Impact of Kevin Warsh's Nomination as Next Fed Chair

International Gold and Silver Prices Plunge, Domestic Gold and Silver ETFs Weaken

Market Expected to Enter a Correction Phase Due to Profit-Taking in the Near Term

The relentless surge in gold and silver prices, which had been breaking all-time highs day after day, has come to a halt. International gold and silver prices plummeted after former Federal Reserve (Fed) Governor Kevin Warsh was nominated as the next Fed Chair. As a result, domestic exchange-traded funds (ETFs) and related stocks have also been affected. Experts predict that the volatility in gold and silver prices will increase for some time due to the nomination of the next Fed Chair.

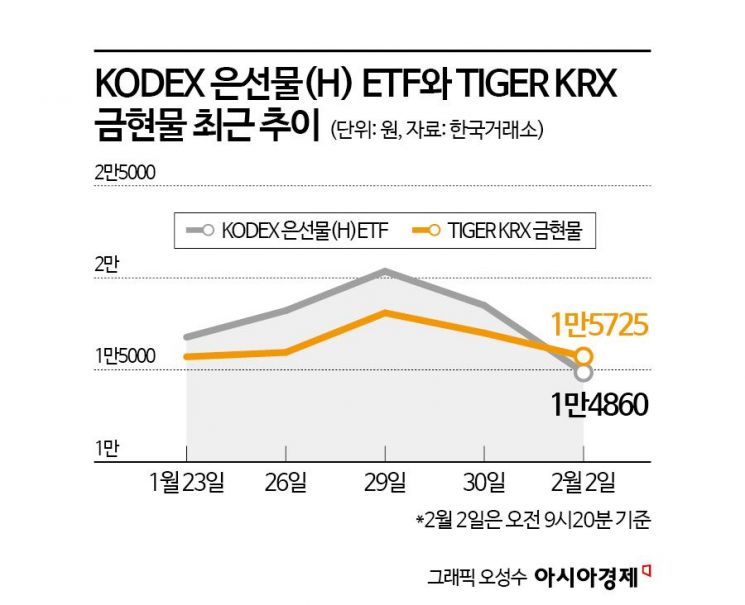

As of 9:25 a.m. on February 2, KODEX Silver Futures (H) was trading at 14,900 won, down 19.46% from the previous session. Other gold and silver-related ETFs are also experiencing sharp declines, with ACE Gold Futures Leverage (Synthetic H) down 12.47%, TIGER Gold & Silver Futures (H) down 8.19%, and TIGER KRX Gold Spot down 7.12%.

Exchange-traded notes (ETNs) are also seeing significant drops, especially in silver-related leveraged ETNs. Meritz Leverage Silver Futures ETN (H) fell by 49.52%, marking the largest decline among all ETNs. KB S&P Leverage Silver Futures ETN (H) dropped 49.49%, N2 Leverage Silver Futures ETN (H) 49.35%, Korea Investment & Securities Leverage Silver Futures ETN 48.91%, and Mirae Asset Leverage Silver Futures ETN B 48.44%.

On the other hand, silver-related inverse ETNs, which profit when silver prices fall, are soaring. Samsung Inverse 2X Silver Futures ETN (H) rose 28.13%, the largest increase among all ETNs. Shinhan Inverse 2X Silver Futures ETN (H) climbed 21.43%, Mirae Asset Inverse 2X Silver Futures ETN 21.08%, and Korea Inverse Silver Futures ETN 13.74%.

Korea Zinc, a precious metals-related stock, is also down by more than 11%. Korea Zinc, which earns additional revenue from silver as a byproduct during the refining process, had been expected to benefit from rising silver prices.

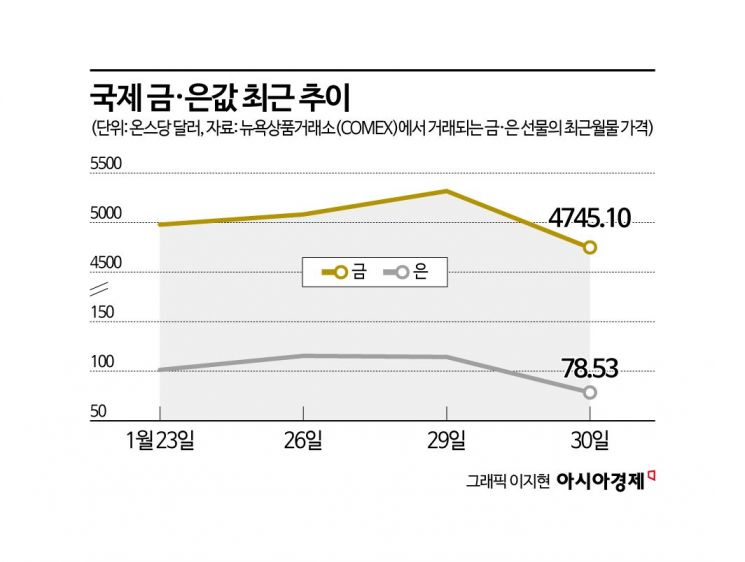

This sharp decline in gold and silver-related stocks, ETFs, and ETNs is due to the dramatic drop in international gold and silver prices. On January 30 (local time), international gold prices fell by more than 11%, while silver prices plummeted 31%, marking the largest drop in 46 years since 1980.

Previously, gold and silver had repeatedly hit all-time highs, with gold surpassing $5,300 per ounce and silver breaking through $110, continuing their steep upward trend. However, the nomination of Kevin Warsh as the next Fed Chair triggered a shock that led to a sharp decline.

The nomination of Kevin Warsh, who is considered relatively hawkish (favoring monetary tightening), increased uncertainty in financial markets and led to a drop in gold and silver prices. In particular, Warsh has maintained a negative stance on balance sheet expansion (quantitative easing). In 2011, he resigned from the Fed after opposing a $600 billion quantitative easing program.

Kim Yonggu, a researcher at Yuanta Securities, stated, "Until Warsh actually takes office as Fed Chair, headwinds related to the debasement trade (the move to alternative assets like gold and Bitcoin in response to weakening currency values) and increased volatility in market interest rates are inevitable. Warsh's emphasis on controlling and reducing the balance sheet suggests a trend toward a stronger dollar, which is likely to act as a headwind for precious metals and virtual assets such as gold and silver, while serving as a tailwind for international oil prices and oil-sensitive stocks overall."

However, some believe that the upward trend in gold and silver will not fundamentally change. Hwang Byungjin, a researcher at NH Investment & Securities, said, "The Warsh shock is merely a short-term adjustment in the pace of the rally and does not undermine the fundamentals of gold. Even after the new Chair takes office, continued Fed monetary policy easing, robust investment demand for gold bars, coins, and ETFs, and central banks' diversification of foreign reserves in response to rising U.S. federal government debt will continue to support strong gold prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)