Hyundai Motor to Discuss Reorganization Plans for Plant 4 Site

Porter Faces Inevitable Structural Changes Due to Stricter Safety Regulations

Production Line Restructuring Considered Amid Rising Costs

Labor Union Opposition Emerges as a Key

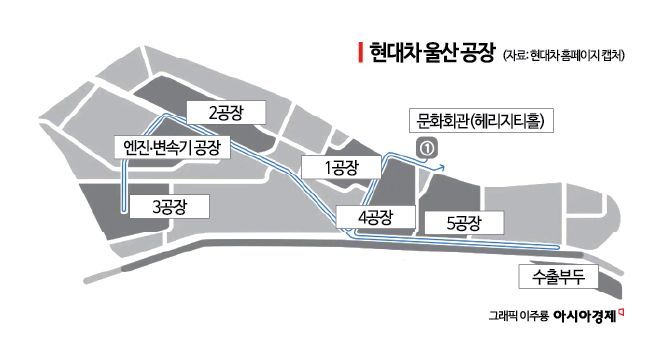

Hyundai Motor Company is considering restructuring the production lines at Ulsan Plant 4, which serves as the main production base for its 1-ton truck, the Porter. As safety regulations are strengthened, the plant ages, and the need for a transition to future vehicles grows, there is increasing discussion about the possibility of structural changes across the entire Ulsan complex.

According to a summary of The Asia Business Daily's reporting on January 23, Hyundai Motor’s labor and management plan to discuss the reorganization of the Ulsan Plant 4 site, where the Porter, Palisade, and Staria are produced, during the third quarter of this year. It is reported that the company intends to present a draft plan to the union in July.

The main reason Hyundai Motor is deliberating over the future of Plant 4 is the tightening of safety regulations surrounding the Porter. With stricter safety standards set to take effect next year, structural changes to the Porter-the plant’s main model-have become inevitable. However, with Porter sales on the decline and reinvestment costs expected to be substantial, these factors are weighing heavily on the company’s decision-making process.

In 2022, the Ministry of Land, Infrastructure and Transport announced plans to strengthen crash safety tests for light trucks under 3.5 tons. Previously, these vehicles were exempt from various crash tests, but due to the fatality and serious injury rates being twice as high as those for passenger cars in the event of an accident, safety standards were tightened. While the new standards will be phased in starting in 2024, existing models like the Porter have been granted a grace period until 2027, considering development timelines.

The core issue lies in the “cab-over” design, where the engine is positioned beneath the driver’s seat. This structure makes it difficult to secure space at the front of the vehicle to absorb collision energy, which has led to concerns about a higher risk of serious injury for drivers and passengers. As a result, Hyundai Motor is considering switching from the cab-over design to a “bonnet” style with the engine compartment at the front. However, the company is reportedly grappling with the combined challenges of increased costs and declining sales.

The Porter is a representative affordable domestic vehicle, making cost reduction through production efficiency critically important. For this reason, the reorganization of production lines has always been a top priority in discussions. The recent sharp drop in sales has added to the pressure. Domestic sales of the Porter fell by 29% in 2024 and by 18% in 2025, marking two consecutive years of double-digit declines. Annual sales, which had hovered around 100,000 units, dropped to approximately 56,000 units last year.

An official at the Hyundai Motor plant stated, “Switching to a bonnet structure is expected to increase production costs by about 5 million won per vehicle,” adding, “There is also talk of repurposing the plant site for other uses.”

Industry insiders predict that the restructuring of Plant 4’s facilities will spark a range of discussions about the production lines at the Ulsan complex. The No. 1 Plant, which opened in 1975, is said to be significantly outdated, and the No. 2 line of the same plant, which produces the Ioniq 5, has seen its operating rate continue to fall recently due to slowing demand for electric vehicles.

Discussions about reorganizing the Ulsan complex are also expected to put pressure on labor-management relations this year. This is the first year for the new executive team of the Hyundai Motor labor union, which has already taken a hardline stance against the possible transfer of production volumes overseas and the introduction of robots. The company, for its part, has signaled it will not back down in the event of strikes or performance bonus negotiations. With the added complexity of plant restructuring talks, many analysts believe these factors could become significant variables in Hyundai Motor’s labor-management relations throughout the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)