7.9 Million Shares to Be Issued at 31,650 Won per Share

1-for-1 Bonus Issue to Follow Paid-In Capital Increase

"Securing Next-Generation Growth Engines through R&D"

Lunit is conducting a paid-in capital increase worth 250 billion KRW.

On January 30, Lunit announced through a board resolution that it had decided to carry out a paid-in capital increase via a rights offering followed by a public offering of forfeited shares, as well as a free share issuance.

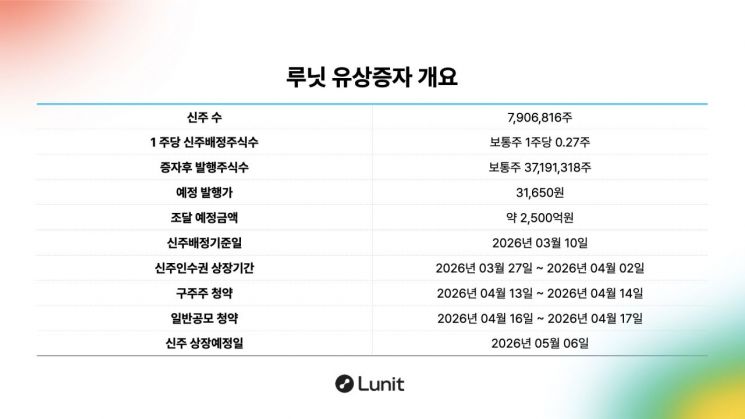

The paid-in capital increase totals 250.3 billion KRW, with 7,906,816 new common shares to be issued at 31,650 KRW per share. Existing shareholders will be allocated 0.27 new shares for each share they own. Of the funds raised, 112.5 billion KRW will be used as working capital, and 137.8 billion KRW will be used for debt repayment.

The record date for the allocation of new shares is March 10. The short-selling ban period related to the paid-in capital increase will run from January 31 to April 8.

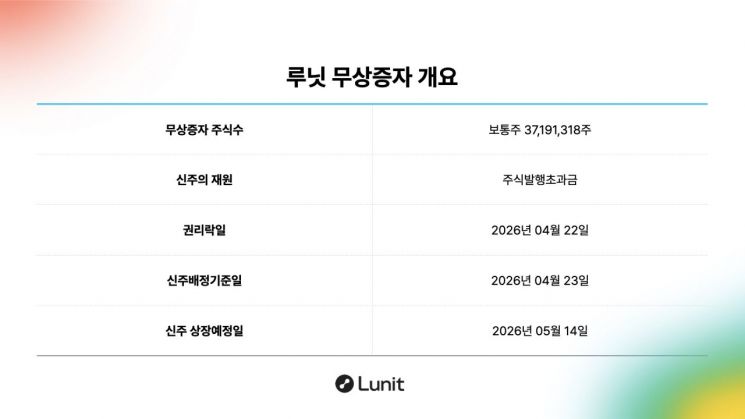

The free share issuance will be conducted after the paid-in capital increase, granting shareholders listed in the shareholder registry one new share for each share they own at no cost. The record date for the free share issuance is April 23, and the new shares are scheduled to be listed on May 14.

This paid-in capital increase is intended to alleviate the financial burden caused by the convertible bond (CB) put option that arose during the acquisition of Lunit International (formerly Volpara). Lunit explained, "Initially, we pursued fundraising through a third-party allocation of convertible preferred shares (CPS) and confirmed investment intentions from multiple institutions. However, we determined that this method alone would not fundamentally resolve the CB put option risk, so we opted for a rights offering paid-in capital increase."

Of the 117.8 billion KRW allocated for debt repayment, Lunit plans to use 98.5 billion KRW to address the convertible bond put option. The company intends to induce the exercise of some put options through negotiations with bondholders and aims to repay or acquire 50% of the total amount. The 112.5 billion KRW allocated as working capital will be invested in research and development (R&D) and overseas business expansion to secure next-generation growth drivers.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.