Pursuing the Sale of Beyond Music: Targeting 700 Billion Won

Fourth Fund of 800 Billion Won Now Fully Deployed

First Investment of the Year: Quantum Computing Firm SDT

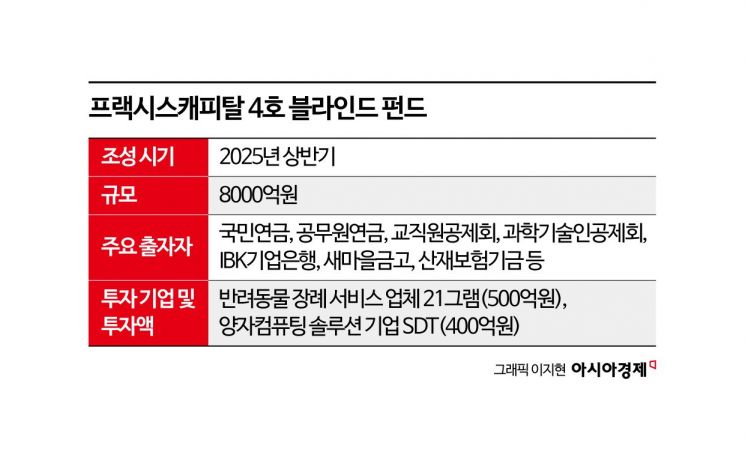

Private equity fund (PEF) manager Praxis Capital Partners is set to adjust its investment pace in earnest this year, following the creation of a large-scale blind fund worth 800 billion won last year. Having achieved external growth, the company plans to accelerate both investments and exits this year, aiming to strengthen a virtuous cycle in fund management.

According to the investment banking (IB) industry on January 28, Praxis, which is seeking to sell music copyright company Beyond Music, plans to distribute investment memorandums (IM) to potential buyers through its sales advisor, Citigroup Global Markets Securities. A teaser letter was distributed at the end of last year, and it is reported that more than 10 global entertainment companies and private equity funds have shown interest.

Praxis made two investments in Beyond Music, in 2021 and 2023. In 2021, it acquired about 60% of the shares for approximately 200 billion won, and in 2023, it invested an additional 200 billion won to raise its stake to 70%. Praxis is hoping for a sale price of around 700 billion won. The EBITDA is about 27 billion won, and the company applied an EV/EBITDA multiple of 25 times, which is the market-recognized standard for Primary Wave, a U.S.-based global music company with a similar business structure. If the transaction is successfully completed, it is expected to serve as a meaningful milestone in Praxis's track record.

Beyond Music is a company engaged in music copyright investment, acquisition, and management. It was founded in 2021 by composer Park Keuntae and Lee Jangwon, the founder of digital sheet music platform Mafia Company. Domestically, it owns the music and song IPs of global K-pop groups such as BTS and Blackpink, as well as the works of the late Kim Hyunsik and Lee Moonse. Internationally, it holds music IPs for global pop stars such as Adele, Katy Perry, Selena Gomez, and Dua Lipa.

Last year, Praxis focused more on enhancing the value of its existing portfolio and establishing exit strategies rather than making new investments. This year, the company plans to accelerate both the exit from Beyond Music and new investments. Praxis rapidly increased its assets under management (AUM) by establishing its fourth blind fund, worth about 800 billion won, last year-one of the largest among domestic mid-sized PEFs. The first investment from this fund was a 50 billion won investment in 21gram, a pet funeral service provider.

Praxis began deploying its fourth fund from the beginning of the year. The first investment for this year and the second for the fourth fund is SDT, a quantum computing company. Of the total 40 billion won investment, 30 billion won was allocated to the issuance of new redeemable convertible preferred shares (RCPS), and about 10 billion won was used to acquire existing shares. Praxis believes quantum computing will play a groundbreaking role in areas such as new drug development and new material exploration. SDT has selected NH Investment & Securities as its IPO advisor and is currently reviewing the process.

In addition, Praxis plans to aggressively expand its credit investment sector this year. Centered on Praxis Credit & Solutions, a credit investment subsidiary established in July last year, the company intends to broaden its scope to include mezzanine and private lending. This strategy is interpreted as an effort to secure stable sources of income beyond traditional buyout investments and to respond to market volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)