End of Credit Recovery Support Measures

Average Credit Score Up 29 Points for Individuals

Average Up 45 Points for Sole Proprietors

"Clear Impact from Debt Repayment"

The deletion of delinquency records for individuals who fully repaid overdue debts within the specified period, as well as the restoration of credit for those granted credit amnesty, has proven to be effective, with average credit scores rising by up to 45 points.

The Financial Services Commission announced on January 22 that the credit recovery support measures implemented on September 30 of last year concluded at the end of last year. These measures targeted individuals and sole proprietors who had incurred small-scale delinquencies of up to 50 million won between January 2020 and August of last year, but fully repaid their overdue amounts by December 31 of last year. Normally, even after full repayment of overdue debts, individuals face disadvantages such as restrictions on financial transactions for up to five years. However, under these measures, those who repaid their overdue debts in full within the deadline were able to immediately return to normal economic activities.

The beneficiaries of these measures included 2,955,000 individuals (according to NICE Information Service) and 748,000 sole proprietors (according to Korea Enterprise Data). Of these, as of last month, 2,572,000 individuals (87%) and 356,000 sole proprietors (47%) had completed repayment and saw their credit scores substantially recover. The Financial Services Commission also explained that since the announcement of the support measures, 123,000 individuals and 228,000 sole proprietors repaid their overdue debts, thereby encouraging debt repayment.

The improvement in financial accessibility resulting from credit recovery was also clear. A total of 38,000 individuals received new credit cards, and 110,000 obtained new loans from banks. Among sole proprietors, 6,000 accessed new bank loans, indicating a normalization of financial transactions. Additionally, there were confirmed effects such as increased loan limits and lower interest rates, allowing beneficiaries to access financial services under more favorable conditions.

For individuals, credit improvement was seen across all age groups (an average increase of 29 points), with those in their twenties and younger experiencing the largest increase (+37 points). For sole proprietors (an average increase of 45 points), the effect was especially pronounced in sectors closely related to daily life, such as accommodation and food service (+42 points) and wholesale and retail (+47 points).

Through these measures, support was also extended to 413,000 individuals and 50,000 sole proprietors who were unable to benefit from the credit recovery support measures in 2021 and 2024 because they had not repaid their overdue debts at those times.

The Financial Services Commission stated, "To enhance institutional financial accessibility for middle- and low-credit individuals, we will actively promote 'Credit Build-up' in policy-based financial programs, enabling people to build credit and transition into the institutional financial system. At the same time, we will expand the use of alternative data to help those with insufficient financial histories quickly discover and accumulate hidden credit."

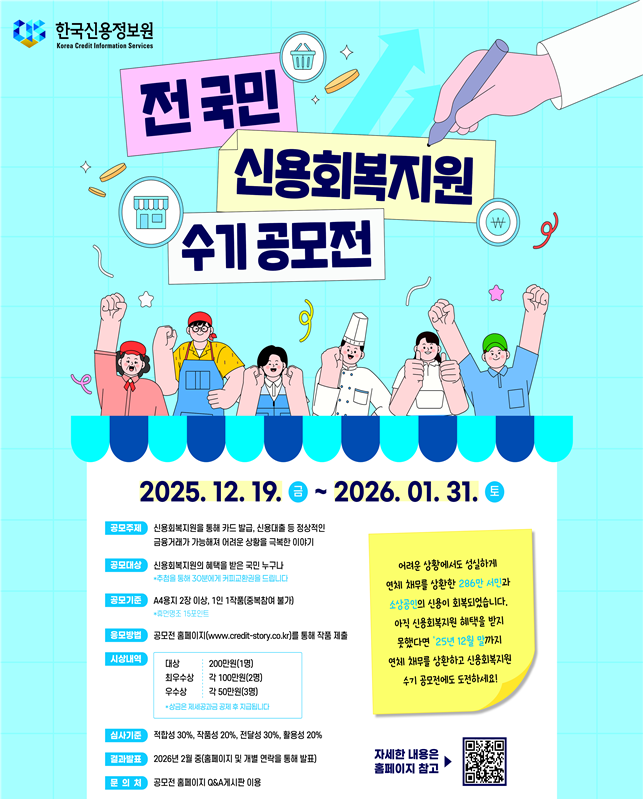

Meanwhile, the Korea Credit Information Services is currently accepting submissions for the 'National Credit Recovery Support Essay Contest,' which was launched last month to share experiences of quickly returning to financial life through these measures and to increase public awareness of the policy. Anyone who has benefited from the credit recovery support measures is eligible to participate, and winners will receive a prize.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)