No LNG CHP Auctions as Outlined in the 11th Basic Plan

No Progress on Clean Hydrogen Power Generation Auctions for Three Months

Ministry Says "Linked to 12th Basic Plan"... Effectively Under Comprehensive Review

Policy Uncertainty Raises Co

The Shin Sejong Combined Heat and Power Plant built by Korea Southern Power. It is the first eco-friendly power plant in Korea that can reduce greenhouse gases by co-firing LNG and hydrogen. Korea Southern Power.

The Shin Sejong Combined Heat and Power Plant built by Korea Southern Power. It is the first eco-friendly power plant in Korea that can reduce greenhouse gases by co-firing LNG and hydrogen. Korea Southern Power.

With the decision to proceed as planned with the construction of two large-scale new nuclear power plants outlined in the 11th Basic Plan for Electricity Supply and Demand, the energy industry’s attention is now shifting toward LNG and hydrogen policies. Since the launch of the new administration, bids for new liquefied natural gas (LNG) and hydrogen power generation projects have been suspended. The government has stated it will determine its policy direction after observing the development of the 12th Basic Plan for Electricity. As this policy uncertainty is expected to persist for some time, concerns are mounting among related companies about potential disruptions to their businesses.

According to the energy industry on February 2, the Ministry of Climate, Energy and Environment has not conducted any bids for LNG combined heat and power (CHP) capacity markets since last year. In addition, more than three months have passed since the ministry abruptly canceled the Clean Hydrogen Power Generation Obligation (CHPS) bid in October last year, with no follow-up measures announced.

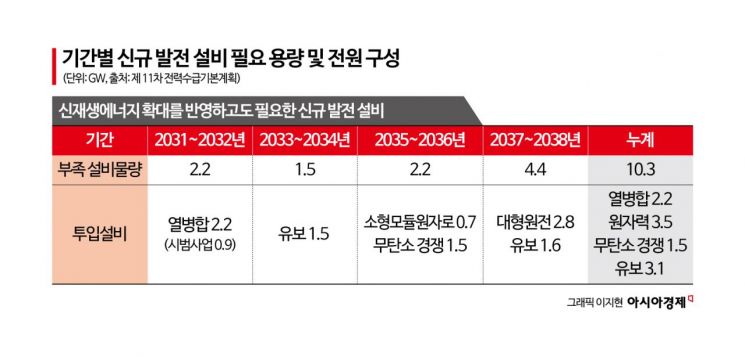

In the 11th Basic Plan for Electricity, which was reported to the National Assembly in March last year, the government stated, “LNG CHP projects will be selected through LNG capacity market bidding,” and added, “After finalizing the 11th plan, we will conduct the main bid to secure the necessary volume.” The government estimated that an additional 2.2GW of power generation facilities would be needed between 2031 and 2032, and planned to meet this demand with LNG CHP plants.

Of this, 0.9GW was allocated to two companies selected through a pilot project at the end of 2024. The government intended to conduct the main bid in the second half of 2025 to select operators for the remaining 1.3GW. However, as of the start of this year, the ministry has yet to announce any plans. The 1.3GW in question is equivalent to approximately three LNG CHP plants.

Regarding this, a ministry official stated, “We are working to address the issues identified in the LNG capacity market pilot bidding and are also considering ways to utilize clean heat. The upcoming ‘Heat Innovation Strategy,’ to be announced in March, will include policy directions for LNG CHP generation.”

LNG CHP refers to power plants that use LNG as fuel to simultaneously produce electricity and heat, thereby improving efficiency. The capacity market is a system in which the government determines the amount of electricity required in advance and selects operators through bidding, as opposed to granting permits based on applications from operators.

There has also been no update on the clean hydrogen power generation bid. The ministry abruptly canceled the clean hydrogen power generation bid on October 17 last year, the day of the bid’s deadline, stating the need to align with the policy to phase out coal-fired power plants by 2040. Although the government initially planned to re-announce the bid by the end of 2025, it has yet to present a clear plan. A power industry official expressed frustration, saying, “We are waiting for the government to re-announce the bid, but there has been no announcement at all.”

In response, a ministry official said, “If the 12th Basic Plan for Electricity is released soon, we will conduct bidding for the volume reflected in the plan. If the plan is delayed, we may hold a separate bid for just this year’s volume.” The draft of the 12th Basic Plan for Electricity is expected to be released in the first half of this year.

Minister of Climate, Energy and Environment: “LNG Generation Will Become Emergency Backup Power”

LNG CHP and clean hydrogen power generation are expected to be significantly influenced by the new administration’s energy mix policy.

On January 26, the Ministry of Climate, Energy and Environment outlined the direction of the 12th Basic Plan for Electricity Supply and Demand, announcing a plan to phase out coal-fired power plants by 2040 and achieve carbon neutrality centered on renewable energy and nuclear power.

The key issue is how to address LNG power generation, which currently accounts for about 30% of total power generation. Minister Kim Seonghwan stated, “We will gradually reduce LNG power generation and convert it to hydrogen and emergency backup power.” This is interpreted as a plan to drastically reduce the role of LNG power generation, a fossil fuel, to that of “emergency backup power.” Consequently, the roles and scale of LNG and clean hydrogen power generation set in the 11th plan are now effectively subject to a comprehensive review.

The 11th plan projected that, even after accounting for renewable energy, an additional 10.3GW of new generation facilities would be needed by 2038. Of this, 2.2GW (including the 0.9GW pilot project in 2024) was to be supplied by LNG CHP by 2032.

Additionally, the plan called for the closure of 28 aging coal-fired power plants by 2036, with conversion to LNG fuel, and for 12 more aging coal plants to be converted to pumped storage, hydrogen-only, or ammonia co-firing between 2037 and 2038. For aging LNG plants, conversion to district energy (CHP) or hydrogen co-firing would be permitted only in limited cases.

The 11th plan projected that clean hydrogen and ammonia power generation would account for 15.5 terawatt-hours (TWh), or 2.4% of total generation, in 2030, and 43.9TWh, or 6.2%, in 2038.

The government presented a vision to “expand corporate participation across the entire clean hydrogen ecosystem, from production and transportation to storage and utilization, in order to establish a stable foundation for hydrogen power generation and, considering energy security, to expand domestic and overseas clean hydrogen production bases.” The plan also included building infrastructure for power generation, such as hydrogen ports, receiving terminals, and pipeline networks.

LNG and Clean Hydrogen Power Generation Plans Also Under Comprehensive Review

However, these plans must now be fundamentally revised as the new administration has decided to completely phase out coal-fired power plants by 2040 and significantly expand renewable energy.

The policy to fully close coal-fired power plants has directly impacted coal-ammonia co-firing power generation. The clean hydrogen power generation bid included even methods that reduce carbon dioxide emissions by co-firing ammonia in existing coal plants. With the coal phase-out policy, coal-ammonia co-firing is expected to be excluded from future bids.

Along with coal, the share of LNG power generation is also expected to be drastically reduced. The 12th Basic Plan for Electricity, which is being developed, will include implementation plans to achieve the Nationally Determined Contribution (NDC) 2035 target, which the government pledged to the international community at the end of last year. According to NDC 2035, greenhouse gas emissions from the power sector are set at 68.8% to 75.3% of 2018 levels, the highest reduction target among all sectors.

Although LNG power generation emits only half as much greenhouse gas as coal, it too must be significantly reduced to achieve the NDC 2035 target. This is why the ministry has not been able to proceed with the main bid for the LNG CHP capacity market. How the ministry allocates LNG co-firing and hydrogen-only volumes in the clean hydrogen power generation bid will likely determine the future strategy for LNG power generation.

‘Four Times More Nuclear in the US’ and ‘Coal Phase-Out in Germany’... Gas Power Generation Expands Amid AI-Driven Electricity Demand

The energy industry has expressed concern about the rapid reduction of LNG power generation. The two large nuclear power plants are expected to be completed between 2037 and 2038. Until then, LNG power generation is still necessary to ensure a stable 24-hour electricity supply.

In fact, the United States, which has set a goal of quadrupling its nuclear capacity by 2050, is accelerating the construction of natural gas power plants to meet the electricity needs of AI data centers. McKinsey projects that 120 new gas power plants with a combined capacity of 80GW will be built by 2030. As a result, there is even a shortage of gas turbines in the US.

Germany, regarded as a model eco-friendly country for its coal phase-out, plans to build 12GW of new gas power plants by 2030.

Yoo Seunghoon, a professor at Seoul National University of Science and Technology, stated, “Since it takes a long time to build nuclear power plants, new LNG power generation is necessary to stably supply electricity to AI data centers as a supplement to renewable energy. It is necessary to actively consider allowing new LNG CHP plants on the premise of transitioning to hydrogen fuel.” Germany also plans to build new LNG power plants on the condition that they can be converted to hydrogen or equipped with carbon capture and storage (CCS) facilities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![The Special Connection Between the Statue of Martyr Lee Jun in Jangchungdan Park and Mayor Oh Sehoon ③ [Current Affairs Show]](https://cwcontent.asiae.co.kr/asiaresize/319/2026012110001599450_1768957215.jpg)