Demand for Realizing FX Gains

Won-Dollar Exchange Rate Surges Above 1,480 During Trading

Authorities Call for Restraint... Banks Lower Dollar Deposit Rates

The dollar deposit balances at major commercial banks have decreased by nearly 2 trillion won compared to the end of last year. As the won-dollar exchange rate surged, many depositors sold dollars to realize foreign exchange gains.

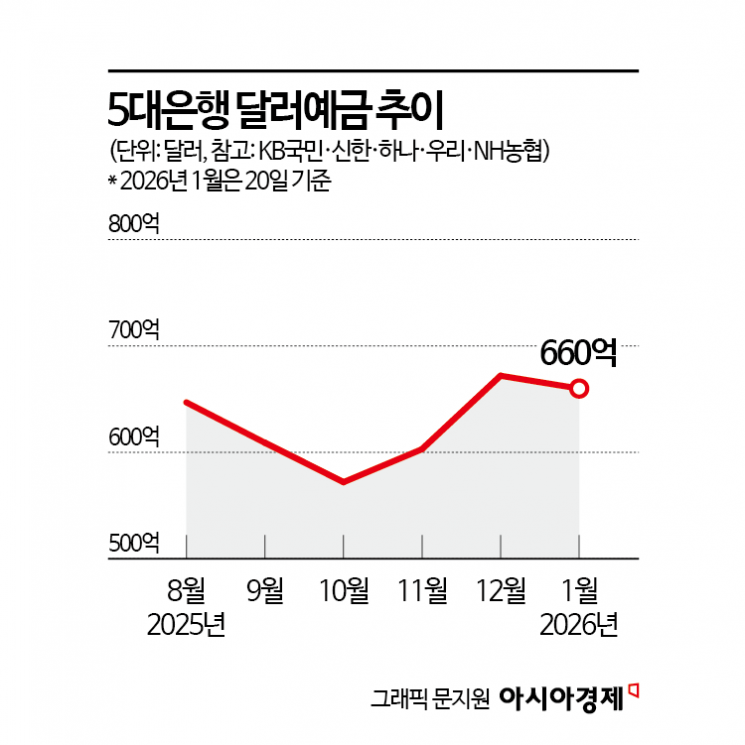

According to the financial sector on the 22nd, as of the 20th, the dollar deposit balance at the five major commercial banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) stood at approximately 66 billion dollars. This represents a decrease of 1.2 billion dollars (about 1.7652 trillion won) compared to the end of last year (67.2 billion dollars). After surging from about 60.3 billion dollars in November last year to about 67.2 billion dollars in December, dollar deposits have recently stagnated at some commercial banks. A representative from one of the commercial banks explained, "We believe there has been demand to realize foreign exchange gains as the exchange rate has risen compared to the end of the year."

The won-dollar exchange rate has remained in the 1,470 won range for four consecutive trading days since the 16th. On this day, it opened at 1,467 won, down 4.3 won from the previous day. This is believed to be due to U.S. President Donald Trump announcing overnight that he would not impose tariffs on eight European countries with which he had clashed over the Greenland issue.

With the won-dollar exchange rate remaining high, banks have recently refrained from marketing dollar deposits and have lowered interest rates. This is due to the financial authorities' request for stricter management. On the 19th, the Financial Supervisory Service convened executives from commercial banks and asked them to come up with measures in response to the high exchange rate. Authorities are reportedly considering investments in dollar products as one of the factors driving the exchange rate higher.

Lee Chanjin, Governor of the Financial Supervisory Service, also requested at a recent market situation review meeting, "As foreign currency deposits and insurance products increase, the risk of financial consumer losses due to exchange rate fluctuations is also growing. Please guide financial companies to refrain from excessive marketing and promotional events through meetings with management."

Accordingly, major commercial banks are not only suspending marketing activities but also lowering interest rates on dollar deposits. Shinhan Bank's interest rate for dollar foreign currency deposits (for maturities of at least three months but less than six months) dropped from an annual rate of 3.21% on the 14th to 3.11% as of the 21st, a decrease of 0.1 percentage point in one week. Woori Bank significantly reduced the dollar interest rate for its overseas travel-specialized foreign currency deposit product, 'Wibitravel Foreign Currency Deposit,' from an annual rate of 1.0% to 0.1%, one-tenth of the previous rate, on the 15th of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.