SK Telecom Up 14% This Month After Last Year's 3% Drop

Atmosphere Shifts with Anthropic Stake Revaluation

Will KT and LG Uplus Reverse the Trend with Improved Earnings and Shareholder Returns?

Among the three major telecom companies aiming for a turnaround this year after overcoming last year's hacking crisis, SK Telecom was the first to break the silence. Despite lingering concerns over uncertain dividends, the company has successfully invested in a U.S. artificial intelligence (AI) firm, gaining an early lead. Attention is now focused on whether KT and LG Uplus can catch up.

AI Competitiveness Highlighted Amid Expectations for Earnings Recovery

According to the Korea Exchange on January 22, SK Telecom's share price has surged 14.02% this year through the previous day. This far outpaces the gains of KT (+5.13%) and LG Uplus (+4.76%) over the same period. On January 20, the stock even reached 63,000 won during intraday trading, setting a new 52-week high.

Considering SK Telecom's stock performance over the past year, this recent rally is a remarkable achievement. In 2025, SK Telecom’s stock return was -3.08%, significantly trailing both the KOSPI (+75.63%) and rivals LG Uplus (+43.18%) and KT (+19.73%). This was due to an unavoidable decline in earnings caused by a hacking incident that resulted in a large-scale subscriber exodus and regulatory fines. In the fourth quarter of 2025, SK Telecom’s consolidated revenue was 4.4 trillion won (down 3.5% year-on-year), and operating profit was 84.4 billion won (down 66.8%), signaling an impending earnings shock.

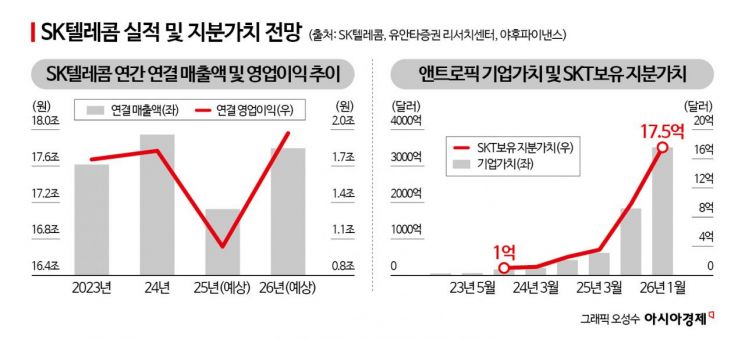

However, as optimism grows that SK Telecom will achieve a full recovery in earnings this year after overcoming last year’s challenges, its stock price is gaining momentum. While net subscriber losses approached 720,000 between April and July 2025, the company reversed this trend and began posting net gains from August onward, turning crisis into opportunity. Kim Jeongchan, a researcher at Korea Investment & Securities, stated, "With the competitor penalty waiver policy in January 2026 leading to an increase in both win-back and new subscribers, wireless earnings are expected to recover." He estimated SK Telecom’s 2026 revenue at 17.7 trillion won (up 3% year-on-year) and operating profit at 1.9 trillion won (up 77%). The number of net new users for SK Telecom in the first quarter of this year is estimated to be around 160,000.

In particular, the government-led independent AI foundation model project’s phase two entry and the positive news of Anthropic’s planned IPO, which drove SK Telecom’s record-high stock price on January 20, are seen as opportunities to further highlight the company’s AI competitiveness. Anthropic, a generative AI company founded in 2021 by former OpenAI researchers, was reportedly valued at $350 billion (about 515 trillion won) in the pre-IPO stage. SK Telecom, which invested $100 million in Anthropic in 2023, is estimated to have a stake currently worth about 3 trillion won, equivalent to 23% of SK Telecom’s market capitalization.

Kim added, "Last year, AI-related revenue for SK Telecom was just 740.2 billion won, accounting for only 5.3% of the total, but this year marks the first year of executing its plan to invest a cumulative 5 trillion won in AI by 2030, and the growth trajectory is highly encouraging." He raised his target price for SK Telecom from 61,000 won to 71,000 won.

The Beginning of a Turnaround for KT and LG Uplus?

While KT lacks a clear upward momentum like SK Telecom, it is still seen as having the potential to reclaim its leadership in the telecom sector. Like SK Telecom, which benefited from a revaluation of its stake in Anthropic, KT also has opportunities for revaluation of its stake in Hyundai Motor Group and its real estate assets. In 2022, KT exchanged 7.7% of its treasury shares (worth about 750 billion won) with treasury shares of Hyundai Motor and Hyundai Mobis as part of a strategic partnership to lead the future mobility business. With Hyundai Motor Group’s stock price soaring recently, KT’s valuation gains are estimated to reach 1.4 trillion won.

The diminished appeal of SK Telecom as a dividend stock, due to uncertainty over continued dividend payouts, could also serve as a springboard for KT’s comeback. KT’s expected shareholder return yield for this year is 6.6%, the highest among the three telecom companies, and it is planning to buy back treasury shares worth 250 billion won in the first half of the year.

LG Uplus, which recorded the best stock performance among the three telecom companies last year, is also expected to maintain its focus on enhancing shareholder returns and tighten its pursuit this year. With a treasury share buyback of 100 billion won anticipated, an increase in dividends per share (DPS) is also expected due to a decrease in the number of dividend-paying shares. Kim projected, "This year, LG Uplus’s DPS will be 750 won, with a payout ratio of 40% and a dividend yield of 5.0%." He added, "Assuming a shareholder return rate of 55%, an additional treasury share buyback of 120 billion won is possible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.