First Round of Heavier Taxation: Transactions Plunge by 53%

Second Round Tightening: 70% Drop in Just Two Months

"Freeze in High-Priced Apartment Listings Becoming Entrenched"

There are concerns that if the government reintroduces higher capital gains taxes for owners of multiple homes, the market could once again follow the pattern of a "transaction cliff leading to a freeze in property listings." During the Moon Jae-in administration, when the capital gains tax for multiple homeowners was implemented and strengthened, the number of apartment transactions in Seoul plummeted, and liquidity in the market quickly dried up as homeowners postponed selling their properties.

The higher capital gains tax for multiple homeowners was first introduced in 2004 during the Roh Moo-hyun administration. However, it was suspended in 2009 due to a sluggish housing market and was completely abolished in 2014. With housing prices soaring under the Moon Jae-in administration, the policy was revived after five years. In the August 2, 2017 policy package, the Moon administration announced that for owners of two homes in regulated areas, an additional 10 percentage points would be added to the basic tax rate (then 6-42%), and for those owning three or more homes, 20 percentage points would be added. The policy was scheduled to take effect on April 1, 2018, with an approximately eight-month grace period.

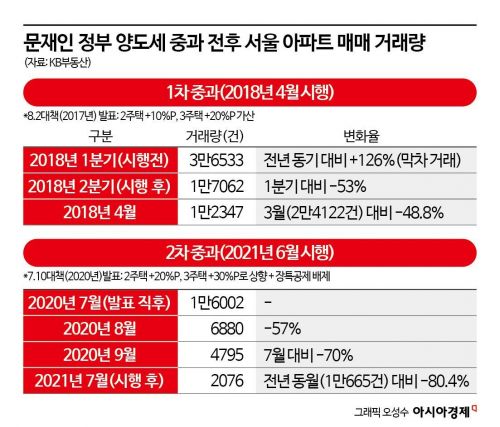

According to KB Real Estate statistics released on January 26, the number of apartment transactions in Seoul in the first quarter of 2018, just before the policy took effect, surged to 36,533 as sellers rushed to complete last-minute deals. However, in the second quarter, immediately after implementation, transactions dropped sharply by 53% to 17,062. There was a brief rebound in the third quarter to 25,934, but the number fell again to 17,093 in the fourth quarter. By the first quarter of 2019, transactions plummeted to 5,326, marking the onset of a full-fledged transaction cliff.

The situation was even more severe in 2021, when the tax rates were raised further. Through the July 10, 2020 policy, the government increased the additional tax rate to 20 percentage points for owners of two homes and 30 percentage points for those with three or more, while also eliminating the special long-term ownership deduction. Although the policy was implemented in June 2021, the market froze immediately after the announcement. In July 2020, there were 16,002 apartment transactions in Seoul, but this number dropped to 6,880 in August and 4,795 in September, a 70% decrease in just two months. The mere announcement of the policy effectively froze property listings.

By the actual implementation in June 2021, the number of transactions had already shrunk to around 4,240. The market failed to recover, and by September 2022, transactions fell to just 856, marking an all-time low.

Both rounds of increased taxation followed the same pattern: a surge in last-minute transactions before implementation, a sharp drop in transactions immediately after, a freeze in property listings, and then a rise in home prices. The annual increase in Seoul apartment prices was 8.03% in 2018 and 8.02% in 2021. According to a study released by the Korea Research Institute for Human Settlements in May 2024, every 1% increase in the capital gains tax rate resulted in a 6.9% decrease in transaction volume and a 0.2% increase in sale prices.

An official from a state-run research institute, who requested anonymity, said, "The notion that taxing multiple homeowners will induce them to sell and stabilize the market is a one-sided view. Multiple homeowners have various options, such as raising rents or simply holding on instead of selling." He added, "This could actually drive prices even higher and intensify the extreme polarization, where expensive apartments become even more expensive."

Regarding the announcement of the policy with only about three months left before the end of the grace period, the official commented, "Policies have inertia, and sudden changes can create confusion in the market," adding, "In particular, a freeze in property listings could become entrenched, especially for high-priced apartments."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.