New York Fed's "Rate Check" Observed

U.S. Administration Moves to Curb Rate Hikes

Currency Cooperation with Japan to Counter Yen Weakness

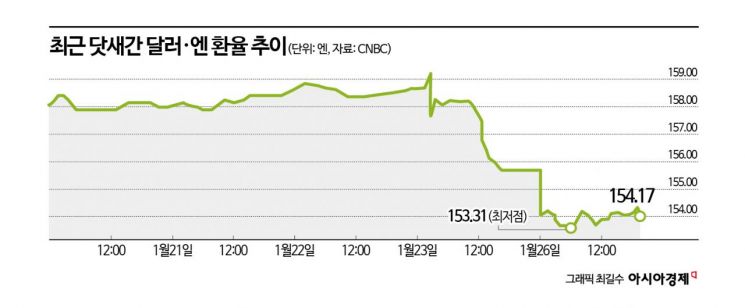

As the U.S. government is observed to have initiated a so-called "rate check," which is interpreted as a preliminary step toward foreign exchange market intervention, the dollar-yen exchange rate showed a weakening trend this week.

According to the Nihon Keizai Shimbun (Nikkei), on the 26th in the foreign exchange market, the dollar-yen exchange rate fell to the low 153-yen range per dollar. The rate, which was in the 159-yen range on the 23rd, dropped by about 6 yen in just three days. A falling exchange rate means a stronger yen and a weaker dollar. Against the euro, the dollar exchange rate surged to $1.1907, marking the dollar's lowest value in four months. The dollar also weakened against the British pound.

This decline in the dollar-yen exchange rate is seen as a result of currency intervention measures by both governments. The Wall Street Journal (WSJ) reported on the 23rd that the Federal Reserve Bank of New York conducted a rate check on major banks regarding the yen-dollar exchange rate. A rate check is a procedure in which the central bank inquires about exchange rate levels with financial institutions. In the market, this is interpreted as a signal that authorities may intervene in the foreign exchange market if necessary.

Although both governments have not officially acknowledged this, foreign media commonly assessed that the recent exchange rate intervention was the result of cooperation between the United States, which wants a weaker dollar, and Japan, which wants a stronger yen. In particular, the fact that the intervention was not carried out solely by the Bank of Japan (BOJ) but also involved the New York Fed strengthened the speculation of bilateral cooperation. Japanese Finance Minister Satsuki Katayama said the previous day regarding the possibility of joint intervention, "There is nothing to comment on at this stage."

The Japanese government has long been wary of a rapid depreciation of the yen. In 2024, it bought its own currency to prevent a sharp weakening of the yen. At the end of last year, in an interview with Bloomberg, it also issued a verbal intervention, stating, "We can take bold action against currency movements that do not reflect fundamentals," warning strongly against the super-weak yen. This was a strong warning based on the view that speculative moves were behind the continued yen weakness, even after shifting to a policy of raising interest rates for the first time in 17 years. According to WSJ, Finance Minister Satsuki recently shared concerns about the sharp drop of the yen with U.S. Treasury Secretary Scott Bessent.

Nikkei pointed out that the background for the bilateral cooperation, rather than unilateral action by Japan, reflected the Trump administration's intention to curb rising U.S. interest rates. Last week in Japan, discussions on a consumption tax cut surfaced, raising concerns about fiscal deterioration, which in turn led to a surge in Japanese government bond yields and a chain reaction of rising U.S. long-term bond yields. If Japan were to intervene in the market unilaterally, selling its holdings of U.S. Treasuries could further destabilize the U.S. Treasury market.

In fact, the rise in U.S. long-term interest rates could lead to higher mortgage rates, posing a significant political risk for the Trump administration ahead of the November midterm elections. On the 20th, Secretary Bessent publicly indicated that the rise in Japanese long-term interest rates had pushed up U.S. long-term rates by about 0.5 percentage points.

After this intervention, short sellers betting on yen weakness were also observed to be closing their positions. Mark Chandler of Bannockburn Capital Markets told Nikkei, "There are concerns in the market that the U.S. may be betting on a weak dollar policy," adding, "If the U.S. further strengthens its checks, the dollar's weakness could deepen."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.