President Lee Continues Pressure, Says "No Benefit in Holding Out"

Tax Reform Roadmap Expected After June Local Elections

Likely Government Move: Raising the Fair Market Value Ratio

"Transaction Tax Relief Needed If Holding Taxes Are Raised"

On January 27, President Lee Jae-myung made it clear that he intends to eliminate the real estate bubble, referencing Japan's "Lost 30 Years." Previously, on January 25, he shared a news article and questioned, "Even if the holding tax is more expensive than the capital gains tax paid when selling, would people still choose to hold on?" This has led to assessments that, following the reinstatement of higher capital gains taxes, an increase in property holding taxes is now virtually confirmed.

With the government yet to present a specific direction after announcing plans to revise holding taxes, the president has stepped forward to signal additional tax hikes. Experts predict that the government is likely to first utilize measures within its discretion and then pursue full-scale tax law revisions after the local elections in June.

"Not Afraid of Resistance"... Continued Pressure Messages

President Lee Jae-myung is speaking at the Cabinet meeting held at the Blue House on the 27th. Photo by Cheongwadae Press Photographers Group

President Lee Jae-myung is speaking at the Cabinet meeting held at the Blue House on the 27th. Photo by Cheongwadae Press Photographers Group

At the Cabinet meeting, President Lee indirectly referred to Japan, stating, "We must learn from the painful example of a neighboring country that experienced the chaos of the 'Lost 20 Years' and 'Lost 30 Years' due to a failure to properly control the real estate bubble." He added, "We will not neglect unfairness and abnormality out of fear of immediate pain and resistance," and emphasized, "We must especially curb misguided expectations of unjust profits." On January 25, he posted on X (formerly Twitter), "Endurance? It's an obvious shortcut, and the policymakers are not foolish enough to allow people to benefit by knowingly holding on." This indicates a determination to pursue strong demand management measures alongside inter-ministerial housing supply policies led by the Ministry of Land, Infrastructure and Transport.

Woo Byung-tak, Senior Specialist at Shinhan Premier Pathfinder, commented, "Simply ending the 'temporary suspension of higher capital gains taxes' in May may not be enough to induce multi-homeowners to put their properties on the market," adding, "This is a strong policy message intended to remind them of the burden of holding costs and encourage voluntary sales."

The market expects a detailed roadmap for tax reform to be announced after the local elections. In a report released the previous day, "A Preview of Real Estate Tax Reform," Lee Eunsang, a researcher at NH Investment & Securities, stated, "Discussions on real estate tax reform will begin in earnest after the local elections and are expected to be announced around the end of July," predicting, "The policy trend will likely be to strengthen taxes on owners of high-priced single homes and multiple properties." He also noted that, following the tightening of loan regulations in October last year, high-priced homes (those worth over 1.5 billion won) will likely become the main target of regulation in the tax system as well.

Official Value Realization Rate Frozen, Tax Hike via Fair Market Value Ratio?

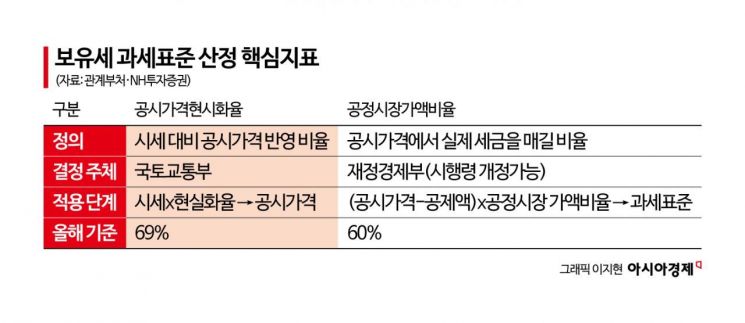

The government has several options to raise holding taxes, including increasing the fair market value ratio, raising comprehensive real estate tax rates (which requires tax law amendments), subdividing tax base brackets, or adjusting basic deductions.

The most likely and immediate measure is to raise the 'fair market value ratio,' which can be done by the government without parliamentary approval. Researcher Lee explained, "Although the official value realization rate for 2026 has been frozen at 69%, the flexible operation of the fair market value ratio (currently 60%), which can be adjusted by revising enforcement ordinances, will be a key variable going forward," adding, "If the fair market value ratio is gradually increased, the tax base for multi-homeowners and owners of high-priced homes will rise sharply, resulting in a substantial effective tax hike."

If the fair market value ratio is raised, the holding tax burden in major areas of Seoul, where market prices have increased, will immediately rise. Although the official value realization rate remains at 69% this year, as it did last year, the increase in market prices in Seoul has been partially reflected, resulting in a significant rise in official values. Park Hapsu, Adjunct Professor at Konkuk University Graduate School of Real Estate, explained, "It may seem like a 20 percentage point increase from 60% to 80% nominally, but when the rise in official values is also taken into account, the actual tax burden increases by nearly 30%."

Comprehensive Real Estate Tax: "Maintain Current Rate" vs "Gradual Increase"

Experts are divided on whether to go beyond adjusting the fair market value ratio and amend the tax law to raise the comprehensive real estate tax rate itself. Professor Park pointed out, "Under the current law revised by bipartisan agreement in 2023, the maximum tax rate for those with three or more homes is 5%, which is by no means low compared to the maximum rate (6%) during the Moon Jae-in administration." He added, "The law has only been in effect for three years, and it would be unproductive to overturn it again and raise the rate by another percentage point without a compelling reason, especially for a law aimed at social stability."

Senior Specialist Woo acknowledged the need for a tax increase but argued that the pace should be moderated. He noted, "The approach of the previous Moon Jae-in administration, which rapidly raised taxes by 1.5 to 3 times in a single year, only triggered tax resistance and failed." Instead, he suggested, "A structure in which taxes are raised gradually each year, lowering perceived resistance but ensuring that, over time, owners of multiple or high-priced homes end up paying significantly more, is necessary for effective tax increases."

Even if tax law revisions are pursued, it is expected to take considerable time before they are implemented. Han Mundo, Adjunct Professor of Real Asset Investment Analysis at Myongji University Graduate School, commented, "Considering the need for public hearings and the legislative process in the National Assembly, it will take at least a year," adding, "Even if a reform plan is prepared this year and passes the National Assembly by year-end, the earliest implementation would be in the second half of next year, or possibly as late as 2028." However, he noted, "Once the policy direction is confirmed, there will be a leading effect as market participants begin to consider selling."

Experts agree that any substantial increase in holding taxes should be accompanied by a reduction in transaction taxes. The logic is that in order to encourage multi-homeowners to sell, an 'exit route' must be provided. Senior Specialist Woo stated, "Strengthening holding taxes is the right direction, but a temporary reduction in capital gains taxes should be implemented in parallel to bring properties onto the market." Professor Han also remarked, "If transaction taxes are lowered in exchange for higher holding taxes, the market will accept and respond accordingly."

Even without changing the comprehensive real estate tax rate itself, the tax burden on owners of high-priced properties can be increased by subdividing tax base brackets or adjusting basic deductions. Currently, the basic deduction for comprehensive real estate tax is 1.2 billion won for single-homeowners, 900 million won for multi-homeowners, and 1.8 billion won for jointly owned properties by couples. The tax base is divided into seven brackets (from less than 300 million won to over 9.4 billion won), and further subdivision could expand the progressive tax burden on owners of ultra-high-priced homes. However, this approach requires tax law amendments and thus parliamentary approval.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)