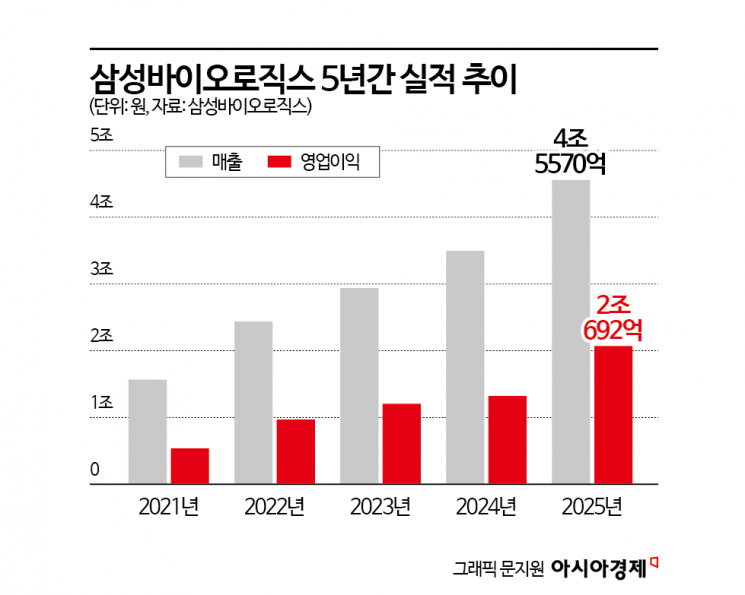

Sales Reach 4.5 Trillion Won, Operating Profit Surpasses 2 Trillion Won Last Year

Outstanding Growth Even Among Group Affiliates

SAMSUNG Biologics has surpassed 2 trillion won in operating profit for the first time in its history. Industry analysts note that the company has moved beyond a phase of aggressive capacity expansion, and is now demonstrating the benefits of economies of scale as both large-scale facility utilization and order intake support its growth and profitability.

On January 21, SAMSUNG Biologics announced through a regulatory filing that its consolidated sales for the previous year reached 4.557 trillion won, with operating profit at 2.0692 trillion won. Sales increased by more than 30% year-on-year, and operating profit grew by 747.8 billion won. The ramp-up of Plant 4 (higher utilization), stable full-capacity operations at Plants 1 to 3, and favorable exchange rates all contributed to these results. For the fourth quarter alone, sales were 1.2857 trillion won, up 35% from the same period last year, while operating profit increased by 213.6 billion won to 528.3 billion won. The expansion in production volume was driven by the continued full-capacity operation of Plants 1 through 4.

The market is particularly focused on the symbolic milestone of entering the “2 trillion won operating profit era.” Since its establishment in 2011, SAMSUNG Biologics has grown rapidly by expanding its facilities, surpassing 1 trillion won in operating profit in 2023 and reaching 1.3201 trillion won in 2024. Then, in the following year, it immediately exceeded the 2 trillion won mark. Not only was the time to achieve trillion-won-level operating profit short, but the pace of growth from 1 trillion to 2 trillion won was even faster.

This milestone is also significant within the group. Although direct comparisons are limited due to differences in founding dates and business structures, SAMSUNG Biologics reached the 2 trillion won operating profit milestone in about 14 years after its establishment. By comparison, SAMSUNG Electronics ushered in the “2 trillion won era” in 1997, 28 years after its founding in 1969, with an operating profit of 2.8562 trillion won. The time taken to surpass the 2 trillion won mark is about half that of SAMSUNG Electronics. The growth trajectory is even steeper compared to other group companies such as SAMSUNG C&T, SAMSUNG Life Insurance, and SAMSUNG Fire & Marine Insurance, all established before the 1960s, which only surpassed 2 trillion won in operating profit in the 2020s. Considering that other major manufacturing affiliates have yet to reach 2 trillion won in annual operating profit, SAMSUNG Biologics’ performance stands out even within the SAMSUNG Group.

The company emphasized that its growth engine has become even clearer following its transition to a “pure-play CDMO (Contract Development and Manufacturing Organization)” structure. Through a spin-off, it reduced concerns about conflicts of interest and established a governance structure focused on strengthening its CDMO competitiveness. At the same time, it continued to invest in future growth, executing key investment projects as planned, such as the acquisition of the Rockville plant in the United States, securing a site for its third Bio Campus, launching “SAMSUNG Organoid,” and completing construction of its fifth plant, thereby expanding its business foundation.

Order intake and production capacity were also highlighted as indicators supporting the “sustainability” of its performance. SAMSUNG Biologics announced that it signed three contracts worth more than 1 trillion won each last year, with total annual orders exceeding 6 trillion won. Cumulatively, the company has achieved 107 CMO (contract manufacturing) deals and 164 CDO (contract development) deals, with total cumulative orders reaching 21.2 billion US dollars (about 31.1343 trillion won). Production capacity expanded to 785,000 liters across Plants 1 through 5 in Songdo, with the operation of the 180,000-liter Plant 5 and the addition of a 1,000-liter bioreactor at Plant 2. Including the 60,000-liter Rockville plant in the United States, the company’s total global production capacity is expected to reach 845,000 liters.

Financial stability was also emphasized. As of the end of last year, the company reported total assets of 11.0607 trillion won, equity of 7.4511 trillion won, and liabilities of 3.6096 trillion won, resulting in a debt ratio of 48.4% and a borrowing ratio of 12.3%. The company provided sales guidance for this year, projecting growth of 15-20% year-on-year, and noted that this forecast does not include the contribution from the Rockville plant acquisition. The company plans to provide an updated outlook that reflects the related results after the acquisition is completed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.