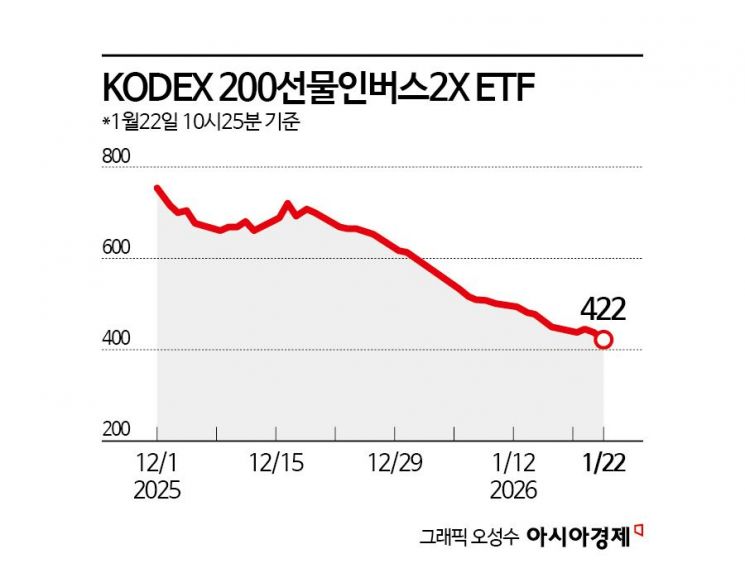

Individuals Make Net Purchases of 650 Billion Won in KODEX 200 Futures Inverse 2X ETF

Investing While Waiting for a Market Correction That May Not Come

As the KOSPI surpassed the 5,000-point mark for the first time in history, losses for investors betting on a market decline are rapidly increasing. With the domestic stock market continuing its strong rally, expectations for a short-term correction have not materialized.

According to the financial investment industry on January 22, individual investors made a net purchase of 652.7 billion won worth of KODEX 200 Futures Inverse 2X ETF over the past month. This increase in net purchases is attributed to steady demand from individuals who anticipated a market correction and consistently bought inverse products. However, it is also possible that this buying surge reflects both short-term hedging purposes and new inflows.

During the same period, the KOSPI rose by 24.1%, while the KODEX 200 Futures Inverse 2X ETF fell by 40%. The average purchase price for individuals was recorded at 513 won, resulting in an average unrealized loss rate of about 18%. Over the past month, individuals also made a net purchase of 211.8 billion won worth of KODEX Inverse ETF, with an unrealized loss rate of approximately 9% for that product as well.

Some voices point out that it is difficult to determine whether investors betting on a decline will be able to recover their losses, given that market volatility may increase in the short term.

Choi Jaewon, a researcher at Kiwoom Securities, said, "While the market is being supported by earnings and liquidity, the medium-term upward trajectory of the KOSPI remains valid. However, the rapid rise since the beginning of the year has led to accumulated technical overheating pressure." He added, "With external uncertainties increasing and volatility expected, it is necessary to consider the possibility of a short-term adjustment in the KOSPI's pace."

However, individual investors' ETF flows are not solely focused on betting against the market. Looking at the top net purchases by individuals, the TIGER Korea Humanoid Robot Industry ETF and the TIGER Semiconductor TOP10 ETF saw net purchases of 335.2 billion won and 324.3 billion won, respectively. The recent returns for these two products reached 50% and 37%, respectively.

The TIGER Korea Humanoid Robot Industry ETF, which was listed on January 6, saw its initial allocation sold out within 15 minutes of listing. This is interpreted as a result of Korean companies showcasing their presence in the so-called "physical AI" sector at CES 2026, the world's largest electronics and IT exhibition, which has fueled investor interest in related themes.

Jung Heehyun, Head of ETF Management at Mirae Asset Global Investments, stated, "The TIGER Korea Humanoid Robot Industry ETF is a solution that allows investment in the entire ecosystem of the humanoid robot industry," and added, "By investing in the physical AI ecosystem, investors can expect to benefit."

The TIGER Semiconductor TOP10 ETF, which became the first domestic semiconductor-themed ETF to surpass 3 trillion won in net assets, is a product that focuses on investing in ten major domestic semiconductor companies, primarily Samsung Electronics and SK hynix. As the semiconductor sector has recently driven the index higher, there is analysis that inflows into related ETFs are continuing.

Park Sanghyun, a researcher at iM Securities, explained, "We confirmed the semiconductor super-cycle through January's exports," and added, "For the time being, robust domestic exports driven by semiconductor shipments and the continued expansion of daily average export value, which shows a high correlation with the domestic stock index, are likely to persist."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)