adding, "Since the domestic private lending market is still in its early stages, we need to closely monitor how risks emerging in overseas markets will spread and how the Korean market will absorb them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.