Hyundai Motor Overtakes LG Energy Solution to Claim Third in Market Cap

Boston Dynamics Humanoid Receives Acclaim

Group Affiliates Expected to Join Value Chain... Target Prices Raised

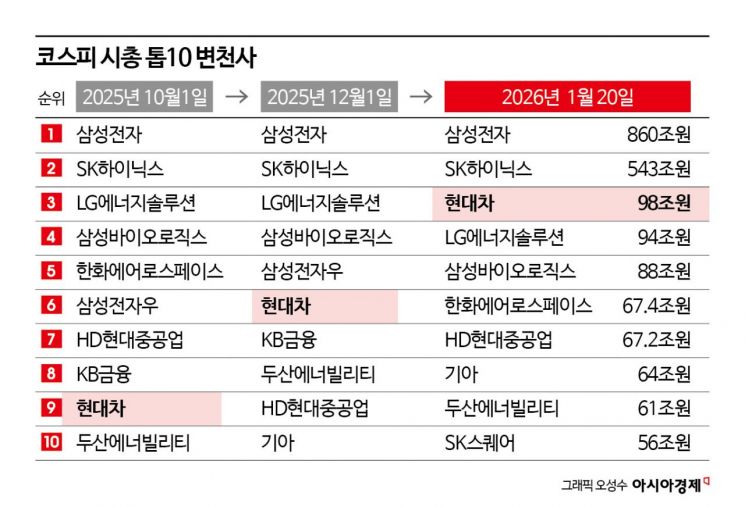

Hyundai Motor Group has secured the 'Big 3' title in group market capitalization, following Samsung and SK. Although it seemed to be falling behind LG in the race to join the '200 Trillion Won Club' at the end of last year, Hyundai Motor turned the tables as it emerged as a leading player in physical AI, pushing LG Energy Solution out of third place in KOSPI market capitalization. As Hyundai Motor Group set the internalization of the robot value chain as a company-wide goal, securities firms are issuing optimistic outlooks for the group’s listed affiliates.

Hyundai Motor Hits 100 Trillion Won in Market Cap, Group Reaches 300 Trillion Won

According to the Korea Exchange on January 21, Hyundai Motor Group’s market capitalization as of the previous day's closing price was about 280 trillion won (excluding preferred shares). Including preferred shares, the group’s market capitalization surpassed 300 trillion won on January 19. As recently as early November last year, Hyundai Motor Group’s market cap was around 193 trillion won, trailing LG’s 197 trillion won. However, as LG group shares struggled due to a downturn in the secondary battery sector at the start of this year, Hyundai Motor Group shares, tied together by the robot value chain, surged collectively, quickly overtaking LG to claim third place in group market capitalization.

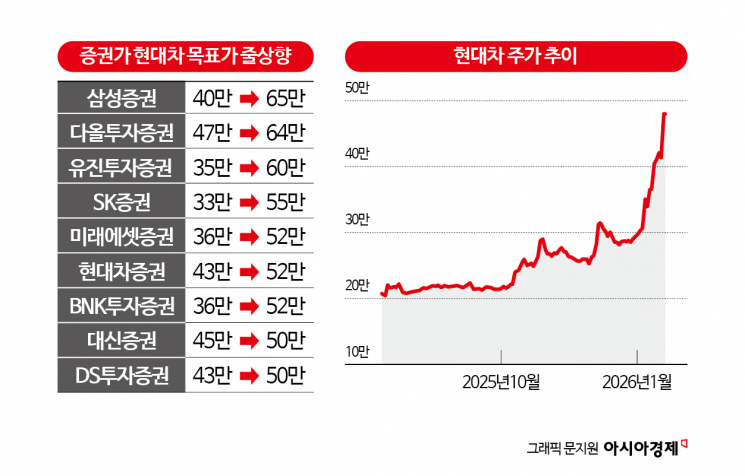

The main driver behind Hyundai Motor Group’s scaling up was its flagship, Hyundai Motor. While Hyundai Motor’s stock price rose only 39.86% last year, even as the KOSPI jumped over 75%, the company’s stock has soared more than 60% since the beginning of this year, showing unstoppable momentum from the start of the new year. On January 19, Hyundai Motor reclaimed third place in KOSPI market capitalization by overtaking LG Energy Solution, and set a new all-time high (507,000 won) the previous day, surpassing 100 trillion won in market capitalization for the first time during trading hours. This marks Hyundai Motor’s return to the top three in market capitalization for the first time in about six years and seven months since June 2019. The company’s highest-ever market cap ranking was second place, achieved in November 2010 after surpassing POSCO.

From Perpetually Undervalued Blue Chip to Humanoid Industry Leader

Until recently, Hyundai Motor was known as a classic example of an 'undervalued blue chip'-a company with strong performance but a stock price that failed to reflect it. This was due to the growing perception that legacy automakers like Hyundai would be left behind as countries worldwide began to legally ban internal combustion engine vehicles, and as autonomous driving and robotaxi companies led by Tesla gained dominance. In fact, while Hyundai Motor’s operating profit grew by nearly 71% between 2014 and 2024, its market capitalization increased by only 20%.

However, since 'CES 2026,' market perceptions of Hyundai Motor have shifted dramatically. The company’s subsidiary Boston Dynamics unveiled its new commercial humanoid, 'New Atlas,' which was named 'Best Robot' at CES, earning widespread acclaim and propelling Hyundai Motor to the forefront as a leader in physical AI. Hyundai Motor is receiving high marks for its ability to provide real-world behavioral data essential for advancing physical AI models at its own and Kia’s manufacturing plants.

Lim Eunyoung, a researcher at Samsung Securities, stated, "As Hyundai Motor Group’s robot business roadmap becomes more concrete, it is time for changes in its peer group as well," raising Hyundai Motor’s target price from 400,000 won to 650,000 won based on the average price-earnings ratio (PER) of leading Chinese electric vehicle companies (18x). This is the highest target price among the more than 20 securities firms that have raised their targets for Hyundai Motor this year.

Trickle-Down Effects Expected for Affiliates... Spotlight on BD Equity Value

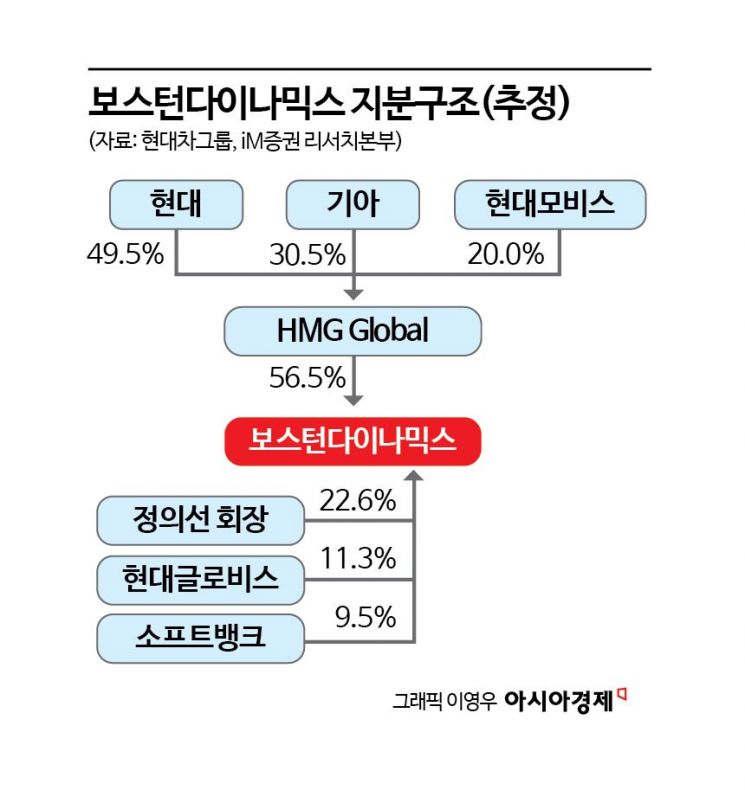

Hyundai Motor Group has announced plans to leverage all internal capabilities to internalize and vertically integrate its robot value chain. This means not only Hyundai Motor, but also Kia, Hyundai Mobis, Hyundai Glovis, and Hyundai AutoEver-its listed affiliates-are expected to benefit from physical AI. For example, when Boston Dynamics designs a robot, Kia and Hyundai Motor deploy it at manufacturing sites to collect large-scale production data.

Kim Junseong, a researcher at Meritz Securities, said, "Once the New Atlas is confirmed to be deployed in software-defined factories (SDF) in the second half of this year, Boston Dynamics’ market value could easily surpass 60 trillion won, the current valuation of Figure AI, the most highly valued startup in the sector." He added, "This will serve as further justification for raising Kia’s appropriate stock price." Kia’s effective stake in Boston Dynamics, held through HMG Global, is about 17%, second only to Hyundai Motor’s 28% among group affiliates.

In the case of Hyundai Mobis, its effective stake in Boston Dynamics is 11%, lower than Hyundai Motor and Kia, but its role within Hyundai Motor Group’s robot value chain is the largest. The actuators developed by Hyundai Mobis are core driving components for humanoids, controlling joints and movements and functioning similarly to human muscles. This is why leading Chinese Tesla actuator suppliers, such as Sanhua and Takbo, have PERs approaching 50x.

Lee Jaeil, a researcher at Eugene Investment & Securities, commented, "Hyundai Mobis is evolving from a tier 1 to a tier 0.5 parts supplier through intensive technological investment in autonomous driving and electrification," and sharply raised the target price from 390,000 won to 560,000 won.

Additionally, Hyundai AutoEver is responsible for operating the robot control system and establishing the group’s AI infrastructure (SI), while Hyundai Glovis plans to apply artificial intelligence (AI) and robotics throughout its logistics processes to enhance supply chain efficiency. Hyundai Glovis holds an 11.3% stake in Boston Dynamics, similar to Hyundai Mobis. Although Hyundai Wia, which supplies industrial and logistics robots, does not have a clear link to the group’s humanoid value chain, its long-term outlook for the robotics business remains positive.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.