U.S. Index Futures and European Markets Plunge

As cracks appear in the 'Transatlantic Alliance' between the United States and Europe due to U.S. President Donald Trump's plan to annex Greenland, the prices of international gold and silver, considered safe-haven assets, are repeatedly hitting all-time highs. In contrast, concerns over a renewed trade war have led to sharp declines in European stock markets and U.S. stock index futures.

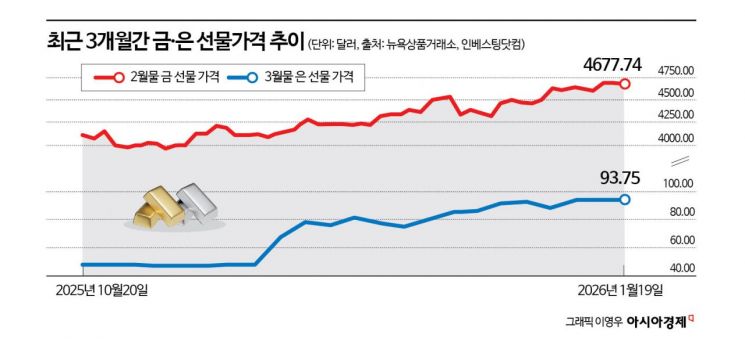

On January 19 (local time) at 8:07 p.m. on the New York Mercantile Exchange (COMEX), gold futures for February delivery were trading at $4,677.74 per ounce, up 1.79% from the previous session. After surpassing an all-time high last week, gold prices once again set a new record high on this day. Silver prices are also surging. U.S. silver futures for March delivery were trading at $93.75 per ounce, up 5.88% from the previous day. At one point during the day, the price climbed to $94.74 per ounce, marking an all-time high.

Geopolitical uncertainty triggered by President Trump's ambition to annex Greenland has driven prices higher. President Trump announced that he would impose tariffs on imports from eight European countries-Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands, and Finland-until a 'complete and comprehensive purchase' agreement for Greenland is reached. He stated that tariffs of 10% would be imposed starting from February 1, and 25% from June 1.

The European Union (EU) has also responded. The EU is considering invoking the Anti-Coercion Instrument (ACI), which would allow it to restrict transactions in sectors such as services, foreign direct investment (FDI), financial markets, public procurement, and intellectual property rights with third countries that economically threaten member states. This measure is referred to as a 'trade bazooka' due to its powerful impact. The controversy over the incorporation of Arctic territories has emerged as a flashpoint in international politics and economics.

European stock markets plunged in response to the U.S. tariff threat. The pan-European STOXX600 index closed down 1.19%, marking the largest drop in two months. Germany's DAX index fell by 1.34%, while France's CAC index declined by 1.78%. Denmark's OMXC, representing one of the countries involved in the conflict, plummeted by 2.73%. Notably, shares of luxury brands such as LVMH and Kering dropped sharply by 4.33% and 4.1%, respectively.

As Europe considers deploying the trade bazooka ACI, U.S. stock index futures also showed declines on the New York Stock Exchange. As of 6:35 p.m., Dow futures were down 0.83%, S&P 500 futures were down 0.92%, and Nasdaq futures were down 1.13%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.