Following MegaMGC and Gongcha, Compose Joins In

Menu Diversification Amid Rising Costs and Labor Expenses

Low-cost coffee franchise Compose Coffee will introduce a tteokbokki (spicy rice cake) menu starting next month. This move is seen as a response to the intense price competition in the budget coffee market, where it has become increasingly difficult to generate profit from coffee sales alone. It is also interpreted as a sign that low-cost coffee franchises are experimenting with menu diversification as a survival strategy.

According to industry sources on January 23, preparations for the tteokbokki menu are underway, primarily among Compose Coffee franchise owners. While the composition and sales method of the menu may vary by store, it is reported that cup tteokbokki featuring bunmoja (thick glass noodles) is a strong candidate. A Compose Coffee representative stated, "It is true that we plan to launch a tteokbokki menu starting in February."

The launch of tteokbokki by Compose Coffee is more than just the addition of a new menu item. It is a strategic move by a low-cost coffee franchise to expand beyond the boundaries of a 'coffee specialty shop' and into the snack food sector. Analysts suggest this reflects a recognition that it has become difficult to maintain profitability with the existing business model alone.

In fact, the environment surrounding the low-cost coffee market is rapidly deteriorating. International coffee bean prices have remained high for an extended period, while the strong dollar has driven up import costs even further. The prices of key ingredients such as milk, cups, and syrup are also generally rising. In addition, increases in the minimum wage and higher rent burdens have significantly eroded perceived profitability for franchise owners.

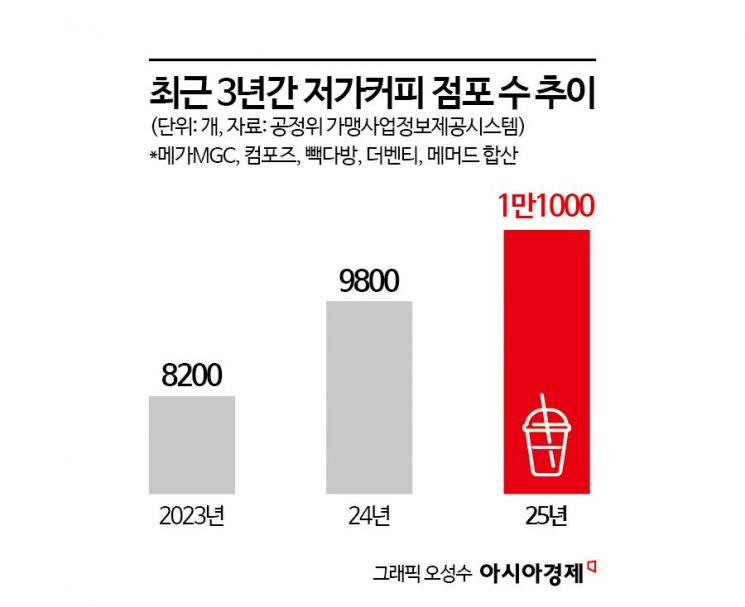

Intensified competition for new store openings is another challenge. Major brands such as MegaMGC Coffee, Compose Coffee, and Paikdabang are aggressively increasing their number of outlets, resulting in near-saturation competition within commercial districts. Given the low average transaction value, simply increasing the number of stores is not enough; industry observers note that expanding the range of products on offer has become essential to achieve a certain level of sales.

According to Statistics Korea, the number of coffee shops nationwide surpassed 100,000 at the end of 2022, reaching 107,290-a 4.5% (4,292) increase from the previous year’s 96,437 outlets. The number of coffee shops nearly doubled in six years, from 51,551 in 2016.

In this context, tteokbokki is considered a relatively practical alternative. The cooking process is simple, cost control is feasible, and it can meet both snack and meal demand. As an additional menu item that customers can order alongside coffee, it is also expected to help raise the average transaction value.

MegaMGC Coffee already offered cup tteokbokki on a limited basis in 2024, and Gongcha drew attention by introducing "Pearl Tteokbokki" featuring its signature tapioca pearls.

An industry insider commented, "With rising costs of goods and labor, it has become difficult for franchise owners to sustain profits through coffee sales alone. There is a growing trend of introducing menu items that do not require significant additional preparation in order to raise the daily sales floor."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)