Public Official in His 30s Bets 500 Million Won with Leverage

Ends Up Taking 10% Profit... Earns 140 Million Won

A case involving a public official who invested as much as 500 million won in SK Hynix shares using leverage has become a hot topic.

According to several online communities on the 6th, in November last year an anonymous office-worker community, Blind, carried a post from a public official in his 30s, referred to as Mr. A, who said he had invested 500 million won in SK Hynix, including 390 million won in margin loans.

At that time, Mr. A posted a purchase verification message when the price of one SK Hynix share was 619,000 won, but the share price then steadily declined to the 500,000-won range. This led to speculation that Mr. A had been subjected to a “forced liquidation.” Forced liquidation refers to a situation in which, after buying stocks on credit, the share price falls and the collateral requirement is no longer met, prompting the securities firm to sell the shares compulsorily and thereby lock in the loss.

However, early this year Mr. A posted again on Blind. He wrote, “When the SK Hynix share price approached 500,000 won per share, I got a call from the securities firm saying my collateral ratio was insufficient,” and added, “To prevent a margin call, I converted 80 million won from a circulation loan into cash stock.”

He said, “The monthly interest on the 300 million won loan alone was 2.6 million won,” and added, “I took profit at just a 10% return and pulled everything out. I made a total of 140 million won.” Mr. A went on to say, “When it really hit 500,000 won, I almost went to the Han River,” and, “Now I can laugh off all the mockery, criticism, and blame.” He added in particular, “I believe semiconductors will continue to trend upward until 2028,” and said, “Two days from now, when the money comes in, I’ll put some here and there into savings and then go all-in again with whatever is left.”

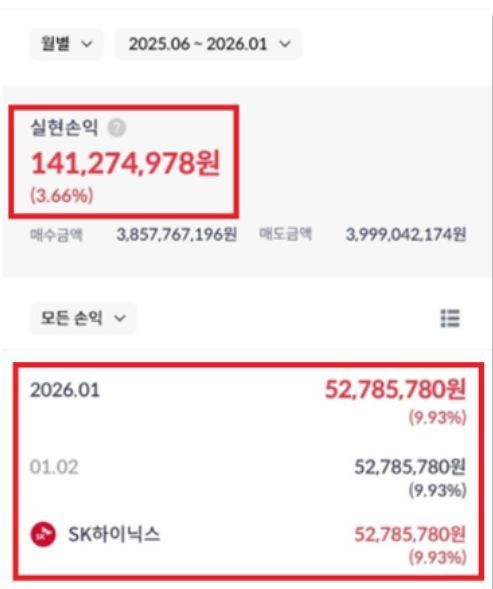

According to the profit verification screenshot Mr. A attached, he sold SK Hynix shares after they had risen to the high-600,000-won range, and recorded a combined profit of 141 million won between June 2025 and January 2026.

Online commenters reacted by saying, “It’s a relief it worked out well,” while also writing, “If it had gone wrong, it would really have been horrific,” “He’s a public official, but he seems far from risk-averse,” and “I’m envious, but it looks too risky for me to copy.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.