Musk plans to "supply solar power in space"

Domestic solar ETFs post 20-30% returns in one month

As Elon Musk has unveiled plans to utilize solar power for both Tesla and SpaceX, related exchange-traded funds (ETFs) are also drawing attention.

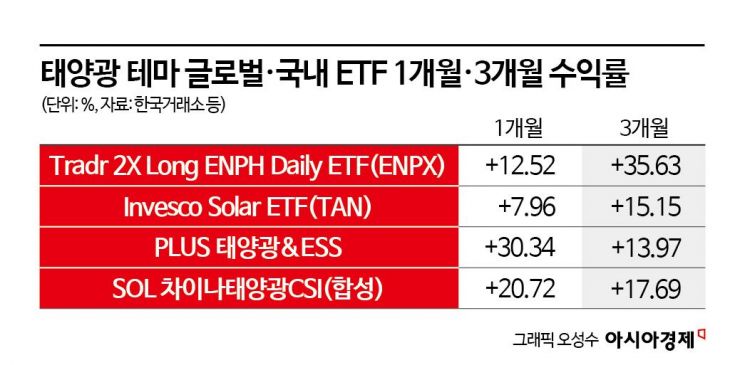

According to the financial investment industry on the 6th, solar-related ETFs listed on the American Stock Exchange (AMEX) on the 4th (local time) moved higher. The global solar ETF "Invesco Solar ETF (TAN)," which captures the value of various companies in the United States, Israel, China, and other countries, closed at 58.10 dollars (about 85,267 won), up 4.52% from the previous session. The "Tradr 2X Long ENPH Daily ETF (ENPX) ETF," which delivers twice the performance of the share price of U.S. solar company Enphase Energy (ENPH), soared as much as 77.78% to 34.56 dollars (50,734 won).

The uptrend in solar ETFs is interpreted as being driven by Elon Musk's recent moves related to solar power. At the World Economic Forum (WEF) in Davos, Switzerland last month, Musk announced a goal of securing solar module manufacturing capacity of 100 GW each for Tesla and SpaceX by 2028. On January 30, he also revealed a plan for SpaceX to launch a constellation of 1 million solar-powered satellites to supply electricity to space-based AI data centers. On the 4th, there were also local reports that Musk had dispatched Tesla and SpaceX teams to China to inspect solar companies.

On the back of this news, domestic solar-themed ETFs are also attracting interest. Although there are few domestic ETFs that track only solar power, they have posted solid returns over the past month. The only ETF in Korea that invests in Korean solar companies is "PLUS Solar&ESS." Its main holdings include Hanwha Solutions (21.21%), LS ELECTRIC (20.60%), OCI Holdings (18.19%), and HD Hyundai Electric (8.77%). Its net assets stand at about 37.2 billion won, and as of the previous day, its one-month return was 30.34%.

"SOL China Solar CSI (Synthetic)," which invests in solar value-chain companies in mainland China, recorded a one-month return of 20.72%. The "CSI Photovoltaic Industry Index (PR)" tracked by SOL China Solar CSI (Synthetic) includes major Chinese solar players such as TBEA (10.70%), LONGi Silicon Materials (8.52%), and Yangguang Power (6.81%). China is the world’s largest solar market in terms of power generation and installations.

Securities firms also hold a positive outlook on the solar industry. Park Wooyeol, Senior Research Analyst at Shinhan Investment & Securities, said, "U.S. solar companies, which have been separated from low-priced competition with Chinese products due to the spread of protectionist policies, are instead emerging as beneficiaries, with 12-month forward sales, earnings, and margins all improving." He added, "Solar power is being re-evaluated as a means of expanding power capacity cheaply and quickly in an environment of surging electricity demand, and beyond ground-based solar power generation, space-based solar power that enhances generation efficiency in orbit is drawing attention as a next-generation power source."

Yoon Jaesung, Research Analyst at Hana Securities, commented, "Musk’s designation of solar power as the essential energy source for the convergence of AI, robotics, and space represents an expansion of the solar power worldview," adding, "Because it underpins broad-based demand growth, it is a factor that can expand the industry’s valuation." However, Yoon also noted, "The fact that China cannot easily be excluded from such an aggressive solar expansion plan is also a risk factor, as it may narrow the scope of the indirect benefits that Korean companies have enjoyed thanks to U.S. policies aimed at excluding China." He diagnosed, "To overcome these risks and secure a position in the core value chain within Musk’s vision, it will ultimately be necessary to demonstrate technological superiority in next-generation solar cell technologies and achieve early commercialization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.