PwC Releases Survey of CEOs in 95 Countries

Top Threats Identified: Tariffs for Korea, Cyber Risks Globally

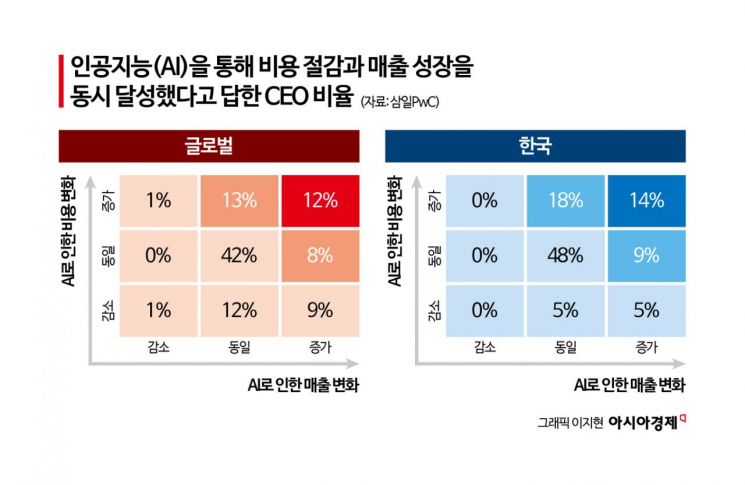

While artificial intelligence (AI) investment is surging among companies worldwide, only 12% of global chief executive officers (CEOs) have achieved both cost reduction and revenue growth through AI, according to recent findings. As disparities in AI utilization among companies are beginning to translate into differences in competitiveness, there are growing predictions that this year will be a watershed moment in determining corporate success or failure through AI.

On January 20, Samil PwC released its "29th Annual Global CEO Survey" report, which contains this analysis. The report is based on the results of the Global CEO Survey conducted by PwC Global in conjunction with the opening of the World Economic Forum (WEF, Davos Forum). The theme of this year’s report is "Leadership in the Age of AI: Turning Uncertainty into Opportunity." The survey was conducted from late September to early November last year, targeting 4,454 CEOs across 95 countries.

The survey found that only a minority of companies are realizing tangible results from their AI investments. Over the past year, 30% of CEOs reported generating additional revenue through AI adoption, while 26% saw cost reduction benefits. However, 22% of respondents said their costs actually increased, and more than half-56%-reported experiencing neither revenue growth nor cost reduction from AI. Only 12% of all companies achieved both revenue growth and cost reduction, with Korea recording a slightly higher figure at 14%.

When asked about the extent of AI adoption across their organizations, relatively few CEOs responded that they were applying AI on a large or very broad scale in areas such as demand generation (22%), support services (20%), their own products, services, and customer experience (19%), strategic direction setting (15%), and demand fulfillment (13%). In contrast, among leading companies that achieved both revenue growth and cost reduction through AI, 44% reported extensive use of AI in their products, services, and customer experience.

The report states, "Tangible results from AI come from enterprise-scale deployment that is consistently aligned with business strategy," and advises that companies should establish a robust AI foundation, including an AI roadmap, governance for responsible AI and risk management processes, and an organizational culture that promotes AI adoption.

Mohamed Kande, Global Chair of PwC, commented, "Some companies are already generating measurable financial returns from AI, while many others remain in the pilot phase. These gaps among companies are now becoming visibly apparent in terms of trust and competitiveness." He added, "This year will be pivotal for companies, as AI will determine their future. If organizations do not take action, the gap will widen rapidly."

Amid widening disparities in AI returns, macroeconomic volatility, geopolitical risks, and cybersecurity threats are converging, leading to a significant decline in CEOs' short-term revenue outlook. Only 30% of CEOs expressed confidence in their company’s revenue growth over the next 12 months, continuing a downward trend from last year (38%) and the peak in 2022 (56%). Among various risk factors, cyber risk has emerged as the top concern for CEOs, alongside macroeconomic volatility.

Additionally, the restructuring of national tax policies toward protectionism has made tariff uncertainty a new risk factor. One in five CEOs (20%) expressed concern about the risk of significant financial loss from tariffs over the next 12 months. In Korea, 36% of CEOs expect to be affected by tariffs in the next year, ranking second globally after Taiwan (49%). The report notes, "Korean companies, with their export-driven economic structure, perceive the strengthening of global protectionism and changes in tariff policies as the most direct threats."

Even in this challenging environment, CEOs recognize innovation as essential for growth. More than four out of ten (42%) said their companies have entered new areas of competition over the past five years. Among companies planning major mergers and acquisitions, 44% are considering investments outside their current industries, with technology identified as the most attractive adjacent sector. In terms of overseas investment, more than half of CEOs (51%) plan to invest internationally over the next year. The United States was selected as the top investment destination (35%), followed by the United Kingdom and Germany (13% each), and mainland China (11%). Interest in India rose sharply to 13%, up from 7% last year.

Yoon Hoonsoo, CEO of Samil PwC, stated, "This survey confirms that companies moving quickly and boldly to innovate their business and operating models are outperforming those that do not. Korean companies must pursue mid- to long-term innovation, including strengthening competitiveness through AI and exploring new markets, to overcome external uncertainties such as tariff pressures." He added, "Samil PwC will continue to monitor changes in the global business environment to support the successful AI transition and innovation of Korean companies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.