Market Disappointment Over Alteogen's 2% Royalty from Keytruda

"Building Large-Scale Sales Track Records and Diversifying Portfolio Are Crucial"

As the core substance patents of Halozyme Therapeutics, a leading U.S. biotechnology company specializing in subcutaneous (SC) formulation technology, are set to expire sequentially from next year through 2029, the so-called "post-Halozyme" competition is expected to intensify.

SC formulation conversion technology enhances patient convenience and drug administration efficiency by changing the method of administering large-molecule antibody therapeutics from intravenous (IV) injection to injection just beneath the skin. Hyaluronidase, which facilitates the diffusion of the drug, temporarily breaks down hyaluronic acid-a component that fills skin tissue-helping high-molecular-weight protein drugs to be rapidly absorbed.

As attention focuses on technology transfer and joint development discussions between domestic companies with proprietary technologies under development and major pharmaceutical companies, a key challenge remains: whether the value of these technologies will be reasonably assessed in actual contracts and whether stable revenue models can be established.

According to the bio industry on January 22, the royalty rate that Alteogen receives from Merck & Co. (MSD) for the SC formulation development and commercialization technology of the immuno-oncology drug Keytruda is reportedly around 2% of sales. This is significantly lower than the 7-8% level anticipated by the market, leading to widespread disappointment regarding profitability. As a result, Alteogen's stock price closed down 22.35% the previous day.

Halozyme, a pioneer in the SC formulation platform market, is known to receive royalties typically exceeding 5% of sales from its partners. Through long-term contracts with major pharmaceutical companies such as Roche and Janssen, the company has generated sustained revenue and has been recognized for the stable value of its technology.

Some industry observers note that it is difficult to directly compare the royalty rates of Alteogen and Halozyme. The contract between Alteogen and MSD is structured so that terms change in stages after the initial license agreement, with more emphasis placed on long-term profitability than on short-term royalty rates.

According to Alteogen, the company signed its first contract with MSD in 2020 and converted it into an exclusive agreement for Keytruda SC in February 2024. The total milestone payments secured through this agreement amount to 1 billion dollars (approximately 1.4716 trillion won). Once certain sales thresholds are met, the agreement transitions to a royalty phase, with payments continuing for about 18 years until early 2043, when the relevant patents expire. The company explains that this is a much longer royalty period than the typical 10 years for standard new drug contracts, allowing for more sustained cash flow over the long term.

Industry analysts suggest that if Alteogen's SC formulation platform passes verification processes such as global regulatory approvals and large-scale sales through the commercialization of Keytruda SC, the company could gain greater negotiating power in future contract discussions.

However, it is also pointed out that diversifying its portfolio is essential for Alteogen to establish itself as a platform company like Halozyme. To date, Alteogen's major achievements have been concentrated on PD-1 class immuno-oncology drugs such as Keytruda and Jemperli, making it premature to assess the scalability of its platform. An industry insider commented, "Whether Alteogen's SC platform can expand its application beyond oncology will be a key turning point in determining its long-term competitiveness."

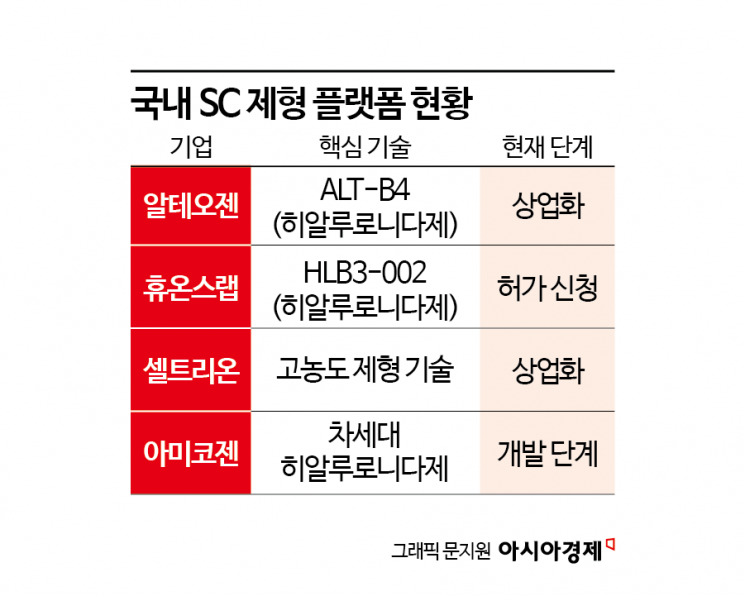

In Korea, other companies besides Alteogen are also pursuing the development of SC formulation conversion platforms. The substance and formulation/use patents for Halozyme's core technology, recombinant human hyaluronidase (rHuPH20), are scheduled to expire in stages in the U.S. from 2027 to 2029. In addition, the fact that major pharmaceutical companies are considering formulation conversion as a new revenue strategy ahead of blockbuster drug patent expirations is also driving market interest.

Alteogen's flagship product, "ALT-B4," is a human-derived hyaluronidase variant that converts IV to SC administration. By temporarily degrading hyaluronic acid in the skin to create a pathway for drug diffusion, it enables the rapid absorption of large-molecule antibody therapeutics. The use of recombinant human protein technology results in lower side effects compared to conventional animal-derived enzymes, and the product is noted for its excellent stability and productivity.

Huons Lab is developing "HLB3-002," an SC formulation platform based on human-derived hyaluronidase. The company has secured a patent for its recombinant human hyaluronidase manufacturing process, enabling the production of high-purity enzymes at high yields. Based on this process technology, Huons Lab has completed domestic patent registration for the composition and use of its finished pharmaceutical product, Hydizym Injection, and has also filed an international patent (PCT). In addition, companies such as Celltrion and Amicogen are also working to secure SC formulation conversion technology as they seek to enter the market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.