Tariff Re-Hike Imminent, Auto Industry on Edge

Additional Tariff Costs Could Exceed 10 Trillion Won

Contingency Plans to Remain in Place This Year

Industry Hopes "Government Will Take an Active Role"

The United States is expected to soon begin administrative procedures to re-raise tariffs, sparking concerns that the damage to Korean industries will become a reality. Tension is spreading first in the automobile sector. Hyundai Motor Group saw its profit shrink by more than 7 trillion won over eight months last year due to tariff burdens, and some analysts warn that if this situation continues this year, the losses could snowball.

The United States is reportedly carrying out administrative procedures to raise reciprocal tariffs (country-specific tariffs) on Korean-made automobiles, lumber, pharmaceuticals, and other products from the current 15% to 25%. Yeo Han-koo, head of the Trade Negotiations Office at the Ministry of Trade, Industry and Energy, said on the 3rd (local time) that U.S. government agencies are continuing coordination among relevant departments over officially publishing the tariff hike in the Federal Register.

If the United States raises tariffs by an additional 10 percentage points above the existing agreement, the tariff burden that the domestic automobile industry will have to shoulder is expected to be greater than last year. As the industry aggressively pushed shipments and cleared local inventories last year, its capacity to absorb the burden has been significantly weakened this year.

On top of this, the companies are now facing the prospect of having to revise their global production strategies, such as cutting domestic production and increasing local production in the United States, which would plunge them into greater management uncertainty.

Last year, the tariff burden that Hyundai Motor paid per vehicle sold in the United States was about 4.17 million won. Given that Hyundai Motor’s average selling price in the U.S. is around 37,000 dollars, or about 54 million won, this means roughly 7-8% of the vehicle price was paid in tariffs. Kia also had to bear about 3.62 million won in tariffs per vehicle.

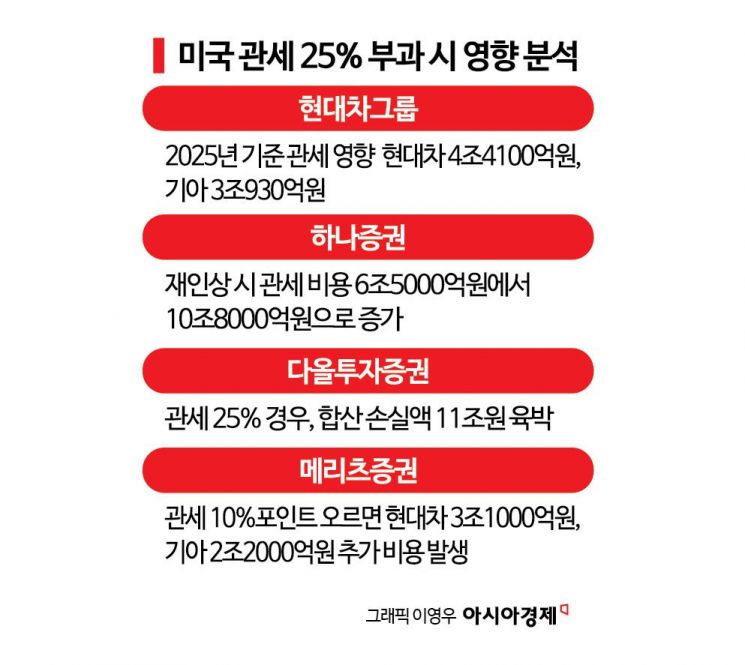

The securities industry expects that if the tariff rate rises again, Hyundai Motor Group’s additional burden could reach more than 10 trillion won per year. Hana Securities estimated that the annual tariff cost for Hyundai Motor and Kia would increase by about 4.3 trillion won, from the existing 6.5 trillion won to 10.8 trillion won, noting, “This means their combined operating profit for this year could fall by 18%.”

Daol Investment & Securities also estimated that if tariffs are set at 25%, the combined loss for Hyundai Motor and Kia would approach 11 trillion won (6 trillion won for Hyundai Motor and 5 trillion won for Kia). Meritz Securities likewise predicted, “If tariffs are raised by 10 percentage points, Hyundai Motor will incur an additional 3.1 trillion won in tariff costs, and Kia will face an additional 2.2 trillion won.”

This is expected to further undermine the profitability of Hyundai Motor and Kia, which has already been eroding despite the benefits of a weak won. According to the FnGuide consensus, Hyundai Motor’s operating profit forecast for this year is 12.8 trillion won, and Kia’s is 10.2 trillion won. Once additional tariff costs are factored in, there is a high possibility that their operating profits will fall below the 10 trillion won level.

For similar reasons, Hyundai Motor and Kia, despite posting record-high sales last year, were unable to avoid a decline in operating profit.

Hyundai Motor last year achieved sales of 186.2545 trillion won and operating profit of 11.4679 trillion won. Compared with the previous year, sales increased by 6.3%, but operating profit plunged 19.5%, worsening profitability. Its annual operating margin was 6.2%. On a consolidated basis, Kia recorded sales of 114.1409 trillion won and operating profit of 9.0781 trillion won. Sales rose 6.2% year-on-year, while operating profit fell 28.3%.

Hyundai Motor Group plans to continue actively implementing contingency plans this year, as it did last year. Its strategy is to increase sales volume in the North American market through flexible sales policies while cutting unnecessary budgets and expenses to lower costs. An industry official said, “Since the tariff re-hike can be sufficiently reconsidered depending on the progress and pace of domestic legislation on investment in the United States, we hope the government will take proactive action.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.