VKOSPI volatility index hits highest level in 5 years and 10 months

Foreign selling concentrated in Samsung Electronics and SK Hynix

Some see it as a "temporary correction within a bull market"

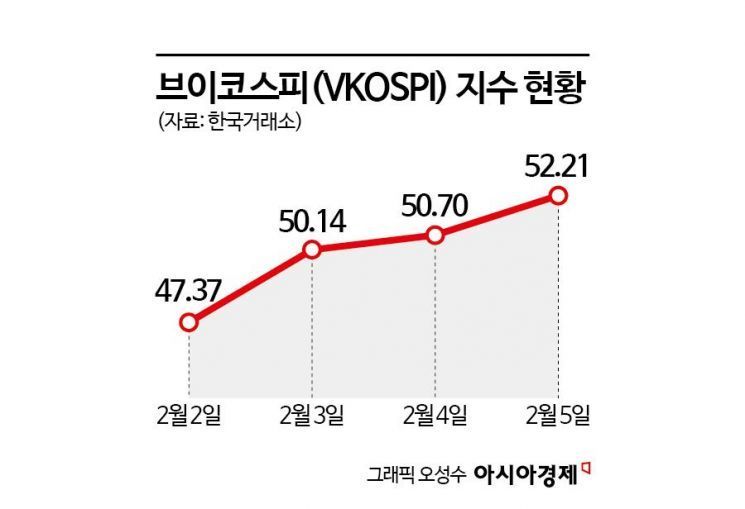

As the stock market plunges, the so-called "fear index," which reflects investor anxiety, is soaring. The KOSPI 200 Volatility Index (VKOSPI), known as the "Korean-style fear index," stood at 52.79 as of 9:29 a.m. on the 6th, up 0.58 points (1.11%) from the previous session. It has risen for 10 consecutive trading days since the 26th of last month. In numerical terms, this is the highest level in 5 years and 10 months since March 2020, during the COVID-19 crisis.

Dealers are working in the Hana Bank dealing room in Jung-gu, Seoul, on the 6th as the KOSPI index broke below the 5,000 level during trading and a sell-sidecar was triggered for the first time in four days. 2026.2.6 Photo by Kang Jinhyung

Dealers are working in the Hana Bank dealing room in Jung-gu, Seoul, on the 6th as the KOSPI index broke below the 5,000 level during trading and a sell-sidecar was triggered for the first time in four days. 2026.2.6 Photo by Kang Jinhyung

KOSPI 200 Volatility Index (VKOSPI) hits highest level in 5 years and 10 months

The VKOSPI had been steadily climbing from 28.85 on December 30 last year, then broke above the 40 level on the so-called "Black Monday" on the 2nd of this month, when the index crashed, and surpassed the 50 level the following day. A reading in the 20s is considered an average range, 30 or above a high-volatility range, and 40 or above a fear zone. With the KOSPI repeatedly surging and plunging throughout this week and the U.S. stock market also continuing to wobble, market anxiety appears to have reached an extreme.

The unprecedented scale of "bit-too" (borrowing to invest) is another factor driving the fear index higher. According to the Korea Financial Investment Association, as of the 4th, the balance of margin lending for stock trading stood at 30.9351 trillion won, up 83% from 16.9034 trillion won a year earlier. Experts point out that while margin trading can serve as leverage to maximize returns in a bull market, it also requires particular caution because it can trigger a vicious cycle of panic selling caused by forced liquidation (margin calls).

The plunge in the domestic stock market is being led by foreign investors, whose selling has been concentrated in top semiconductor stocks such as Samsung Electronics and SK hynix. On the previous day alone, foreign investors recorded net selling of Samsung Electronics shares worth 2.58 trillion won, leading the decline in the KOSPI. They also posted net selling of 1.3792 trillion won in SK hynix. Foreign selling continued in other semiconductor-related stocks such as SK Square (431.5 billion won) and Hanmi Semiconductor (171.5 billion won). As foreign selling of Samsung Electronics and SK hynix persisted on the day, their share prices were down 3.45% and 3.80%, respectively, as of 9:56 a.m.

As of the previous day, foreign investors were also net sellers in most large-cap stocks outside semiconductors, including Hyundai Motor (276.1 billion won), Hanwha Aerospace (172.7 billion won), NAVER (129.8 billion won), Korea Aerospace Industries (120.9 billion won), Kakao (107.1 billion won), and Mirae Asset Securities (70.1 billion won).

Han Jiyeong, a researcher at Kiwoom Securities, said, "This large-scale net selling by foreign investors appears to be largely strategic profit-taking focused on sectors such as semiconductors and automobiles, whose share prices surged in January," adding, "In the short term, it is time to switch on a cautious mode regarding foreign net selling and pay closer attention to managing returns."

Dealers are at work in the Hana Bank dealing room in Jung-gu, Seoul, on the 6th as the KOSPI index fell below the 5,000 mark intraday and a sell-sidecar was triggered for the first time in four days. 2026.2.6 Photo by Kang Jinhyeong

Dealers are at work in the Hana Bank dealing room in Jung-gu, Seoul, on the 6th as the KOSPI index fell below the 5,000 mark intraday and a sell-sidecar was triggered for the first time in four days. 2026.2.6 Photo by Kang Jinhyeong

Possibility of a temporary correction within a bull market

However, some also view this correction as a temporary phenomenon occurring within a bull market, given that earnings prospects for Korean companies remain solid.

Na Jeonghwan, a researcher at NH Investment & Securities, said, "This correction in technology stocks was triggered by two factors: first, the fact that the first-quarter guidance of U.S. semiconductor company AMD fell short of market expectations; and second, heightened concerns that artificial intelligence (AI) could replace existing software." He added, "This is more of an adjustment to elevated expectations following a rapid short-term rally, rather than a collapse in AI demand itself or damage to its structural growth potential."

Na went on to say, "Corrections in a bull market often occur not because of damage to the fundamentals of leading stocks, but in the process of profit-taking and shifts in supply and demand," and added, "This decline also appears to fall largely within that category."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.