WEF Report:

"Limitations in Dominating the Entire AI Spectrum Like the US and China"

"Expanding Models and Services on Top of Hardware Strengths Is Crucial"

There is advice that, rather than blindly following the all-encompassing AI dominance strategies of the United States or China, South Korea-which has focused its investments on artificial intelligence (AI) hardware-should pursue a more realistic approach by concentrating on its areas of strength and compensating for shortcomings through international cooperation.

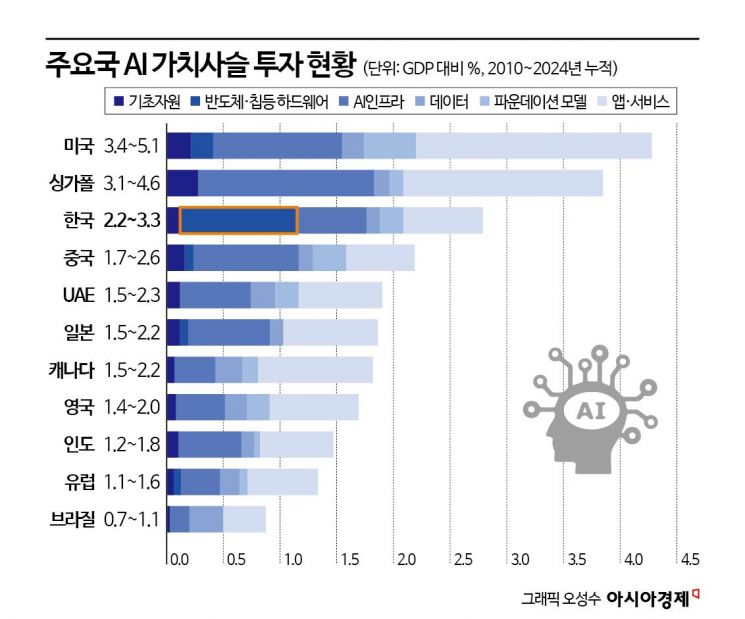

On January 27, the World Economic Forum (WEF, Davos Forum), in a report titled "Redefining AI Sovereignty" jointly published with the global consulting firm Bain & Company, stated that South Korea "initially concentrated investments in hardware sectors such as semiconductors, and has since expanded its efforts to foundation models and applications (apps)." The report also cited statistics showing that from 2010 to 2024, South Korea invested 2.2-3.3% of its gross domestic product (GDP) across the entire AI value chain, evaluating the country as one that has built competitiveness based on its AI hardware and manufacturing capabilities.

South Korea's AI investment, amounting to 2.2-3.3% of GDP, is lower than that of the United States (3.4-5.1%) or Singapore (3.1-4.6%), but higher than China (1.7-2.6%), which is also recognized as a leading AI powerhouse alongside the United States.

In its report, the Davos Forum categorized global AI competitiveness strategies into five types.

The United States and China were classified as "Global AI value chain leaders," having made massive investments across the entire AI infrastructure, model, and service spectrum. Singapore and the United Arab Emirates (UAE) were presented as prime examples of "Ecosystem builders," having established regional ecosystems through relatively balanced investments and policy coordination. Germany and France were identified as "Selective players," focusing competitiveness on certain segments of the AI value chain such as data and apps, while India was described as an "Adoption accelerator," concentrating on expanding app services and AI usage. Countries still in the early stages of developing AI capabilities were referred to as "Emerging collaborators."

Applying this categorization to South Korea, the report suggests that the country is currently in a transitional phase, moving from a "Selective player"-with strengths in specific areas-toward an "Ecosystem builder" by expanding investments into foundation models and applied services.

Based on this typology, the report emphasized that "for most countries, it is realistically impossible to directly own the entire AI value chain as the United States and China do." In fact, since 2010, more than half of global AI-related investment has been concentrated in infrastructure such as data centers, as well as apps and services, with investment in AI infrastructure alone surpassing $600 billion (about 864.18 trillion won). Currently, the United States and China together account for about 65% of total investment across the AI value chain.

Maria Basso, Head of AI Applications & Impact at the WEF Centre for AI Excellence and a contributor to the report, stated that in this context, "AI sovereignty should be redefined not as a matter of owning everything directly, but as the ability to design and govern AI in accordance with national values and norms, and to secure resilience that remains unshaken even in times of crisis." She particularly noted that, because AI infrastructure and foundation models have high barriers to entry in terms of capital, energy, and supply chains, strategic interdependence based on international cooperation and partnerships could be the key pathway to competitiveness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.