Sales Up 2.6% for 11 Food Companies, But Profits Down 1.6%

Food Industry Squeezed by Exchange Rates and Costs: More Sales, Less Profit

Only Samyang Foods Surges... Exchange Rate Effect Drives 50% Operating Profit Growth

While the overall size was maintained, profitability declined. Last year, major domestic food companies in Korea saw a slight increase in sales, but operating profits actually decreased due to rising raw material costs and exchange rate pressures, which expanded overall cost burdens.

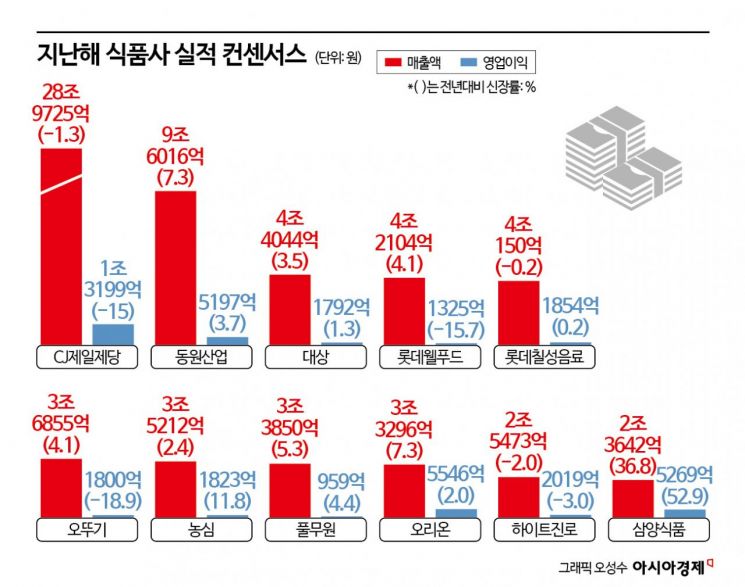

According to financial information provider FnGuide on January 23, the consensus for total sales among 11 food companies last year (the average forecast by securities firms) was 70.0166 trillion won, up 2.6% from the previous year. In contrast, total operating profit during the same period is expected to be 4.0783 trillion won, down 1.6% from 4.1464 trillion won the previous year.

Only a few companies recorded a decrease in sales, while most maintained or slightly grew their sales compared to the previous year. However, when it comes to operating profit, a significant number of companies saw a decline. Industry experts note that there is a prevailing trend of "selling products but earning less profit" across the sector.

Sales Held Up Last Year, but Profits Declined

CJ CheilJedang, the industry leader, is expected to post sales of 28.9725 trillion won last year, a decrease of 1.3% from the previous year. Operating profit dropped by 15% to 1.3199 trillion won. The simultaneous decline in both sales and profit exerted downward pressure on the overall industry performance.

Lotte Wellfood and Ottogi both increased their sales but saw profits decline. Lotte Wellfood's sales rose 4.1% to 4.2104 trillion won, but operating profit fell 15.7% to 132.5 billion won. Similarly, Ottogi's sales increased 4.1% to 3.6855 trillion won, but operating profit decreased by 18.9% to 180 billion won.

On the other hand, some companies showed relatively stable results. Dongwon Industries' sales grew 7.3% to 9.6016 trillion won, with operating profit also rising 3.7% to 519.7 billion won. Daesang also recorded increases in both sales and operating profit, up 3.5% and 1.3%, respectively.

Nongshim's sales growth was limited to 2.4%, but operating profit increased 11.8% to 182.3 billion won. Pulmuone and Orion also saw increases in both sales and operating profit, but the growth rates remained in the single digits.

The alcoholic beverage and soft drink sector showed relatively stagnant trends. Lotte Chilsung Beverage saw sales decrease by 0.2% to 4.015 trillion won, but operating profit edged up 0.2% to 185.4 billion won, essentially remaining flat. HiteJinro's sales dropped 2.0% to 2.5473 trillion won, with operating profit also falling 3.0% to 201.9 billion won, reflecting a sluggish performance.

Samyang Foods stood out. Last year, Samyang Foods recorded sales of 2.3642 trillion won, a 36.8% increase from the previous year, while operating profit surged 52.9% to 526.9 billion won. Among the 11 food companies, Samyang Foods was virtually the only one to achieve double-digit growth in both sales and operating profit. This has led industry insiders and outsiders alike to describe its performance as "close to a solo run."

Profitability Blocked by Exchange Rates, Costs, and Labor Expenses

The securities industry attributes these results primarily to "profit deterioration" rather than "sluggish sales." The diagnosis is that, although sales increased, the gains did not translate into profits. The biggest burden cited is the exchange rate. With the won-dollar exchange rate remaining in the 1,400-won range, manufacturing costs have generally risen for food companies with a high proportion of imported raw materials. Major raw materials such as grains, oils, sugar, and cocoa are often settled in dollars, so the rise in the exchange rate directly translated into higher costs. In fact, Lotte Wellfood estimates that a 10% fluctuation in the won-dollar exchange rate leads to an approximately 3.5 billion won change in pre-tax profit.

Rising labor costs also squeezed profitability. The expansion of the scope of ordinary wages and increases in the minimum wage raised unit labor costs, and not only base salaries but also various allowances, severance pay, and the four major social insurance contributions increased, resulting in a higher proportion of labor costs in selling and administrative expenses. Additionally, as companies expanded into global markets, marketing and promotional expenses, logistics costs, IT and system investments, and one-off expenses further increased the burden of selling and administrative costs. For companies such as Lotte Wellfood, Nongshim, and Ottogi, even though overseas sales grew, the upfront recognition of marketing and facility/system investment costs limited the extent of profitability improvement.

The effect of price increases was also limited. The food industry has attempted to offset cost burdens through price hikes. While some price adjustments were made last year, they were limited to certain items. This was due to increased social pressure regarding consumer spending slowdowns and inflation concerns.

Industry insiders believe these trends cannot be seen as merely temporary fluctuations. The traditional model of "cost increases leading to price hikes and then profit protection" is no longer functioning as it did in the past. A food industry official commented, "With such high exchange rate volatility, it's difficult to even gauge this year's business environment," adding, "Uncertainty is greater than ever."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)