Tmon's Reopening Plan under Oasis Acquisition

Stalled by Difficulties in Card Company Negotiations

In Stark Contrast to Competitors Benefiting from Coupang's Fallout

The indefinite postponement of the reopening of Tmon, a first-generation e-commerce platform, has cast doubt on whether its services will resume within this year. In June of last year, Tmon was acquired by Oasis Market, raising hopes for a revival. However, the company encountered difficulties as negotiations to establish a payment infrastructure fell through. This has deepened concerns for Oasis, which invested hundreds of billions of won in acquiring Tmon.

According to industry sources on January 22, the normalization of Tmon's services, which had been scheduled for September 10 of last year, has been effectively suspended. Currently, a notice announcing the postponement of the reopening has been posted on the Tmon homepage, and the Tmon app displays a "connection unavailable" message, making access impossible. In the notice, Tmon explained the reason for the suspension, stating, "Following the news of our business resumption, a large number of complaints were filed by victims through our partner credit card companies and related agencies," and added, "We have once again been forced to postpone the reopening due to this dire situation."

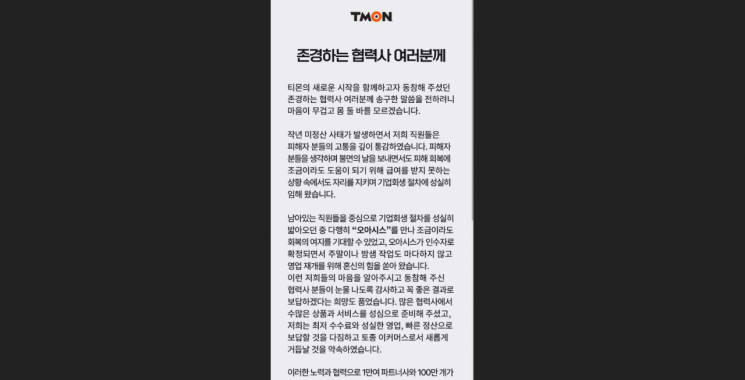

A notice announcing the postponement of the reopening has been posted on the Tmon homepage. Screenshot of the Tmon homepage

A notice announcing the postponement of the reopening has been posted on the Tmon homepage. Screenshot of the Tmon homepage

Since the Tmemep (Tmon + Wemakeprice) incident that shook the retail industry two years ago, Tmon has struggled to regain its footing. Wemakeprice and Interpark Commerce failed to find buyers and were declared bankrupt by the courts. In contrast, Tmon survived after being acquired by Oasis Market in June of last year. However, persistent complaints from consumers and sellers led to ongoing issues with some credit card companies that contract with payment gateway (PG) providers. Although PG providers can facilitate online payments after signing contracts with credit card companies, the reluctance of these companies to participate has prevented the establishment of a payment infrastructure.

Oasis Market spent a total of 18.1 billion won to acquire Tmon. Of this, 11.6 billion won was used to purchase new shares in Tmon, while the remaining 6.5 billion won was allocated to unpaid wages, severance payments, and other liabilities. As a result, Tmon's rehabilitation proceedings ended in August of last year, and Oasis announced plans to resume services around September, implementing a revamped system that included applying an industry-low commission rate of 3-5% for victimized sellers.

With the reopening delayed longer than expected, there are concerns that the hundreds of billions of won spent on the acquisition could turn into losses. Oasis aimed to expand its business in preparation for an initial public offering (IPO) through the acquisition of Tmon. Unlike competitors, Oasis had operated primarily through direct purchasing and dawn delivery services, without running an open market. As a result, its transaction volume was smaller compared to competitors who simultaneously operated both direct purchasing (1P) and open market (3P) businesses.

In 2024, Kurly's gross merchandise value (GMV) reached 3.01 trillion won, with sales totaling around 2.2 trillion won. In contrast, Oasis's GMV and sales during the same period remained at approximately 520 billion won. This suggests that Oasis sought to rapidly increase transaction volume through the open market business. Previously, Oasis attempted to list on the KOSDAQ in January 2023 but voluntarily withdrew the application due to weak demand.

Meanwhile, Tmon's competitors have benefited from increased marketing efforts and resulting gains following Coupang's personal information leak incident at the end of November last year. According to SSG.com, the average daily number of visitors to SSG.com surged by 200% from January 1 to 21. The number of first-time customers using "SSG Delivery" increased by 60%, and the total number of orders also rose by about 10% compared to the previous year. Kurly also saw its paid membership program, "Kurly Members," surpass 2.75 million cumulative subscribers by the end of last year, a 94% increase from the previous year. Naver Shopping's guaranteed delivery service, "N Delivery," saw its transaction volume increase by 76% year-on-year last month.

In fact, the number of users of competing e-commerce platforms increased across the board following the Coupang incident. According to WiseApp Retail, an app and payment data analytics firm, Coupang's monthly active users (MAU) in the previous month fell by 0.3% from the previous month to 34.28 million. In contrast, Naver Plus Store's MAU rose by 11.5% to 6.44 million, and Gmarket's MAU increased by 1.6% to 6.96 million. Kurly reported that its MAU reached a record high of 4.49 million during the same period, up 34% year-on-year.

An Oasis Market representative stated, "We remain firmly committed to reopening, but it is a difficult situation due to public sentiment." A retail industry insider commented, "Following the massive personal information leak at Coupang, companies like Kurly and SSG.com have ramped up their marketing and are reaping the benefits," adding, "If Tmon had reopened, it could have been chosen as an alternative platform."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.