Big Pharma, Including Lilly, Pursues Successive Acquisitions and Technology Transfers

Korean Companies Olix, Argynomics, and ST Pharm Also Benefit

The clock hands of the global pharmaceutical and biotechnology market are rapidly turning toward "ribonucleic acid (RNA) therapeutics" from the very beginning of the new year. Major pharmaceutical companies, having secured massive cash reserves thanks to the recent boom in obesity and diabetes treatments that swept through the global industry, are now identifying RNA therapeutics as their next growth engine. Since last year, global pharmaceutical giants have been pouring astronomical sums-amounting to trillions of won-into acquiring these technologies, and this year, a large volume of key clinical data is set to be released, drawing significant attention.

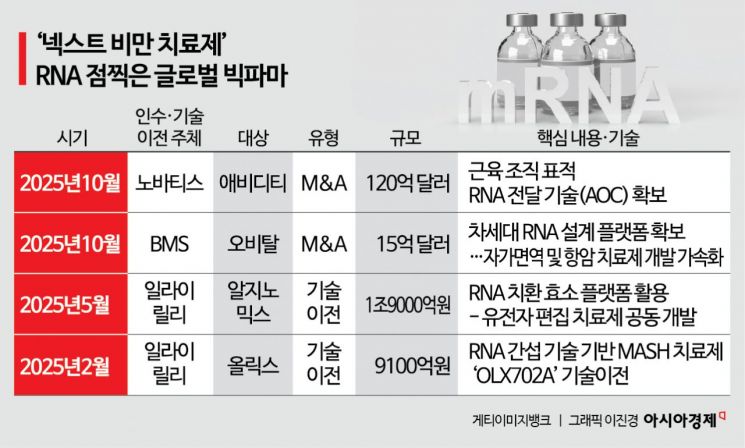

According to the industry on January 28, the aggressive mergers and acquisitions (M&A) and technology transfer deals by major pharmaceutical companies since the second half of last year are seen as a signal that RNA therapeutics have entered the mainstream market. In October last year, Novartis struck a "mega deal" by acquiring Avidity Biosciences, which possesses RNA delivery technology for muscle tissue, for approximately 12 billion dollars (about 17.226 trillion won). Once this acquisition, currently in its final stages, is completed in the first quarter, Novartis will instantly secure a late-stage RNA pipeline. Bristol Myers Squibb (BMS) also joined the fray in October last year by acquiring RNA-based therapeutics company Orbital Therapeutics for 1.5 billion dollars (about 2.1532 trillion won).

The reason major pharmaceutical companies are so focused on RNA is due to the limitations of existing drugs. Traditional antibody or compound therapies work by blocking disease proteins after they have already been produced, which means symptoms can recur if treatment is stopped, and there are many disease proteins that are structurally difficult to target. In contrast, RNA therapeutics act at the mRNA (messenger RNA) stage-the blueprint for protein production-fundamentally blocking or modifying the creation of the causative proteins themselves.

Specifically, siRNA (small interfering RNA) directly degrades disease-causing mRNA, while ASO (antisense oligonucleotide) promotes degradation or alters gene processing by binding to mRNA. Conversely, if there is a deficiency of a particular protein, normal mRNA can be introduced to induce production, and "RNA editing" technologies that directly modify mRNA sequences are also reaching commercialization.

It is noteworthy that Korean companies are at the center of this enormous trend. Eli Lilly, which became the world’s largest biotechnology company by market capitalization with its obesity drug "Mounjaro," invested nearly 3 trillion won in Korean biotechnology last year. In February last year, Lilly signed a technology transfer agreement worth 910 billion won with Olix, securing the candidate "OLX702A" for the treatment of metabolic dysfunction-associated steatohepatitis (MASH). This move recognized the advantages and scalability of Olix’s proprietary RNA interference platform for local administration. Then, in May, Lilly signed a deal worth up to 1.9 trillion won with Argynomics to jointly develop gene-editing therapeutics using Argynomics’ "RNA replacement enzyme" platform.

In the manufacturing infrastructure sector, ST Pharm has solidified its position as a global powerhouse. By internalizing the entire process-from raw material synthesis to mass production-in the oligonucleotide CDMO (contract development and manufacturing organization) sector, which provides the key raw materials for RNA therapeutics, ST Pharm is responding to the growing global demand.

This year will be the year when these technologies receive their "report cards." Argynomics plans to be the first in the world to verify the efficacy of its RNA replacement enzyme technology in humans through clinical results for hepatocellular carcinoma. Olix also faces the challenge of demonstrating the value of its platform through clinical progress of the MASH pipeline transferred to Lilly.

An industry expert commented, "This year will be the inaugural year that determines whether global pharmaceutical companies’ RNA therapeutics can be effective not only for rare diseases but also for cardiovascular, metabolic, and central nervous system diseases. If domestic companies can prove their competitiveness with real patient data, rather than just exporting technology, it could lead to a quantum leap in corporate value."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.