Transition to "Conditional Choices" Weighing Delivery Fees, Minimum Orders, and Discounts

Nine Out of Ten Consumers Say "Delivery Fees Are Expensive"... Cost Now Trumps Speed

Delivery Market Shifts from Expansion to a Stage Where Only "Surviving

Eight out of ten consumers now consider current delivery fees to be expensive. While delivery has become a daily routine in South Korea’s dining-out market since the COVID-19 pandemic, it is now shifting toward a high-involvement purchase, chosen only when price and conditions are met.

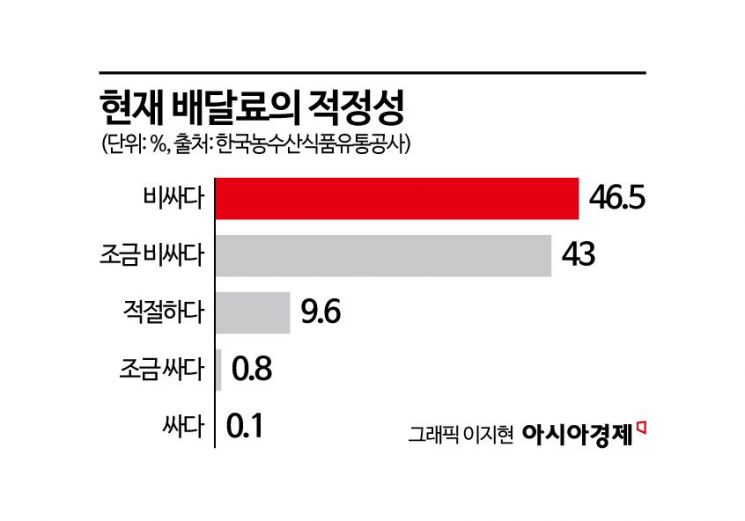

According to a survey on delivery usage behavior by the Korea Agro-Fisheries & Food Trade Corporation (aT) released on January 26, 89.5% of respondents said that current delivery fees are "expensive" or "somewhat expensive." This indicates that dissatisfaction with delivery fees has evolved beyond a simple sense of cost to become a structural perception that makes consumers hesitant to use delivery services at all. In contrast, only a single-digit percentage of respondents said the fees are "appropriate." Delivery fees have become the primary hurdle that determines whether an order is placed, rather than a tolerable convenience cost.

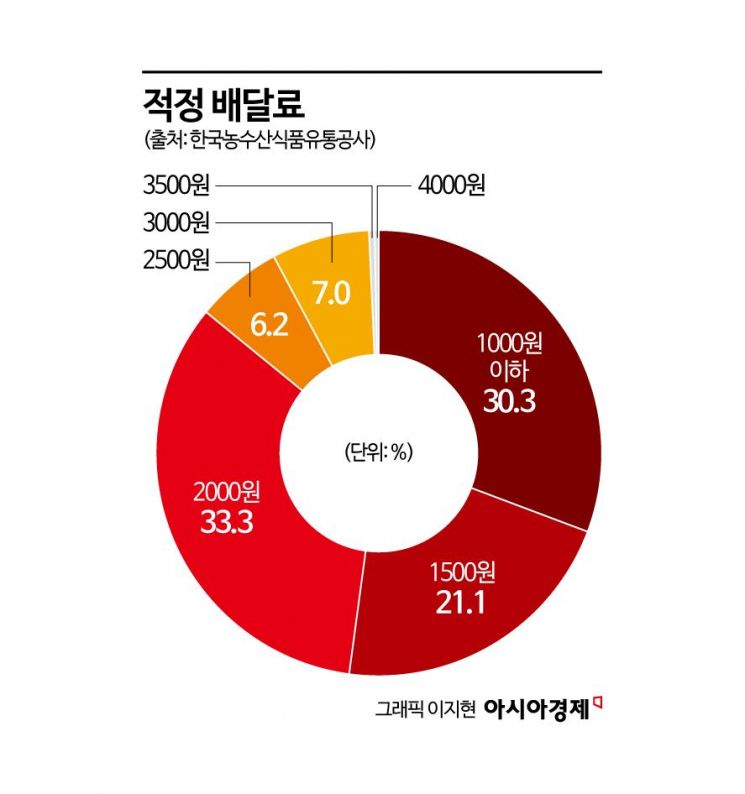

Consumers' perceptions of an appropriate delivery fee make this trend even clearer. 81.7% of respondents said a reasonable delivery fee should be 2,000 won or less. Many even consider 1,000 won or 1,500 won to be the proper threshold. The moment delivery fees exceed 2,000 won, delivery is eliminated as an option altogether. A clear psychological upper limit for delivery fees has thus been established.

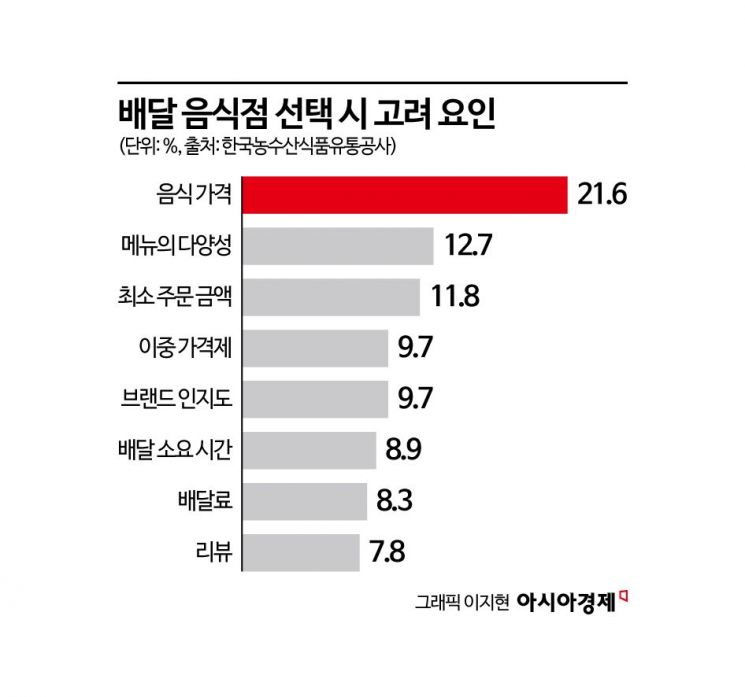

This shift in perception is changing the entire process of placing delivery orders. In the past, delivery was a straightforward purchase: choose a menu and place an order. Now, however, consumers scrutinize the total payment amount, minimum order value, discounts, and delivery methods before deciding to order. If the conditions do not meet their expectations at any stage, they cancel the order and either opt for takeout, visit in person, or choose a completely different dining option. Delivery is no longer an automatic substitute for dining out but has become a secondary choice, only allowed when it is not disadvantageous compared to eating out.

'The Value of Fast Delivery Declines... Platform Loyalty Collapses, Only Conditions Remain'

This change is also evident in how consumers choose delivery methods. In 2025, the share of "budget delivery" usage rose to 33.0%, up 7.1 percentage points from the previous year. In contrast, the share of single-household and standard deliveries declined. This means consumers are no longer willing to pay extra for slightly faster delivery. Speed, once the core competitive edge in delivery, has been relegated to a lower priority, while cost-saving options have become the main criterion for choice.

This suggests that the value propositions delivery services have long emphasized are now hitting their limits. Speed and convenience remain important, but they are no longer absolute factors that justify the price burden. Delivery is now competing not as "the fastest service," but as "the least disadvantageous option."

Changes in how consumers order delivery reflect this same trend. The share of orders placed through delivery apps has increased, while usage of brand-specific apps has dropped significantly. Rather than increased loyalty to a particular platform or brand, this reflects a stronger tendency to move to whichever channel offers the best prices or benefits. Consumers no longer remain loyal to a single channel. Instead, they move to wherever discounts, coupons, and delivery fee conditions are most favorable. Delivery consumption has shifted from lock-in to an area of comparison and mobility.

Public delivery apps are also subject to this conditional consumption structure. In reality, only 54.3% of users reported being satisfied or more, hovering around half, and the proportion of "average" responses was also high. When clear price benefits are present, public apps are chosen, but if not, users return to private delivery apps-a pattern that repeats itself. Rather than being an alternative that reshapes the delivery market, public delivery apps function more as an auxiliary tool, used only when cost conditions are met.

Although delivery demand did not disappear last year, the conditions under which consumers allow themselves to use delivery have become much stricter. Consumers have removed delivery from the realm of everyday convenience goods and placed it on the same table of comparison and judgment as dining out. The delivery market has moved beyond a phase of expansion-generating more orders-and entered a phase of refinement, where only certain orders survive.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.