Treasury Shares to Be Cancelled Except for RSU Allocations

Targeting 20% Average Annual TSR... Enhancing ROE

Succession Plan Formalized for Next-Generation Leadership

Stick Investment has publicly announced an extensive value enhancement (value-up) plan by the deadline demanded by activist fund Align Partners. The company stated that it would not only focus on improving performance, but also address issues that have drawn market attention, such as the cancellation of treasury shares, improvements in corporate governance, and the founder’s succession plan.

According to the investment banking (IB) industry on January 20, Stick Investment disclosed this value enhancement plan the previous day. This was in response to Align’s “final ultimatum.” Previously, Align had sent an open letter to Stick Investment’s board of directors, demanding measures to enhance shareholder value. At that time, Align stated, “We requested several announcements last year, and although Stick Investment said it would make an announcement in the second half of 2025, it missed the deadline,” adding, “The plan must be shared by January 19 so that shareholders can exercise responsible voting rights before the general shareholders’ meeting in March this year.”

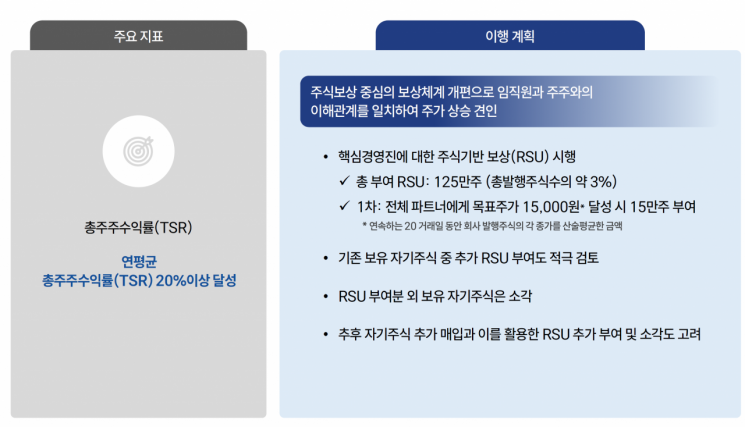

Treasury Share Cancellation... "TSR 20% CAGR"

Stick Investment first detailed its plan for utilizing treasury shares. The company announced its intention to cancel all treasury shares except those allocated for employee stock-based compensation (RSU). As of the end of last year, Stick Investment held 13.52% (5,633,228 shares) of its own shares, which is more than the founder and chairman Do Yonghwan’s stake of 13.46%.

Of the total treasury shares, approximately 1.25 million shares (about 3% of total shares issued) will be allocated as RSUs to key management. Initially, if the share price reaches 15,000 won (based on the arithmetic average closing price over 20 consecutive trading days), 150,000 shares will be granted to all partners.

Treasury shares not allocated as RSUs will be canceled. Furthermore, the company is considering additional purchases of treasury shares to either grant as RSUs or cancel. Through these measures, Stick Investment emphasized its aim to raise the total shareholder return (TSR), including dividends, to an average annual rate of 20%.

Corporate Governance Reform... "Succession Plan" Formalized

The company also hinted at restructuring its corporate governance centered around Chairman Do. The plan is to diversify the board of directors to enhance expertise and independence.

Currently, the largest shareholder of Stick Investment is US-based Millie Capital with a 13.48% stake, slightly higher than Chairman Do’s 13.46%. Align also holds 7.63%, and domestic Petra Asset Management owns 5.09%, bringing the total stake of activist investors to 26.20%. This suggests that the board composition-and thus the governance structure-could be changed at the regular general shareholders’ meeting in March.

Additionally, the company announced plans to shift its management focus to the next generation. This indicates an intention to resolve the “one-man risk” and succession uncertainty by transitioning from the first-generation management led by Chairman Do to a new leadership team.

During this process, the company stated it would provide equal opportunities to key personnel and repeatedly evaluate and select candidates who meet criteria such as ▲capability and performance ▲leadership ▲sense of responsibility to the company. Furthermore, the company plans to raise its corporate governance guideline compliance rate from the current 47% to over 60%.

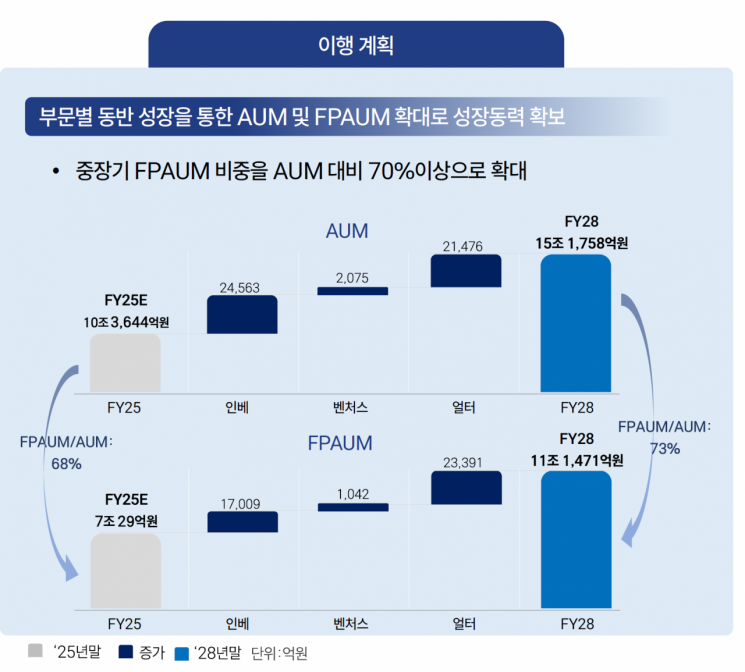

AUM 15 Trillion Won... Pursuing Profitability at the Level of Global Private Equity

The company also presented specific targets for performance improvement. Externally, it aims to increase its assets under management (AUM) to 15 trillion won and achieve 11 trillion won in fee-producing assets under management (FPAUM). As of the end of last year, Stick Investment’s AUM was 10.3644 trillion won, and FPAUM was 7.0029 trillion won.

In terms of profitability, the company set targets of over 10% return on equity (ROE) and over 35% fee-related earnings (FRE) margin. Last year, Stick Investment’s FRE margin was 31.8%. The average FRE margin for major global private equity funds (PEFs) is reported to be 46.1%.

The company stated, “We will expand our assets under management through diversification and specialization strategies, and increase ROE by reallocating capital efficiently. We have secured professional IR personnel for overseas institutional investors and, starting this year, will provide performance materials in the format used by leading global PEF managers, thereby strengthening communication with shareholders.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)